Customer Experience Design: Attracting and Retaining Customers in the Financial Sector

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

How do you make customers feel connected with your brand? You need a comprehensive and powerful customer experience design strategy to get the job done. And that’s what we’ll tackle in this article.

We’ll focus on the financial sector, which has been moving past legacy systems and keeping up with disruptive tech players.

First, we’ll explain the concept of CX design and its relevance in today’s business landscape.

What Is Customer Experience Design?

Customer experience design, or CX design, is a customer-centered approach to design that aims to optimize user interactions with your brand before, during, and after conversion. It requires considering every touchpoint across the customer journey. Design teams try to remove every obstacle to positive interactions and pave the way for a seamless experience with your brand.

State of CX Design

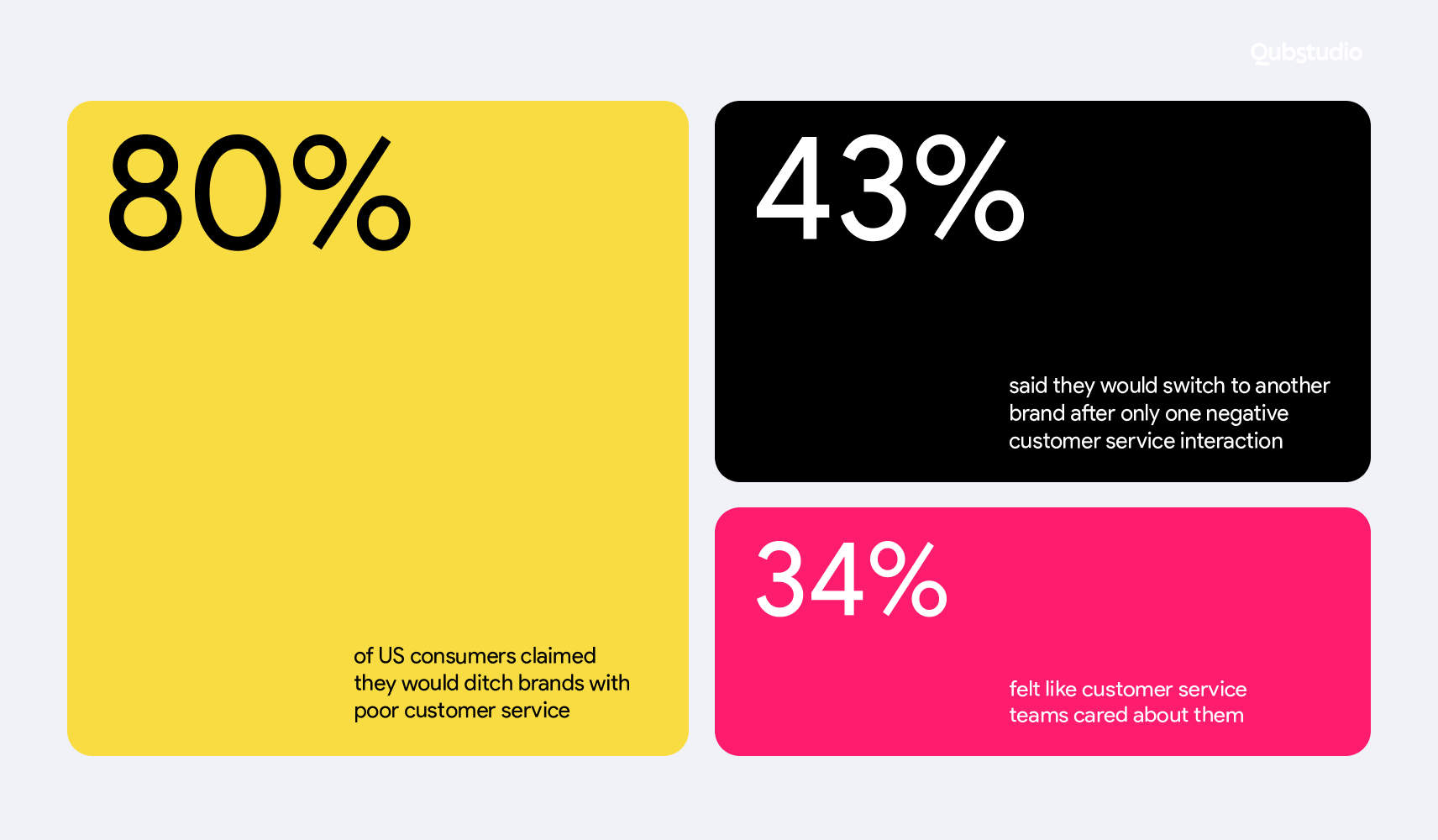

Consumers keep brands on their toes—a 2021 Qualtrix survey revealed that 80% of US consumers claimed they would ditch brands with poor customer service. Forty-three percent said they would switch to another brand after only one negative customer service interaction.

Only 34% of respondents felt like customer service teams cared about them. This means businesses aren’t meeting customer expectations. In other words, businesses aren’t closing the experience gap.

The Experience Gap

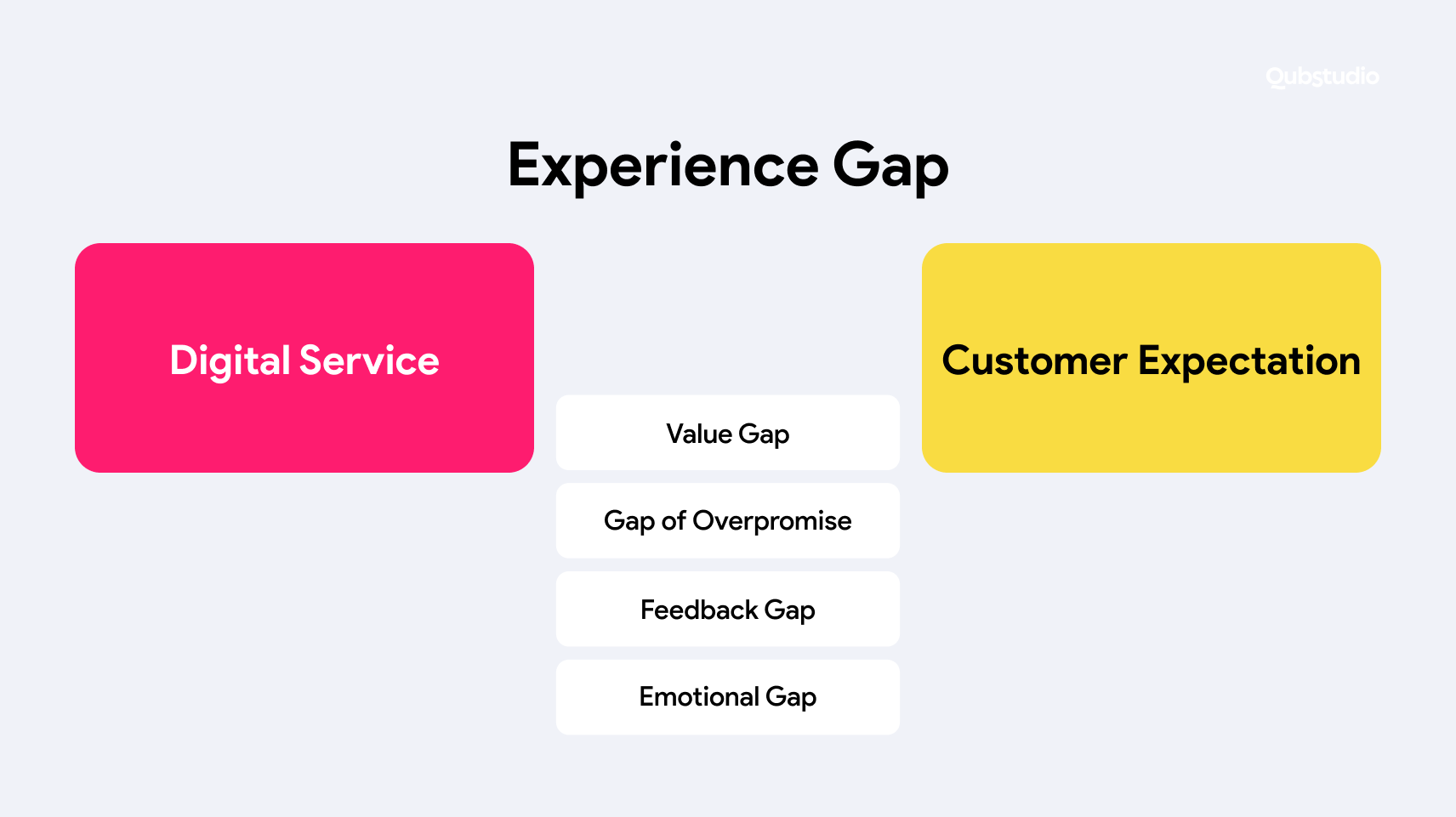

An experience gap—the discrepancy between customer expectations and what brands actually deliver—has been manifesting in digital banking design.

To remedy this, financial organizations need to work on the following areas for improvement:

- Culture gap. Businesses that don’t cultivate a customer-centric company culture fail to provide customers with a consistently positive experience across departments.

- Feedback gap. Companies grapple with a lack of customer expectation data or fail to leverage existing data, and as a result, don’t know how customers perceive their brand.

- Design gap. Failure to prioritize user-centered product design results in poor execution and a substandard end product.

- Gap of overpromise. Promising more than a product can deliver leads to disappointed users.

- Emotional gap. Overemphasizing functional features may interfere with creating emotional connections with customers.

Financial organizations can take a cue from Apple, which has cultivated customer loyalty with sleek CX design, compelling advertisements, and an awe-inspiring sense of innovation. The emotional connection is unmistakable, with loyal Apple users eagerly awaiting new product releases.

Why Is CX important?

Below, we list the consequences and benefits that demonstrate just how essential CX design is.

Consequences of Failing to Deliver a Positive CX

A negative CX can have consequences that take a serious toll on your bottom line:

- Reputational damage. Bad customer experiences could cause a serious blow to your brand reputation, which means lost profits and reduced social capital.

- Lost leads. Prospects who have a negative experience with your brand may opt out of purchasing your product.

- Customer churn. Existing customers may abandon your brand if it fails to provide consistently positive experiences.

Now let’s examine how good CX benefits your bottom line.

How Investment in CX Boosts Your Numbers

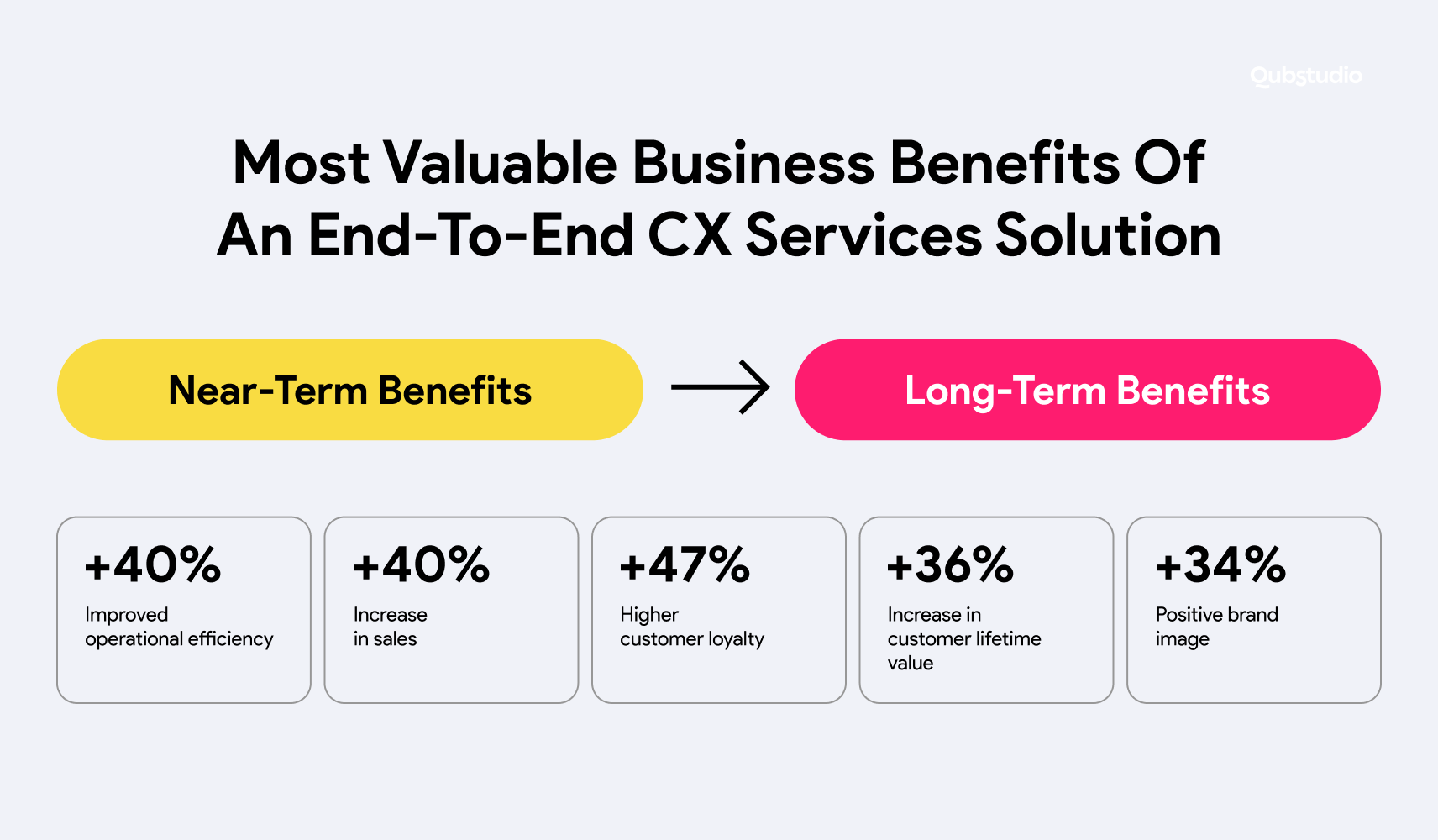

Let’s consider the short-term and long-term benefits of a positive CX.

Short-Term Benefits

Businesses can expect the following short-term benefits from well-executed CX design:

- 40% operational efficiency boost. Forging a customer-centric culture results in departments streamlining their workflows to deliver faster results.

- 40% sales increase. Increased customer satisfaction leads to higher conversion rates and lower churn, which both translate to increased sales.

Long-Term Benefits

Investing in CX design has a lasting impact.

- 47% customer loyalty boost. Positive CX fosters an emotional connection that makes customers stick with your brand.

- 36% customer lifetime value increase. Satisfied customers who stick with your brand spend more on your offerings.

- 34% brand image improvement. Excellent CX improves your brand’s reputation, increasing your potential to attract even more customers.

Without a full understanding of CX, you may fail to tap its full potential. To fully grasp what CX design is about, you need to understand how it’s different from UX design.

CX and UX Design: What’s Common and What’s Different?

It’s not uncommon for people to conflate CX design with UX design. Both CX and UX put the customer front and center and require a lot of insight into customers’ needs. At the same time, they’re two distinct concepts.

How are CX and UX different? CX design is an encompassing strategy that covers product design, brand reputation, operational efficiency, and customer support. Under the broader umbrella of CX design, UX design hones in on a digital product’s usability and accessibility.

Put simply, CX design deals with user interactions with the brand in general, while UX design focuses on user interactions with the digital product.

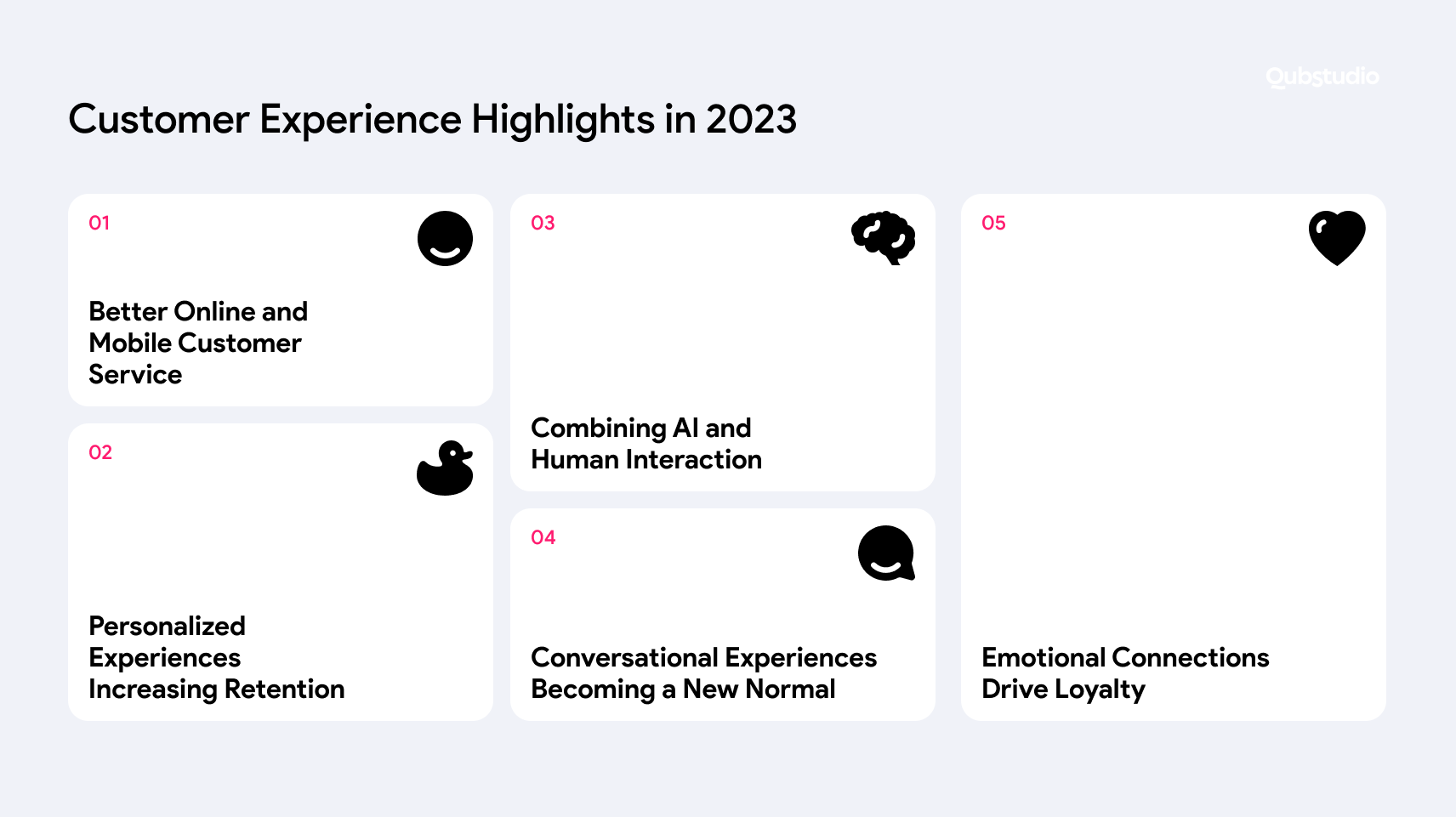

Customer Experience Highlights in 2023

Let’s take a closer look at key CX numbers in the financial sector that should inform your CX design.

1. Better Online and Mobile Customer Service

- 84% of customers rely on online banking.

- 72% use mobile apps to access online banking and interact with their primary bank.

- 64% of users have problems using financial institution apps to resolve issues.

2. Personalized Experiences Increasing Retention

- 72% of customers rate personalization as “highly important”.

- 77% of business leaders recognize the role of personalization in promoting customer loyalty.

3. Combining AI and Human Interaction

- 59% of business leaders vouch for the measurable ROI of AI-led chatbot technology in customer experience.

- 63% of customers prefer direct conversations with bank representatives.

4. Conversational Experiences Becoming a New Normal

- 70% of customers expect consistent conversations with their primary bank across all channels, which means that bank representatives must have a full view of customer data.

5. Emotional Connections Drive Loyalty

- 87% of direct banking customers plan to stick with a brand that makes them feel valued.

- The same percentage plan to use more of the bank’s services and spread the word about their positive experience with the brand.

Next, let’s get to know today’s FinTech consumers.

From Sales to Emotions: The Modern FinTech Consumer’s Portrait

Apart from choosing financial service providers that offer the most value and the best digital tools, modern users gravitate towards brands that mirror their own social conscience.

To meet the needs of these customers, financial institutions need to shift their sales-oriented approach to one that creates emotional connections. This means effectively communicating the company’s values and corporate social responsibility (CSR) initiatives.

So, how does this translate in terms of designing a positive CX?

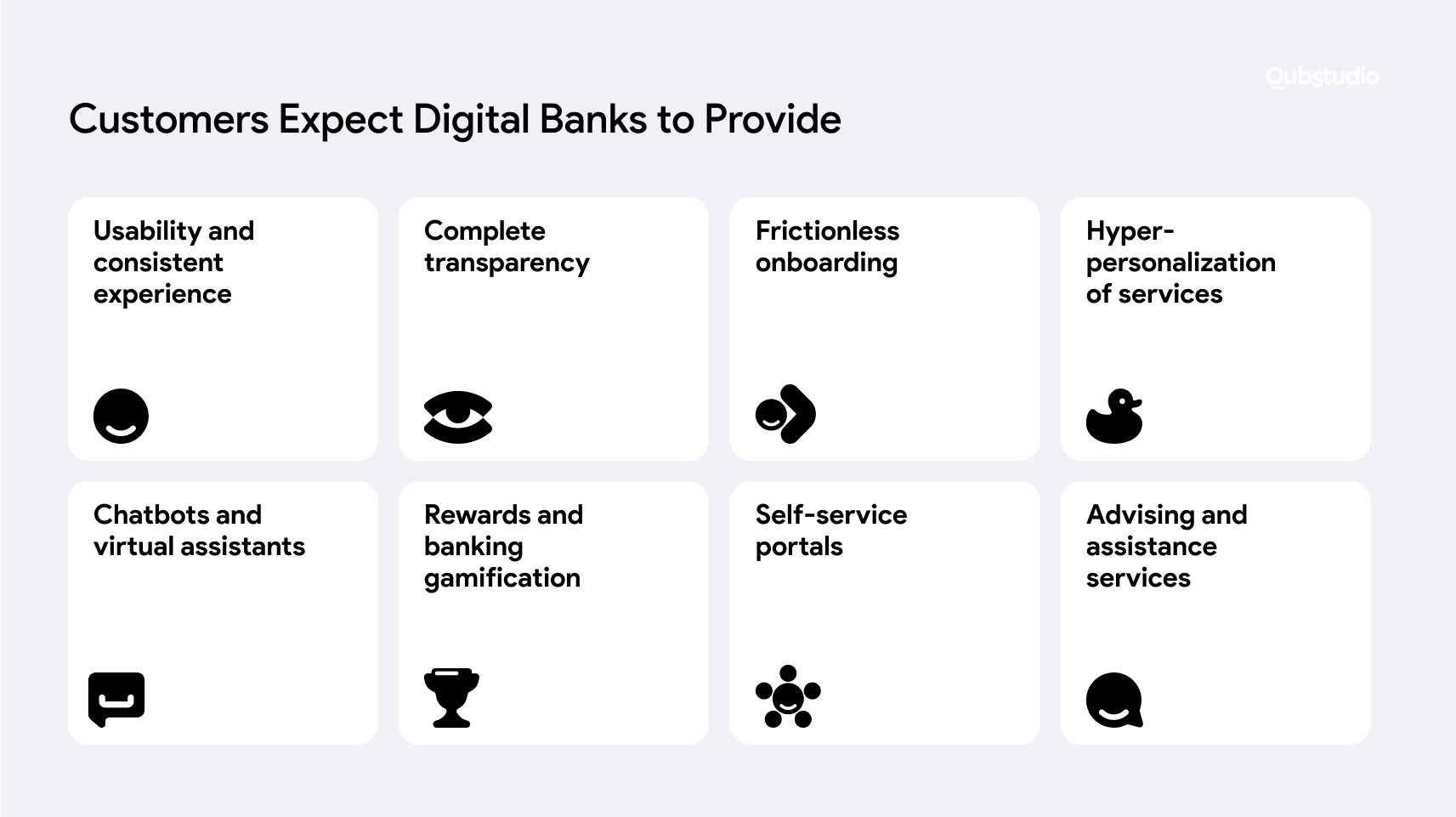

What Customers Expect from Digital Banks in Terms of CX

Today’s consumers expect results with a few taps on their smartphones.

They expect digital banks to deliver the following:

- An intuitive interface for easy usability;

- Complete transparency about exactly what they’re signing up for;

- A seamless onboarding process that improves their understanding of and experience with the product;

- Hyper-personalized services that meet their individual needs and preferences;

- Chatbots and virtual assistants that provide support around the clock;

- Rewards and banking gamification that make the app more engaging;

- Self-service portals that empower them to address their own concerns;

- Advising and assistance services to help them make the most of the brand’s offerings.

How can companies deliver a CX that meets those expectations? We’ll discuss that in the next section.

Innovative CX Design Strategies

Let’s get down to the practicalities of CX with top design strategies and examples.

1. Building Trust and Embedding Empathy into Product Strategy and Design

Your product design and execution must be a tangible manifestation of the empathy you have for your customers. This connects your digital products with the actual needs and preferences of your customers.

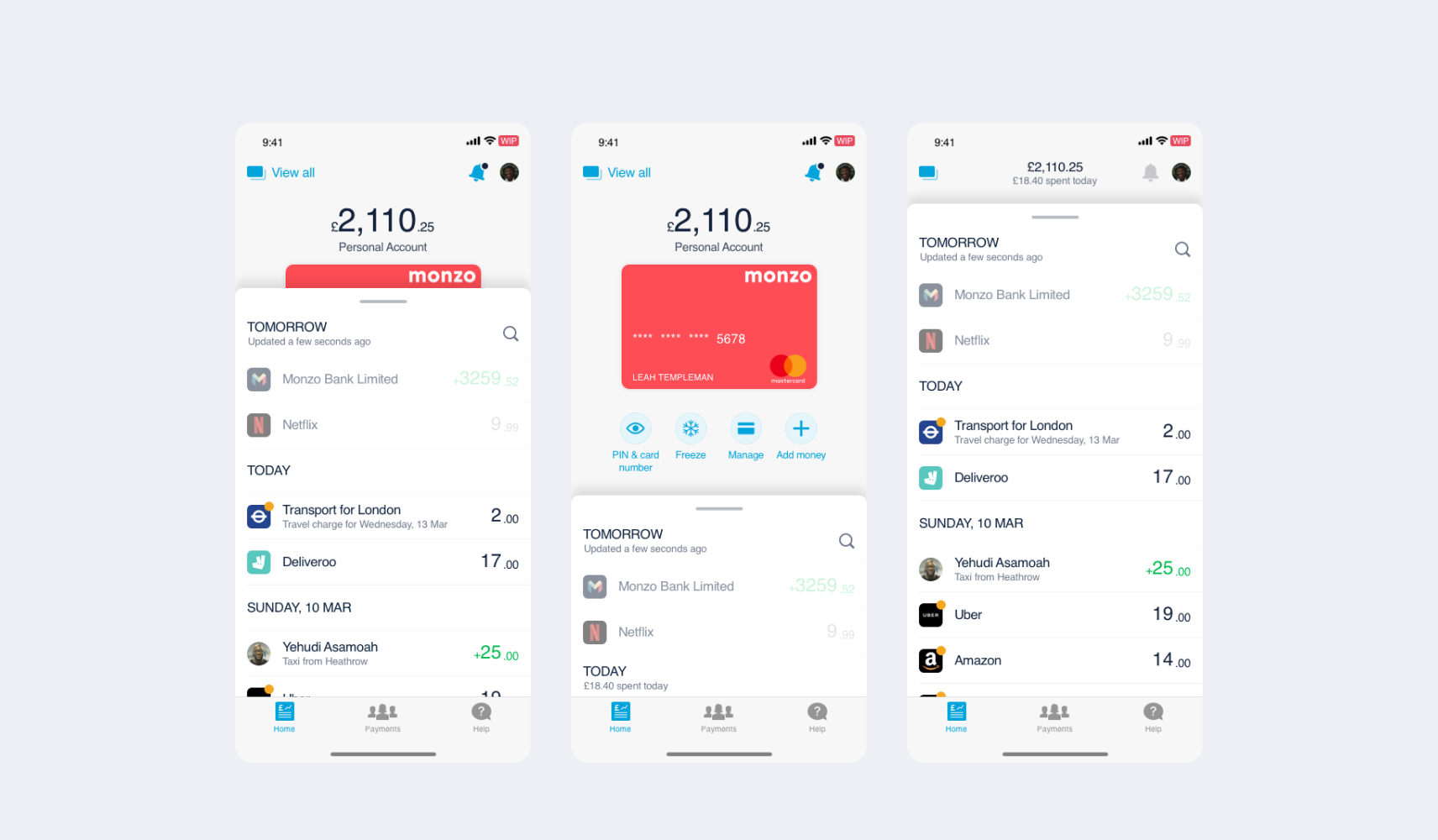

Case in Point: Monzo

Monzo, a British online bank, empathizes with their customers and gains their trust by ensuring their product offerings are transparent and easy to understand. For example, they explain loan options in plain language that people from all walks of life can understand. They also make the sign-up process quick and easy.

2. Making Emotional Connections with Customers

Customers who are emotionally connected with a brand tend to stay loyal for an average of 5.1 years and increase their lifetime value (LTV) by 306%. They’re also 30.2% likely to advocate for your brand.

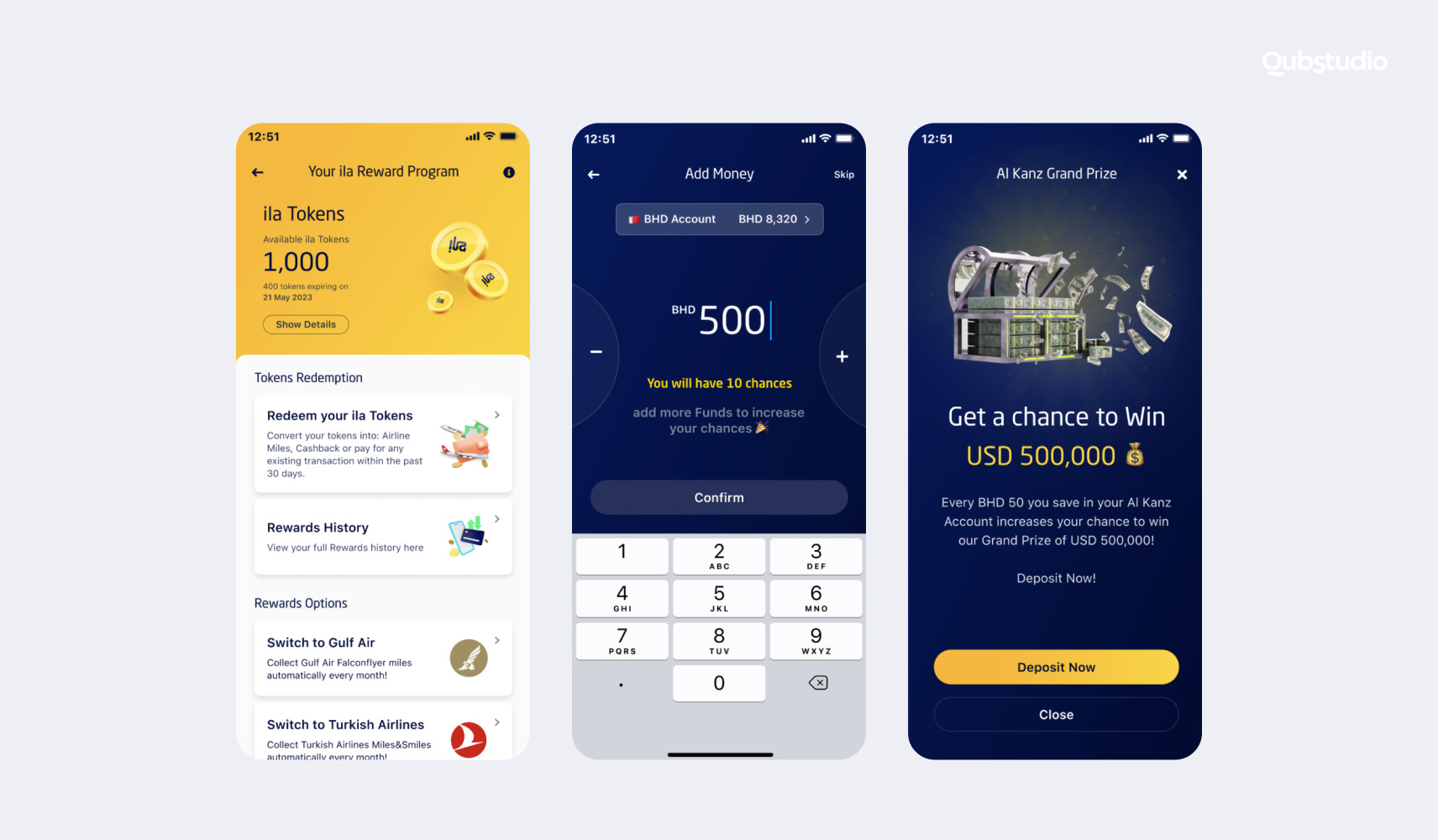

Case in Point: ila Bank

ila Bank, an online bank in Bahrain, engages its customers by rewarding them with tokens (which can be redeemed as miles or cashback) for their credit card purchases. Those who save their money with the bank can also win cash prizes of up to US$2.25 million.

3. Gamification

Gamifying makes the experience with your brand fun and engaging, encouraging customers to stick with you for the long haul.

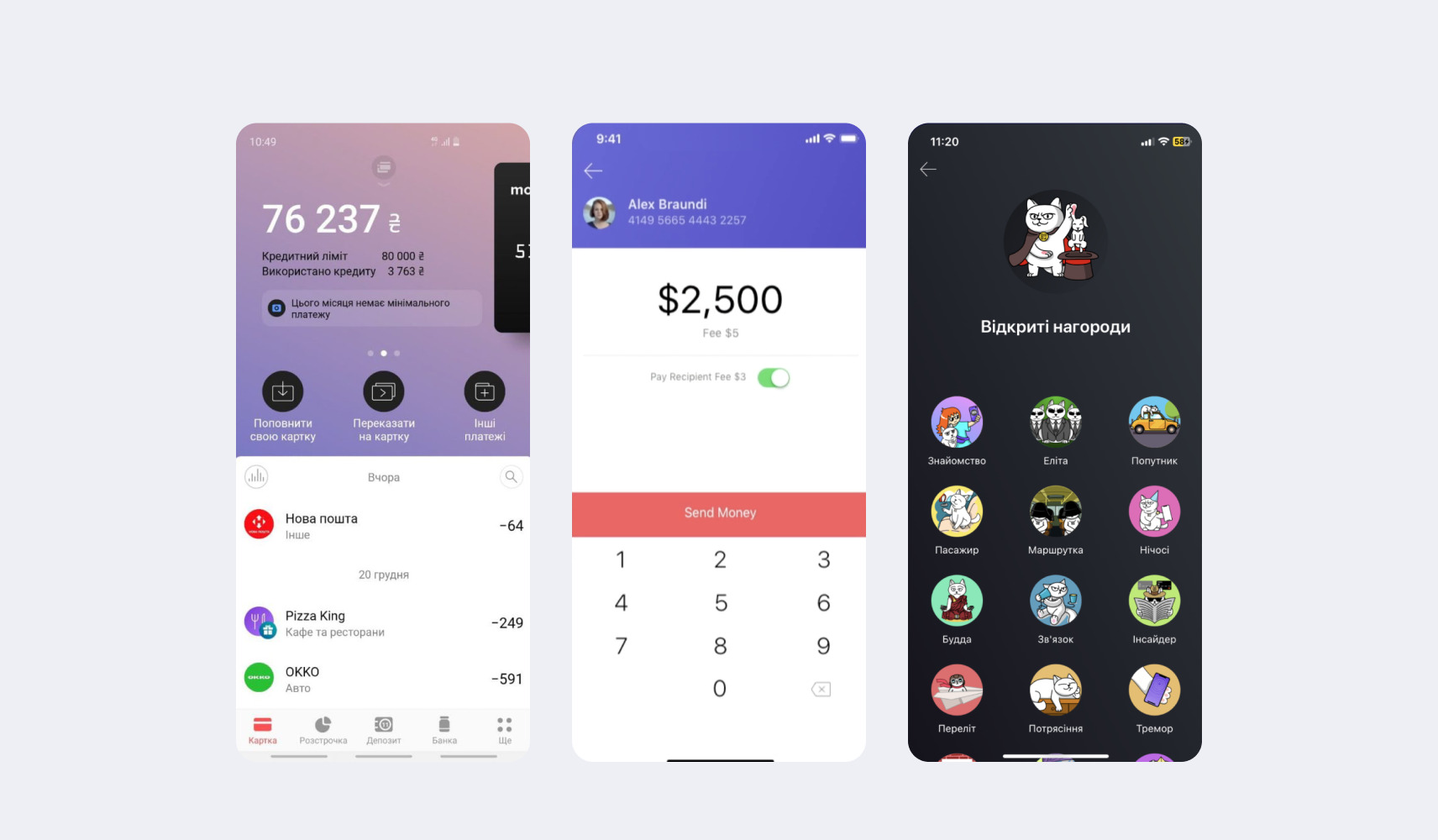

Case in Point: Monobank

Mono, a Ukrainian online bank, initiated the Lovemark strategy, which aims to foster emotional connections with fun games, awards, stickers, badges, and unlockable achievements.

4. Consistent Omnichannel Experiences

76% of customers expect consistent experiences with your business across different departments. Banks need an omnichannel strategy to meet this need. This means unifying data so every department has a 360-degree view of the customer.

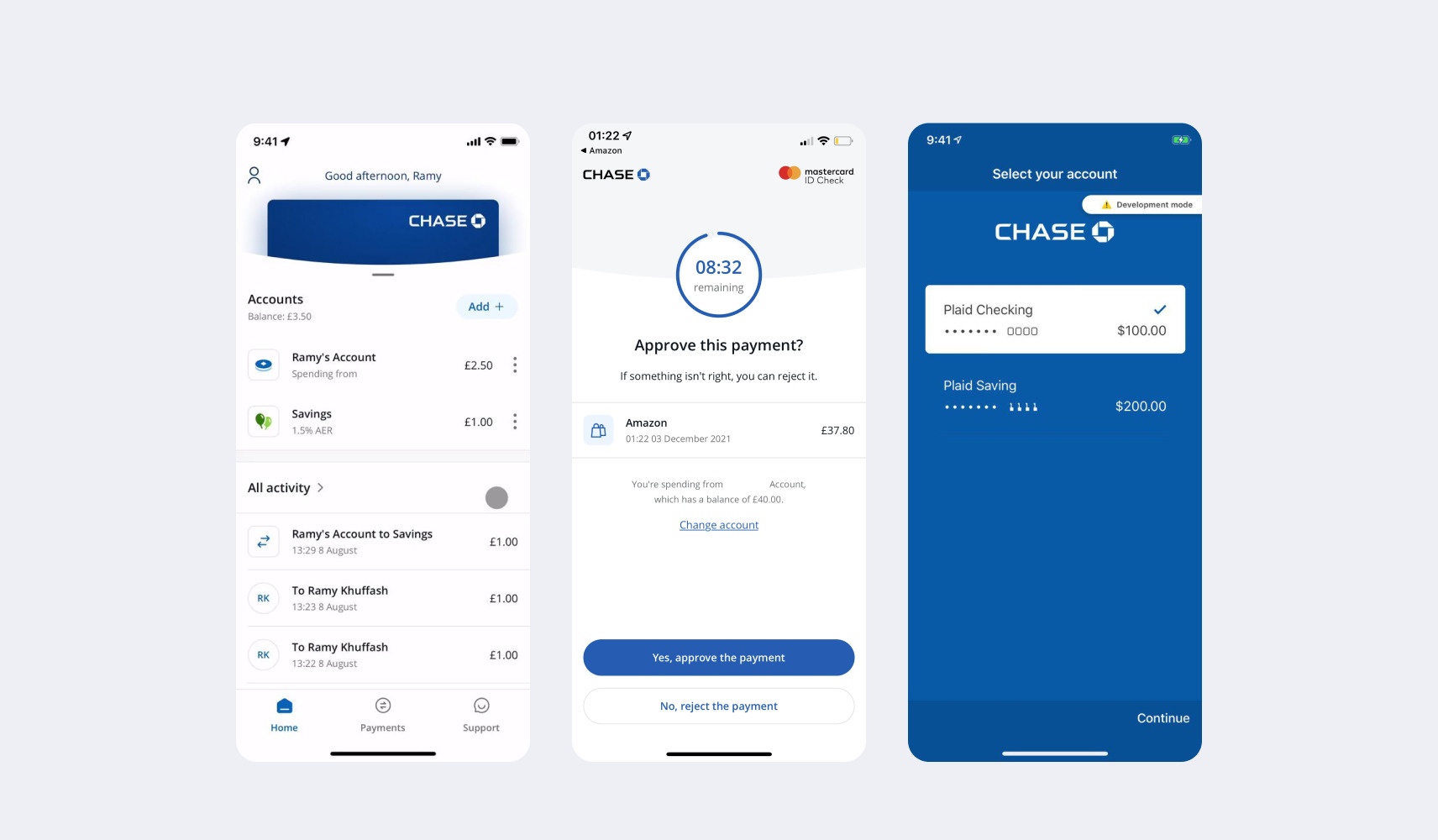

Case in Point: Chase

JPMorgan Chase boasts a comprehensive digital suite that enables cross-device compatibility. Their customers can move from one device to another and still access all the same tools, products, and services.

The Right Design Processes

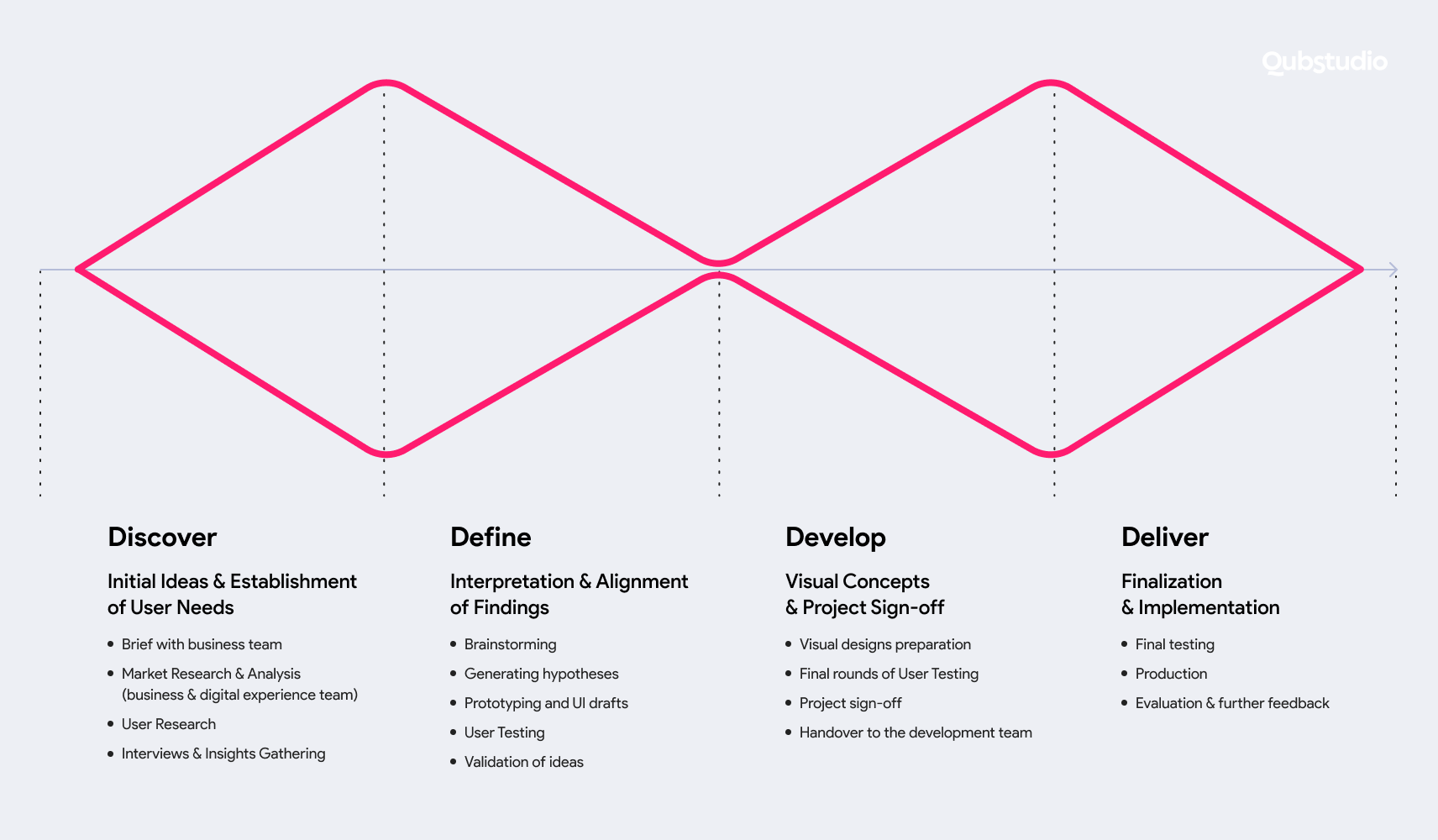

The right design processes set a strong foundation for your design strategy. The Double Diamond approach offers a framework to help you get it right. It comprises two diamonds and four phases:

Diamond one—Discover and Define

This stage involves research and exploration. Here, your mission is to understand your users’ needs, define the problem, and determine how this problem impacts the users.

Diamond two—Develop and Deliver

In this stage, you create prototypes to validate your idea and run it through a barrage of tests.

The right strategy can help you design a consistently positive CX that attracts prospects and keeps existing customers loyal.

Customer Experience Design with Qubstudio

Customer experience design is a complex process with many moving parts. Fortunately, seasoned experts can help set you on the right track.

Qubstudio is a digital product design and branding agency that takes a user-centered and data-driven approach to user experience design. We have considerable experience working with FinTech companies, including ila Bank, Finova, and Tamara Pay.

Case in point, ila Bank is now known as a digital pioneer in the MENA market. This Bahranian bank has also been awarded the Best Digital Bank User Experience by MasterCard in 2020 and the World’s Best Consumer Digital Bank Awards in the Middle East by Global Finance in 2021.

At Qubstudio, we carried out in-depth user research and established a design-driven process to help ila Bank grow their digital product. Our customer-centered approach to the design process involved user surveys, stakeholder interviews, data analytics, creative brainstorming sessions, and engaging the dev team.

Conclusion

Customer experience design is a comprehensive strategy that can help your brand create deeper and more lasting connections with your customers. When done right, it can do wonders for your brand value and directly feed your bottom line. It can bring undeniable value to companies in the financial sector, which is undergoing disruption by powerful FinTech apps.

Carve your own space in the sector by working with the design experts at Qubstudio. You can reach them here.

Sources

- https://www.theuxda.com/blog/banking-customer-experience-trends-2021-define-post-covid-digital-strategy/

- https://www.qualtrics.com/blog/qualtrics-servicenow-customer-service-research/

- https://www2.deloitte.com/us/en/insights/industry/financial-services/digital-transformation-in-banking-global-customer-survey/

- https://www.zendesk.com/blog/customer-experience-in-banking/

FAQ

What is CX design, UX design, and service design?

CX considers all the touchpoints across the customer journey, UX focuses on the user’s interaction with a digital product, and service design (SD) takes refers to the organization of all of a business’s channels and touchpoints.

How do I engage my audience through customer experience design?

A positive customer experience keeps customers engaged by using an empathetic product strategy and design, reward systems, and consistent experiences across channels and departments.

How do I design a customer experience strategy?

Here are the key steps for designing a customer experience strategy:

- Get to know your customers

- Respond to feedback

- Map out your brand’s customer experience journey

- Identify areas for improvement

- Develop an action plan

What is design thinking in CX?

Design thinking, a customer-centric approach to problem-solving, can be applied to customer experience design to help brands create products and forge interactions that truly resonate with the customers.

How does web design affect CX?

Web design involves the visual elements of the web product interface that users interact with, or UX. CX considers all customer interactions with the brand, including UX.