Customer Research as an Essential Part of Digital Transformation in Financial Services

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

The world of consumer banking has undergone a crucial shift due to the rise of digital transformation. This has not only rewritten practices for how customers interact with financial institutions but has also radically raised the CX standards and a demand for financial services innovation.

In this article, we are exploring what fintech product leaders should focus on while working on the product strategy and how to meet the customer’s expectations for business success.

How did Digital Transformation in Financial Services Reshape Customer Behavior?

Digital transformation within financial services is a profound shift that leverages technology to reimagine every aspect of the financial world.

This transformation is more than just the adoption of new tools; it’s about crafting a new way in how we interact with our finances, focusing on making complex financial services understandable and accessible to everyone.

Today’s consumers no longer see financial management as a series of transactions but as an integrated part of their digital lifestyle.

Customers Have Already Shifted to Digital

According to a recent study by Entrust, 88% of customers now prefer online banking, with 59% utilizing mobile apps and 29% opting for desktop browsers. Digital transformation in financial services is no longer “nice-to-have”, but a must for business innovation strategy.

Kearney’s 2023 European Retail Banking Radar Report says that digital channels were used by 44% of consumers in Europe to purchase banking products by 2023, with a significant increase from the 33% recorded in 2020. Furthermore, 37% of European banking interactions now occur exclusively through digital channels.

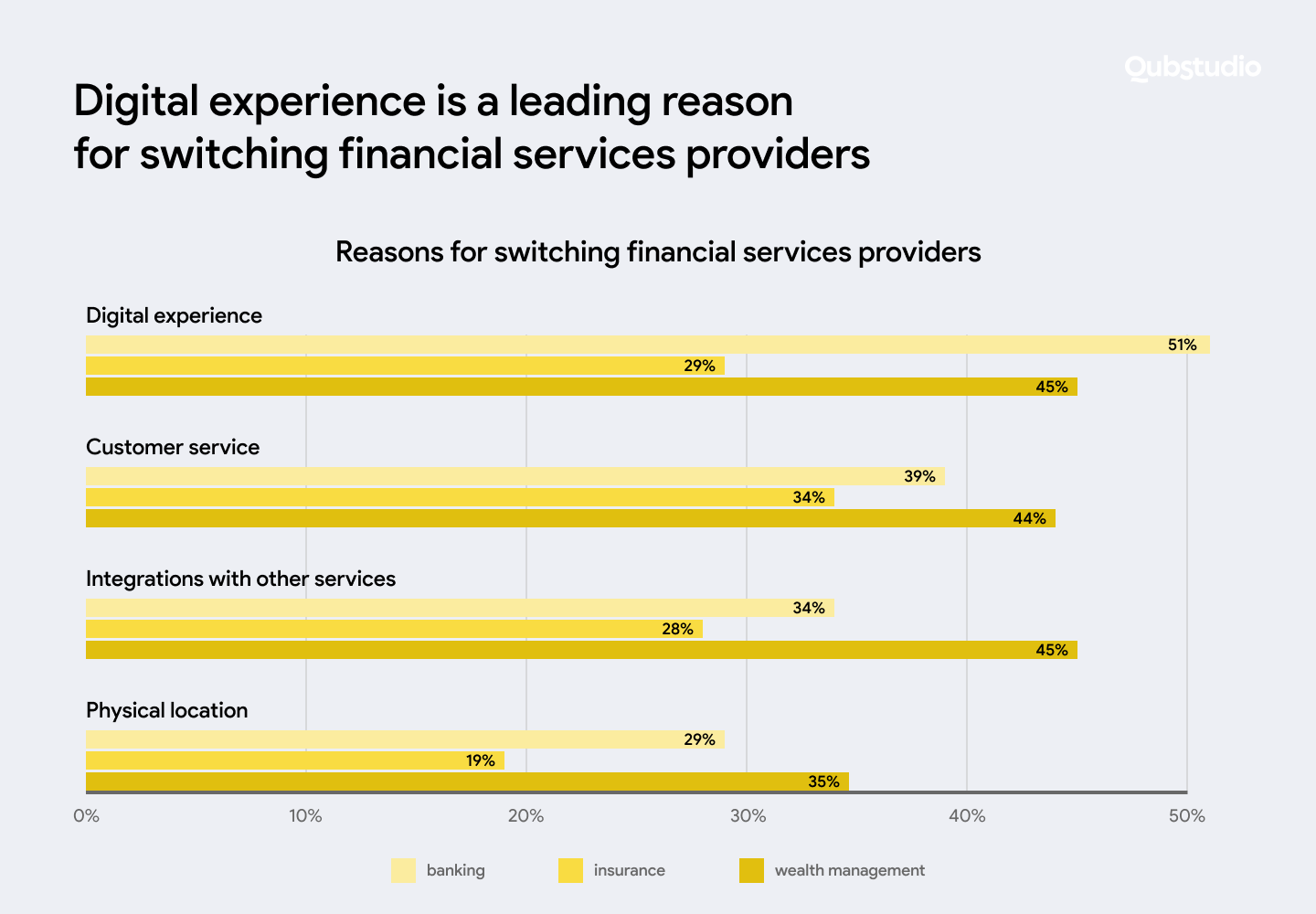

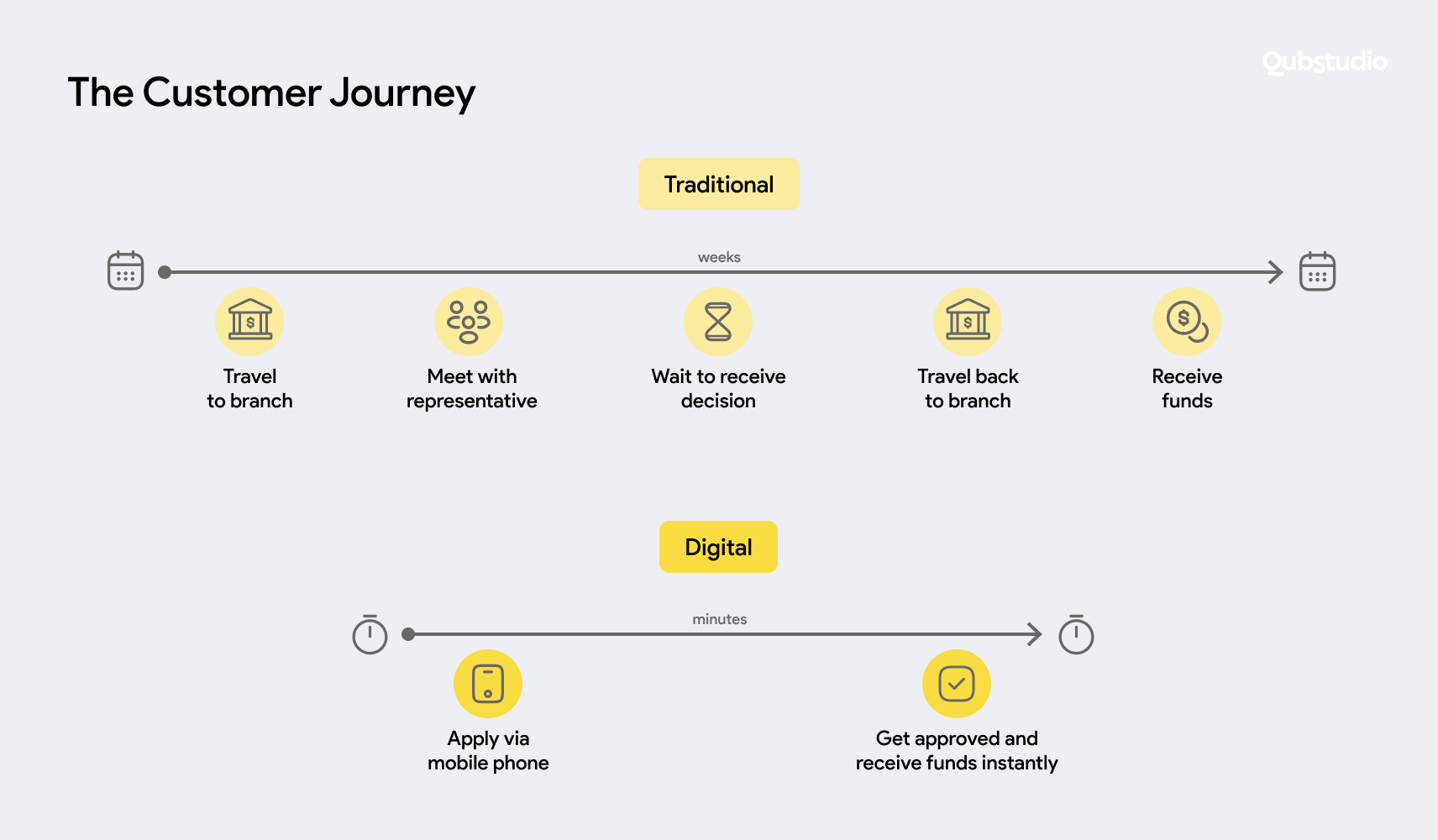

In today’s market, providing seamless experiences across all digital channels is no longer a mere option but a necessity for business strategy and innovation. Customers are willing to switch to a different financial service provider in pursuit of a superior digital experience and fintech innovation.

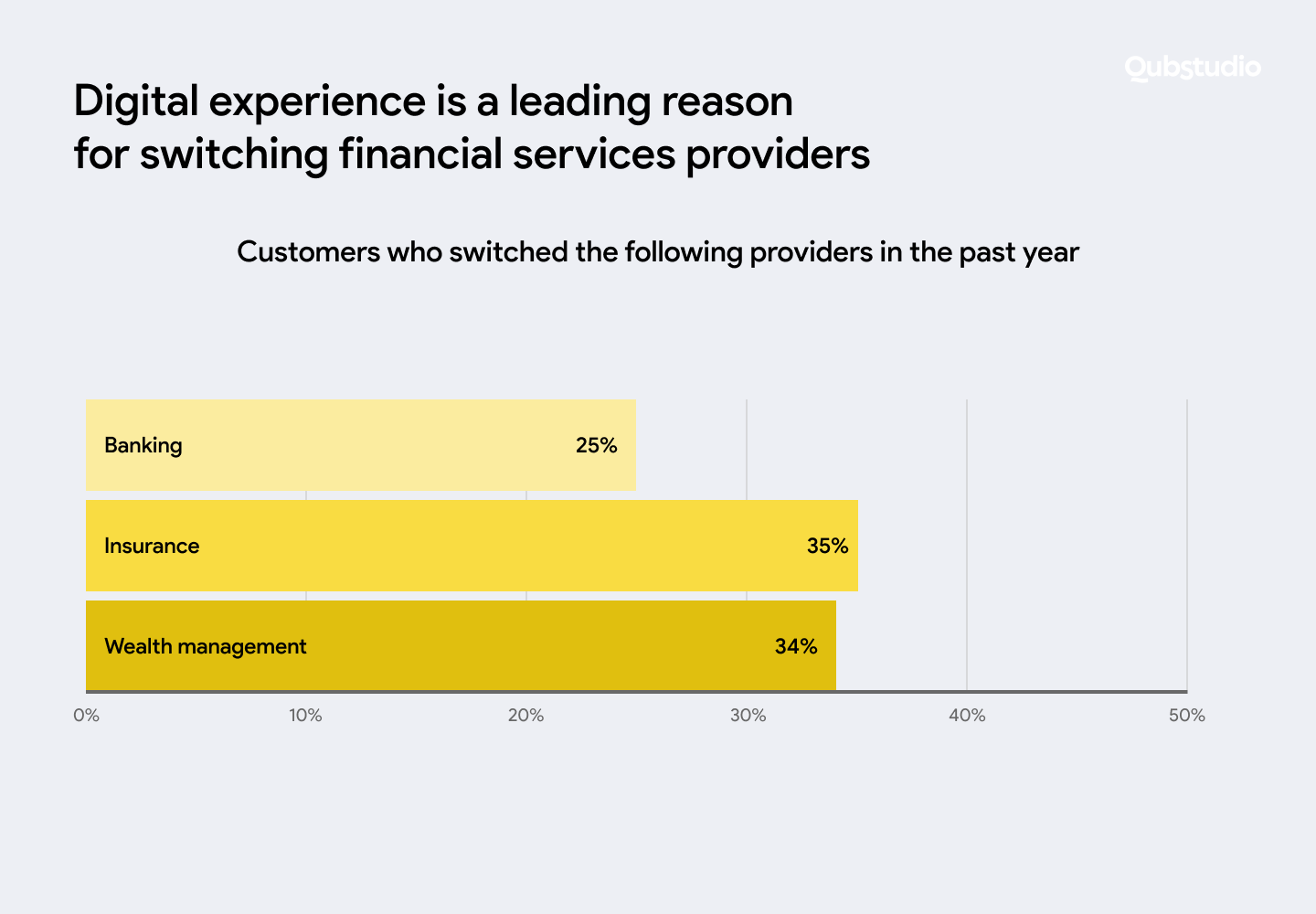

In 2022, 25% of customers changed banks, and over a third switched insurers and wealth managers, primarily driven by the quest for enhanced digital experiences.

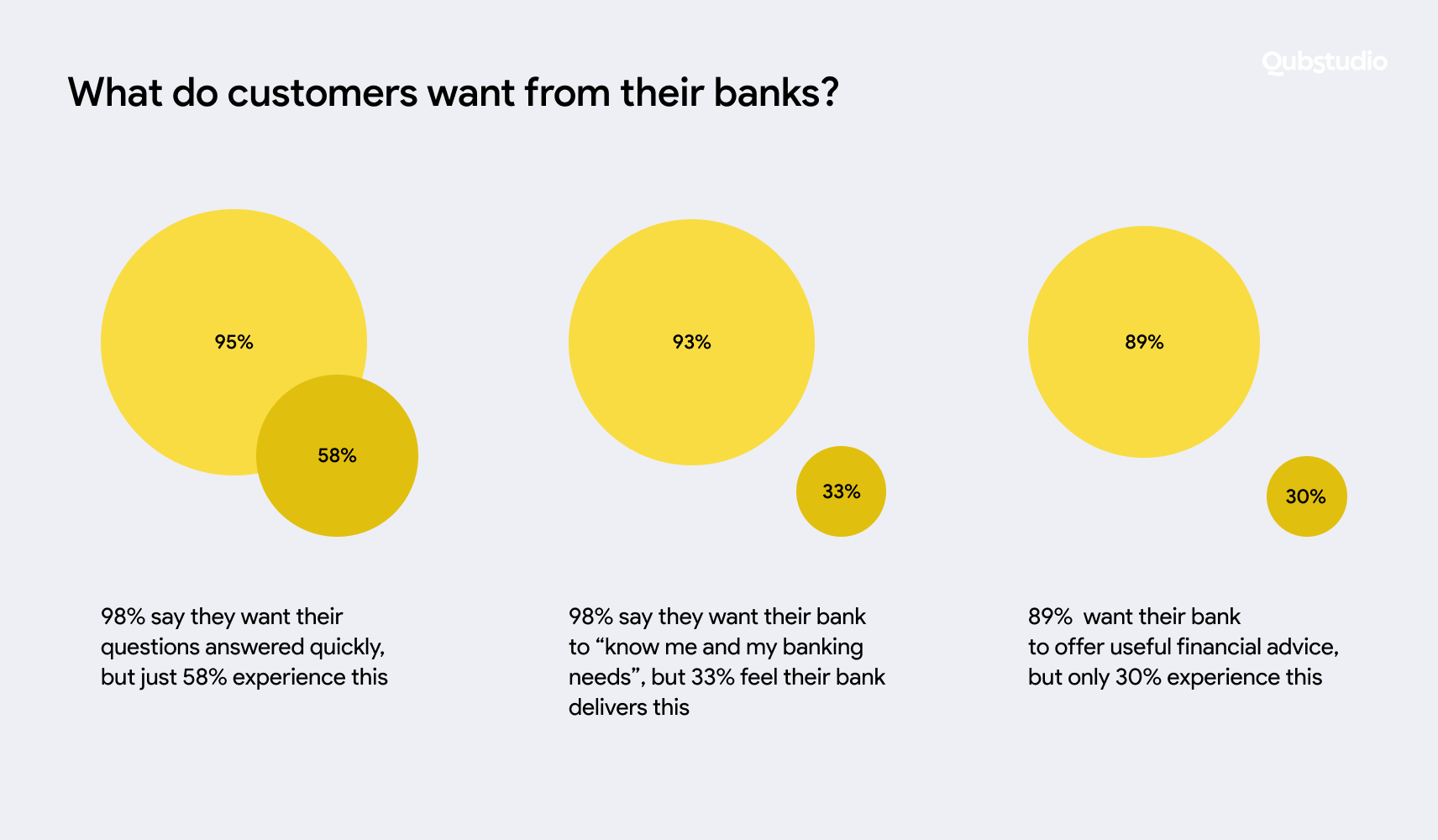

Customers Expect Personalized Solutions and Advice

Businesses cannot overlook the importance of personalization seeking for the fintech innovation in the banking industry as 66% of consumers indicate they prefer to change service that fails to deliver personalized experiences.

Modern customers want more than an easy-to-use digital app – they expect quick support, a solid understanding of their needs, and comprehensive help and guidance from the financial service provider.

Access to customer data is essential for creating personalized experiences. However, the growing concern for safeguarding personal data highlights the crucial role of trust in the provider-customer relationship. Achieving success hinges on striking a balance between personalization and maintaining high-security standards.

Despite this, more than half of customers (56%) are willing to share their data in return for an improved experience. However, customers demand transparency and control over the data-sharing process, including information about what data is shared, who has access to it, and how it will be used.

Considering growing customer expectations and competition from innovative solutions, big financial organizations need to overcome the inner challenges.

Common Challenges of Fintech Organizations During Digital Transformation in Financial Services

Big fintechs operate in an environment that is less adapted to rapid changes, fintech innovation, and lean-approach. Being a product leader for a fintech, meaning taking these specifics into account.

The Slow Pace of Change

Traditional financial firms struggle to integrate new digital solutions and agile work methods with existing systems and processes. Digital transformation in fintech could be more resource-consuming for product leaders compared to other markets. This is compounded by resistance from team members and leaders who are accustomed to conventional operating models, creating further roadblocks to progress and overall fintech innovation.

Regulatory Compliance

Financial services operate within stringent compliance standards and regulations, which often slow down the product development process and make digital transformation in fintech challenging. Striking a balance between efficiency and compliance is crucial in order to avoid potential legal risks.

Siloed Departments

Financial institutions manage numerous products, services, and stakeholders, leading to organizational silos. Such structure can hinder collaboration, slow fintech innovation, inhibit the sharing of crucial information, and ultimately lead to fragmented decision-making and execution.

Navigating within the storms of inner and external challenges requires having a trustworthy compass. While planning, strategizing, and implementing the decisions, CX research will serve you as a nord star.

Continuous CX Research for Informed Decision-Making and Business Success

Organizations that prioritize continuous CX and UX research are better equipped to create user-centric products and foster business growth and have a solid group of innovation in product design.

According to survey results from The Future of Finance, a significant 88% of respondents reported that customers’ research directly correlates with effective decision-making. Teams conducting research more frequently—on a weekly or daily basis—reported higher levels of effectiveness compared to those conducting it quarterly or yearly.

These findings underscore the positive impact of gathering customer insights throughout the product life cycle. This approach not only enhances customer satisfaction but also improves product adoption, active users, and revenue rates.

While an increasing number of product teams recognize the value of customer insights in driving innovation, many organizations still face challenges in conducting comprehensive research. In fact, 78% of respondents believe their companies could benefit from conducting more studies.

What is UX Research Maturity?

Research maturity measures the incorporation and effectiveness of research practices, including UX research, market research, and data analytics, within a company.

A recent report based on extensive research with 500 product experts, “A Research Maturity Model for User-Centric Organization” released by Maze outlines five maturity stages. From limited integration in Level 1 to a fully strategic approach in Level 5, these levels highlight research methods and their corresponding advantages.

It shows that research-mature organizations

- 2.3 times improved business outcomes: Research significantly contributes to business growth, particularly in reducing time-to-market by 4.3 times, increasing revenue by 4.2 times, and enhancing brand perception by 3 times.

- 1.8 times more inclined to conduct research regularly: Various roles across the organization are empowered to engage in research, and they do so with greater frequency.

- 5.1 times more inclined to conduct exploratory research: Organizations that prioritize research actively seek to understand customers’ needs and proactively explore new opportunities.

- 1.5 times more inclined to invest in research tools: Insights from users are gathered throughout the product life cycle, from initial exploratory phases to post-launch assessments.

How We as a Product Design Team Began to Implement CX into the Product Strategy

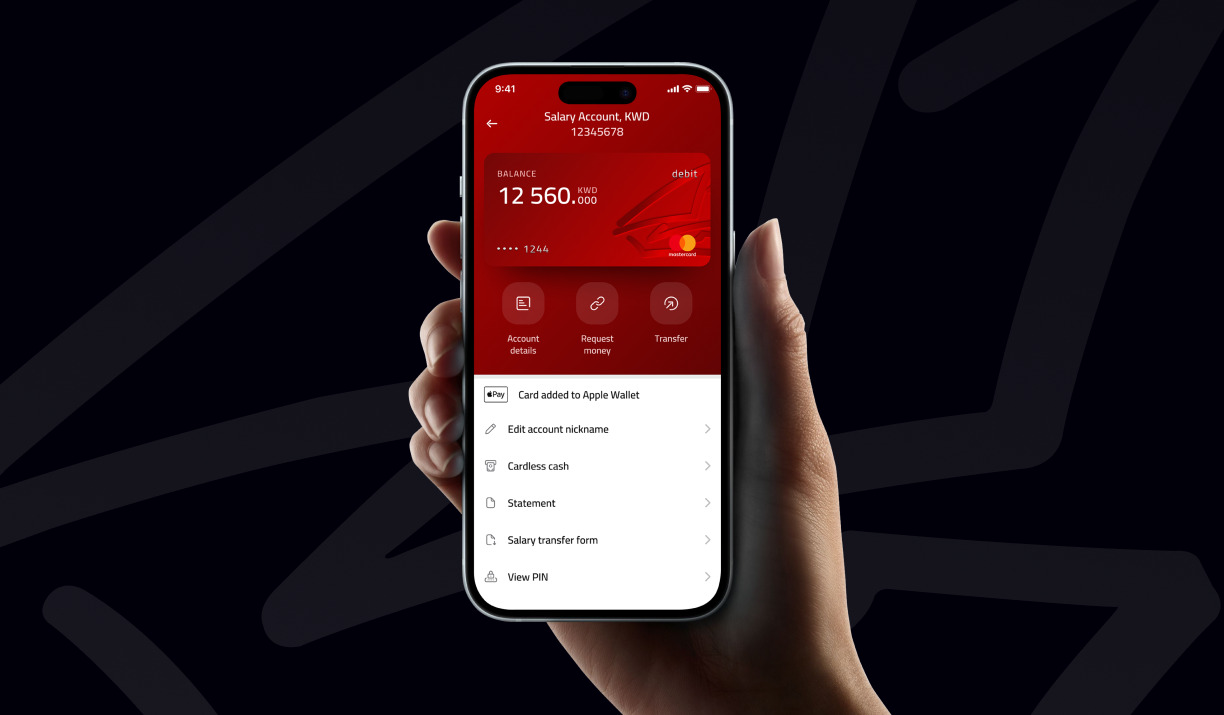

Over the past year, our team has been collaborating with a prominent Middle Eastern bank.

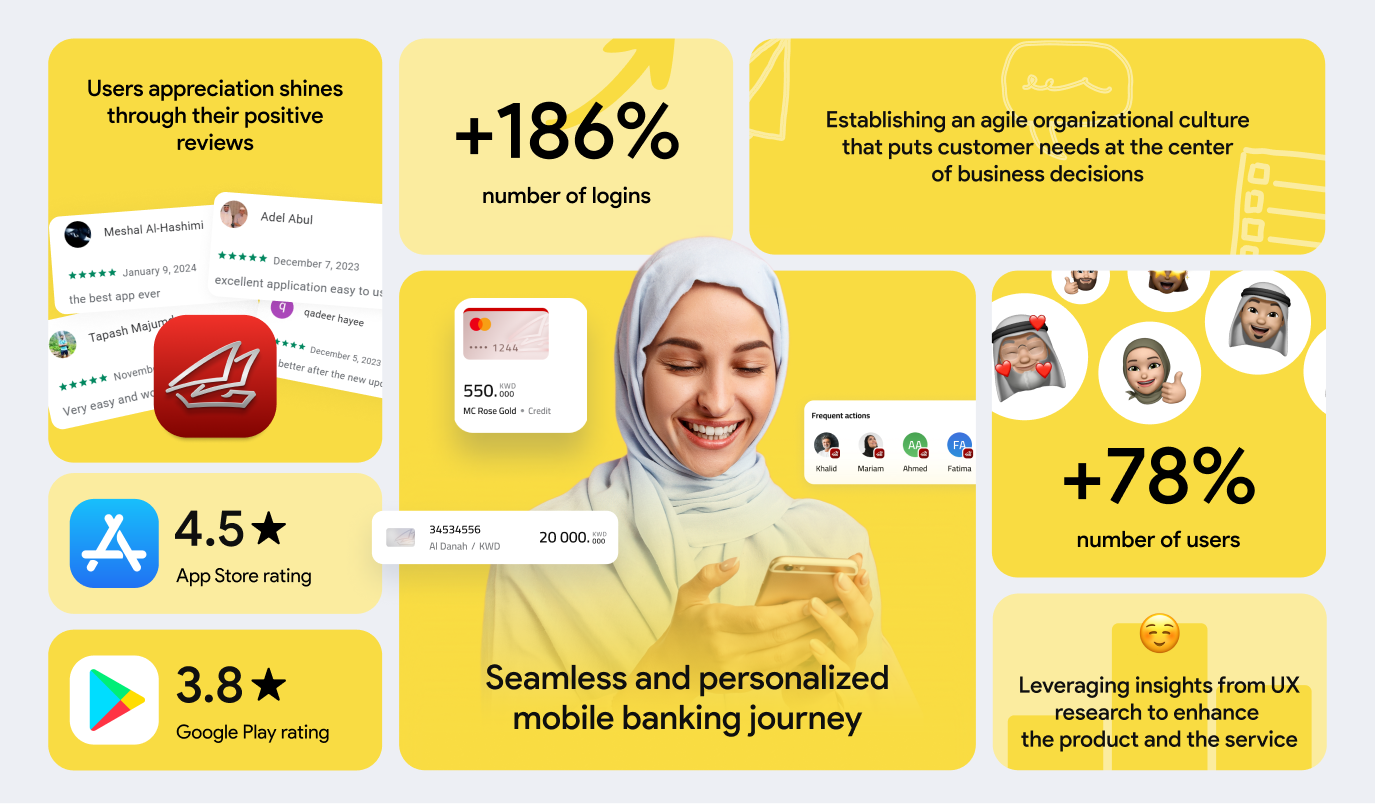

The Middle East market is going through a boom of digital transformation in financial services, competition is growing and there is a lot of fintech innovation these days. Working closely with the stakeholders, we have been instrumental in innovating the digital mobile customer experience (CX) and supporting the bank’s transition towards an omnichannel model.

Incorporating regular customer research activities into our design process took several months. However, once we shared our initial insights with the stakeholders, it served as compelling evidence of the value and provided a convincing argument for consistently engaging with customers.

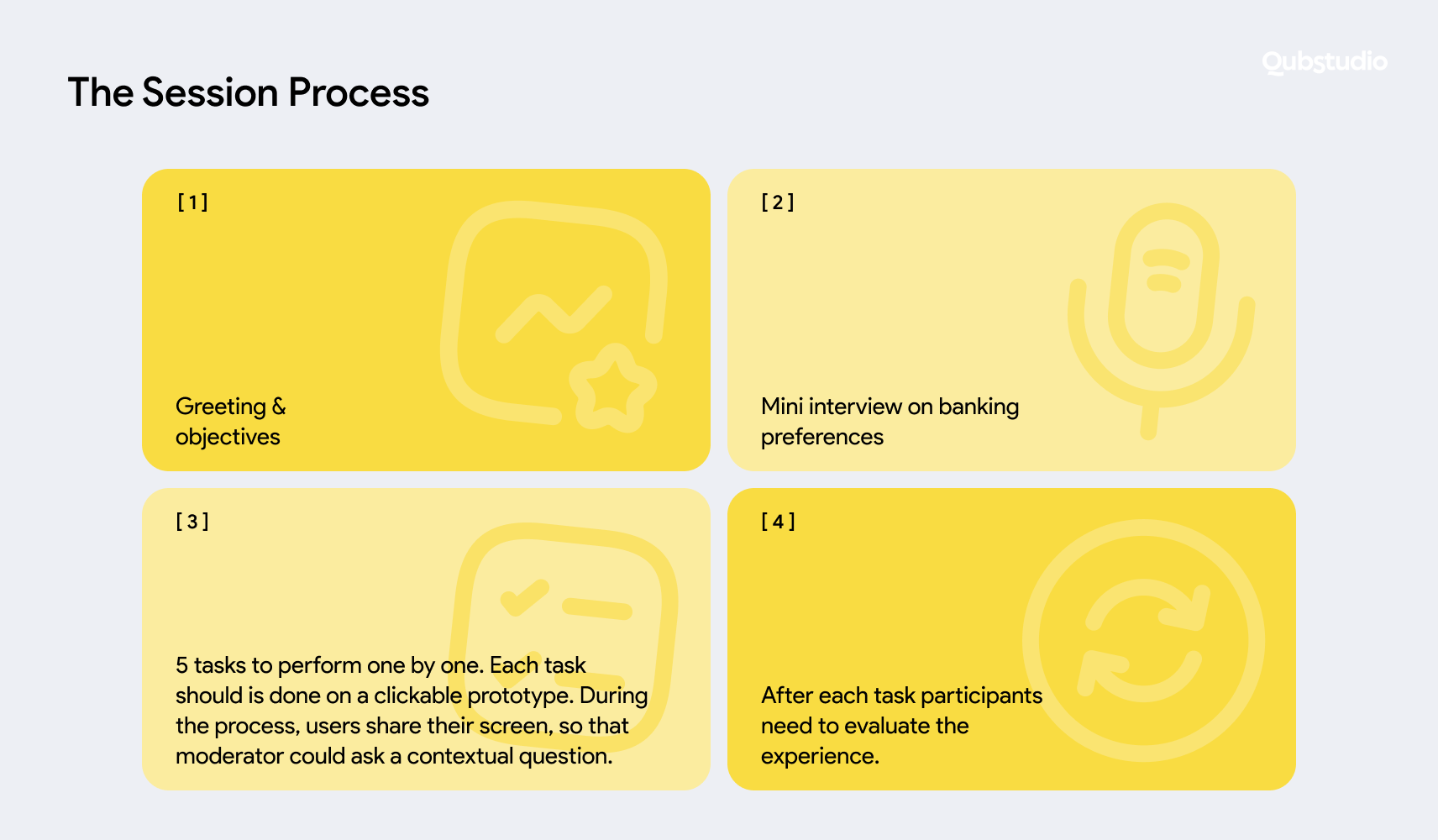

Currently, we conduct regular usability testing, user interviews, and surveys, and analyze feedback from the Help Center and social media platforms.

Following the launch of the redesigned product, we observed a twofold increase in the app’s rating on the App Store and a 78% surge in the number of active users.

What to Focus on as a Fintech Product Leader in 2024

Foster Cross-Department Collaboration: Promote teamwork and open cross-functional communication to improve work processes and foster fintech innovation ideas.

Invest in a Customer-First Culture: Place customer needs at the center of business decisions to elevate satisfaction. Building strong customer loyalty ultimately drives business growth.

Deliver Seamless Experiences: Apply UX research findings to strive for exceptional CX. Utilizing insights from UX research to tailor personalized financial offerings can differentiate the product from existing market solutions.

Conclusion

By prioritizing these focus areas, financial services organizations can position themselves for success in an increasingly competitive landscape by meeting the evolving needs and expectations of their customers. The best driver of fintech innovation is foreseeing customer needs.

Starting with customer research can be challenging. Being experts in solving the specific issues related to fintechs CX and UX, Qubstudio team is ready to navigate your product team on any part of this journey.