Design Thinking in FinTech: How to Implement

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

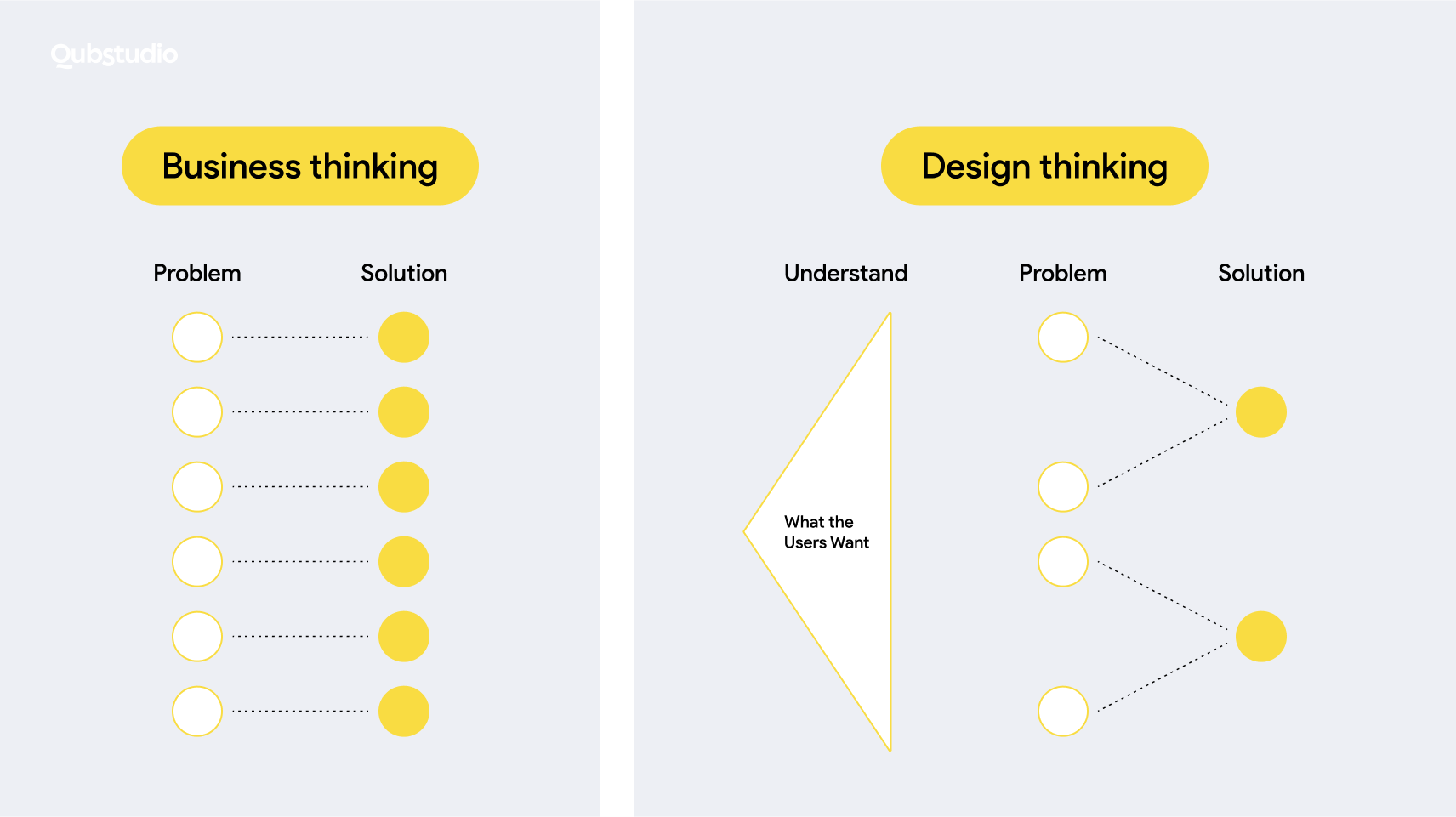

The FinTech market is growing rapidly, but not all companies succeed. Often, businesses prioritize their goals over end users – the very people their products are meant to serve. As a result, users struggle with bureaucratic labyrinths and seek simpler alternatives.

Design thinking offers a human-centered approach instead that puts people first.

This article explores how design thinking in FinTech can harmonize business goals with customer needs through empathy, iteration, and simplicity.

What Is Design Thinking in FinTech?

Design thinking is a creative problem-solving process centered on understanding user requirements. It involves observing users and uncovering their unmet needs.

Design thinking in FinTech (as well as any in other industry) relies on rapid prototypes – a quickly produced, often simplified product versions, created for testing and validating a future solutions. Rapid prototypes are produced in iterations and get more refined over time based on user feedback.

The iterative nature of prototyping allows you to put new concepts in front of users in days rather than months. But this is just one of many other benefits of design thinking in FinTech.

The Main Benefits of Design Thinking in Fintech and Banking

As Qubstudio experts explain, “In today’s highly competitive banking sector, developing products from scratch without any prior knowledge or hypotheses about your users can be an exceptional challenge.” That’s where design thinking kicks in.

It shifts the focus from merely ticking off business goals to crafting experiences that solve human problems. This shift brings the following advantages.

1. Avoiding Wasted Investment

Testing early means failure is cheap. With design thinking, products or features that might flop are identified early through rapid prototyping and testing. You can decide to give up on ideas that aren’t working well before you invest too much time and effort in them. This prevents costly mistakes.

2. Discovering the Right Problems to Solve

Observing real customers reveals their friction points. Design thinking highlights issues that may not be obvious from a business perspective. For example, users might want the flexibility to generate a bank statement for a single transaction, not a statement containing all transactions made within a given day.

3. Aligning Earning Opportunities with Customer Value

Charging for ATM access or sending SMS for a fee may provide a short-term income boost but can come across as unnecessary to users.

Rather than trapping customers with fees for basic services, design thinking reveals smarter earning potential around actual user needs. For example, customers may gladly pay for access to licensed financial advisors or customized reports on financial habits and trends.

4. Lowering Customer Acquisition Costs

Acquiring new customers is more expensive than retaining existing ones, especially in banking: changing financial service providers involves earning trust and overcoming inertia.

Design thinking can lower customer acquisition costs. Products effectively addressing user pain points generate word-of-mouth referrals and loyalty.

5. Attracting Partners and Investors

McKinsey reports that banks have struggled to attract investors in recent years, becoming the lowest-valued sector globally in 2021. The reason is that most traditional banks have been slow to embrace cross-industry partnerships compared to other industries. It clearly shows that institutions clinging to closed, legacy ways of work will continue to be undervalued.

Fortunately, design thinking in banking provides companies with a roadmap for reinvention. It aligns their objectives with the interests of investors while positioning them as adaptable, customer-focused, and well-prepared for the future.

If you’re ready to reap the benefits of the human-centered approach, let’s figure out how to proceed.

The Process of Design Thinking in FinTech

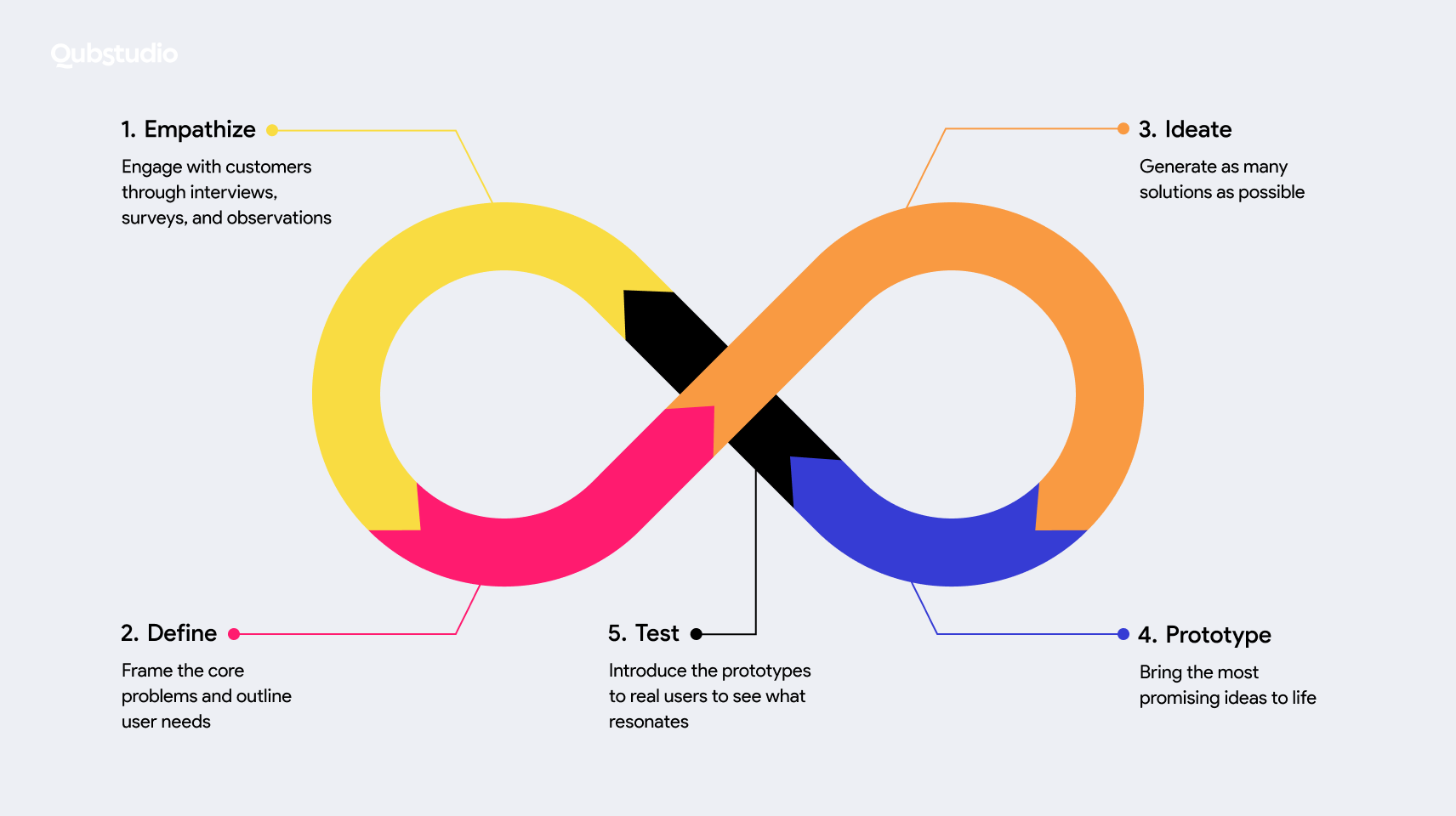

Design thinking in finance requires a creative yet structured process for FinTech innovation. It must keep the end-user front and center through each of the five phases of the Stanford design thinking process:

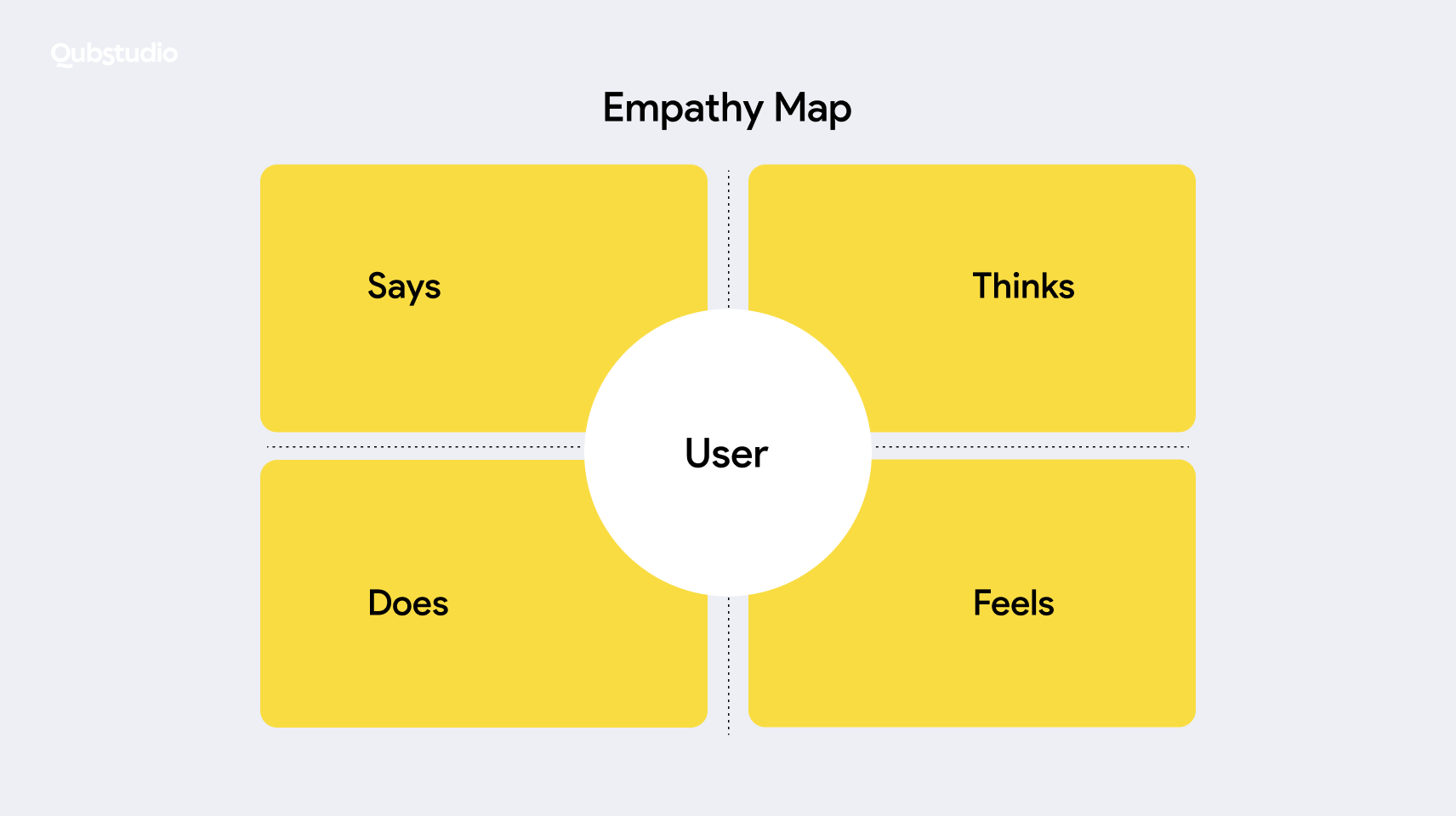

Phase 1: Empathize

The first stage focuses on gaining empathy for users. Rather than making assumptions, design thinkers should directly engage with customers through interviews, surveys, and observations.

The Qubstudio experts advise combining interviews with user testing sessions. This way, you can speak with your users’ about their frustrations and desires and simultaneously observe points of confusion in practice as they use the platform.

In addition, the Qubstudio professionals suggest, “Split users into different categories: those who are new to the FinTech niche, and those who know the industry well.” For example, an investment app company would begin by conducting in-depth interviews both with novice investors and seasoned retail traders.

Phase 2: Define

Next, design thinkers make sense of what they’ve learned by framing the core problems. For the investing app, key issues may be simplifying trading for newbies and providing personalized recommendations for experienced investors.

Phase 3: Ideate

During the ideation stage, design thinkers generate as many potential solutions as possible. No idea should be too unconventional at this point. For the investment app, ideation may produce ideas like an interactive chatbot that educates on investing basics and advanced projections of long-term returns tied to specific life events, like retirement.

Phase 4: Prototype

The next step is bringing the most promising ideas to life by prototyping. This is when design thinkers build simplified MVP versions to test the concepts. No extra complexity—only features to show how the solutions would work. In the case of the investment app company, the prototypes may be a chatbot or an investment planning tool.

Phase 5: Test

Design thinkers introduce the prototypes to real users to see what resonates and what needs work. Testing may show the chatbot is user-friendly, but the retirement projections fail to account for personal risk tolerance. The company can then use the input and further iterate on the planning tool.

In the race to disrupt FinTech, it’s tempting to see design thinking in financial services as a miraculous solution. But implementing human-centered design comes with certain issues, like getting stuck in analysis mode or overcomplicating things. It is best to follow a set of specific principles to address the challenges of this mindset shift.

Fundamental Principles of Design Thinking in FinTech

Adopting key design thinking guidelines allows you to create impactful products that win over customers. Here are four principles to implement.

1. Create Experiences, Not Just Products

Traditional business thinking focuses on maximizing features and functionality. However, this approach often misses the mark for FinTech products. FinTech is complex, with many specificities across different sub-industries.

Design thinking recognizes that utility alone is not enough. Rather than overwhelm users with a billion bells and whistles, it’s better to focus on deeply understanding what features really matter most to them. This is where insights received from interviews and research will help.

2. Make Incremental Progress, Not Instant Perfection

Don’t strive for perfection from the outset. It can cause ‘analysis paralysis,’ where teams keep evaluating potential solutions but never move forward to validate market fit.

In contrast, design thinking in FinTech relies on iterative prototyping and user testing cycles. You must acknowledge that the first product may not be perfect, but the final will. This incremental development keeps teams grounded in reality rather than detached in a bubble when they generate ideas that may not even be needed.

3. Stay Empathetic Yet Rational

Business decisions are often made based on rational factors like costs and efficiency.

Within design thinking in banking, empathy for the user perspective is equally crucial. By balancing qualitative understanding of emotions with quantitative evaluation, FinTech companies can create products that make logical—and emotional—sense.

4. Seek Simplicity While Addressing Complexity

FinTech solutions often face multifaceted challenges like security, compliance, and data integration. The conventional approach is to confront complexity with more complexity. Design thinking offers simplicity as a solution, though—finding ways to boil down complex things into straightforward user experiences, like balancing security and functionality.

Now that you know the key design thinking principles, check out the examples below to see them work in practice.

How Is Design Thinking Used in the Financial Sector?

By integrating empathy, iteration, and simplicity into their design processes, these FinTech disruptors have produced products that truly resonate with consumer financial needs.

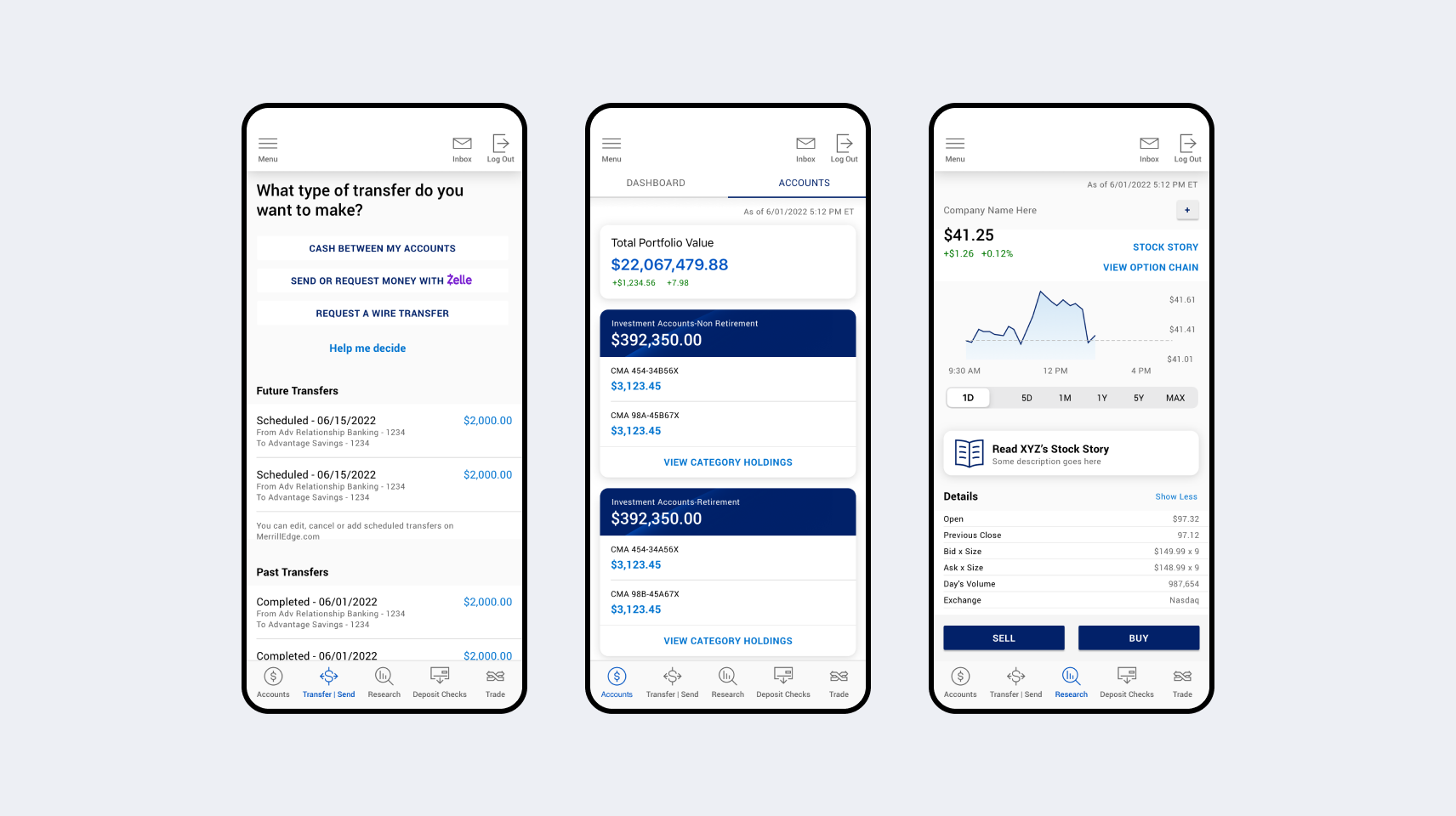

- Bank of America has embraced AI to gain an in-depth understanding of customer needs and expectations. This innovation drives their most popular solutions: Erica, an AI assistant; Zelle, a digital payment app; and Merrill Guided Investing, an online advisory program.

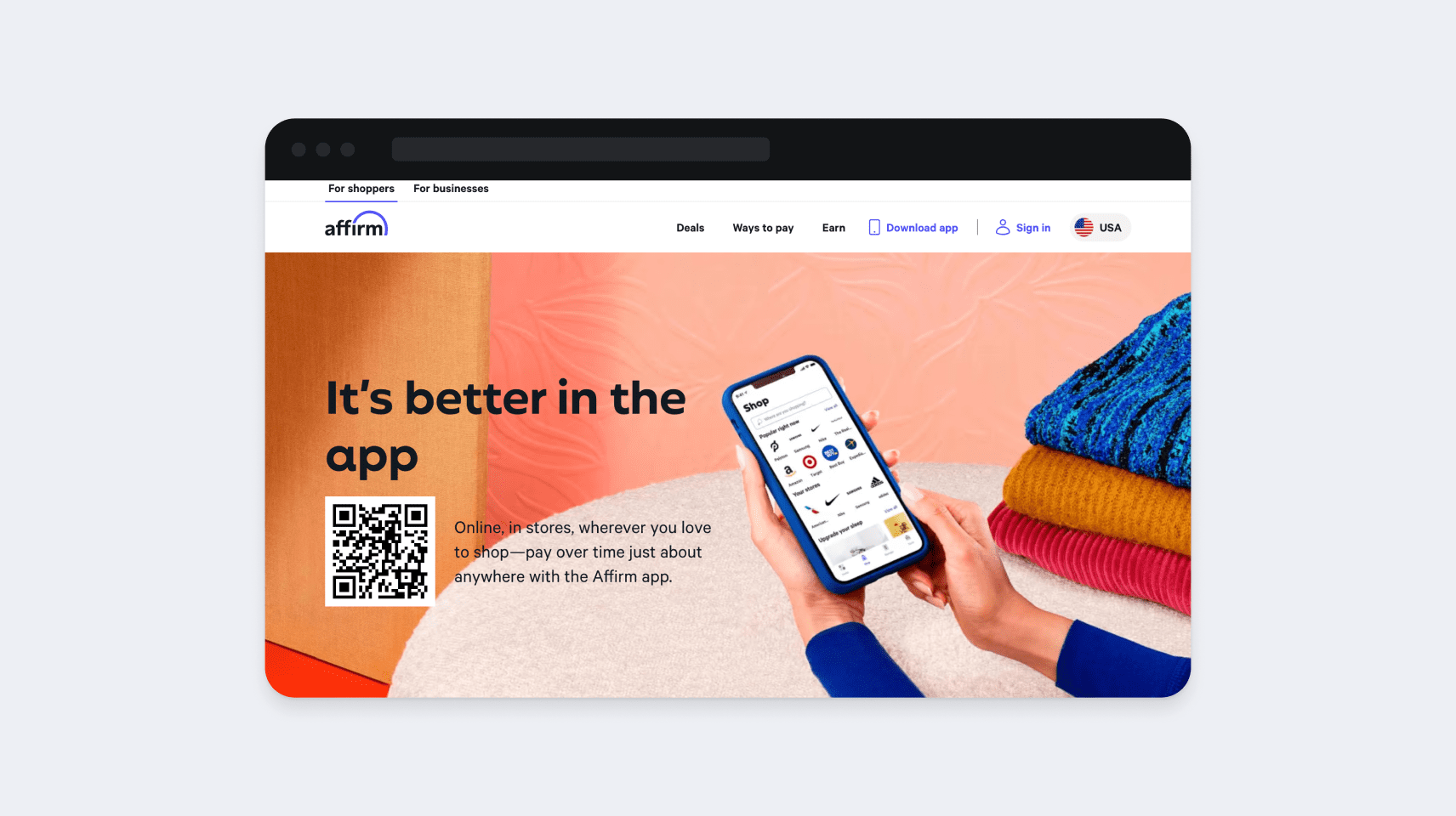

- Affirm, a FinTech company that provides point-of-sale financing and online payment solutions, is committed to improving lives over profits. Their CEO says they will always take the more difficult path if it means benefiting people. Affirm offers an intuitive app and website so customers can easily manage payments. Their browser extension helps shoppers estimate costs to improve their shopping journey.

- Petal, a financial service company, aims to expand credit access through using alternative data like cash flow. By collaborating across the industry, Petal seeks to evolve credit systems to help consumers “build credit, not debt.”

Ultimately, these cases illustrate that design principles combined with technology can create products that seamlessly blend utility and meaning.

Conclusion

The FinTech revolution has brought countless new products to enhance how people manage their financial lives. However, creating digital solutions that truly resonate with consumers requires more than just technical competency. It demands deep empathy for user perspectives and creating experiences, not just functional products. This is where design thinking in FinTech comes in.

The path forward is collaborating with professionals adept at design thinking and its agile, collaborative process. Instead of getting frustrated when iterations falter, the right mindset is to enjoy the process of exploring real consumer needs. Qubstudio has a proven track record and deep expertise in leveraging design thinking in banking to develop digital financial products that can excite your customers.

FAQ

1. How can a FinTech startup benefit from design thinking?

Adopting design thinking and focusing on early user research, prototyping, and iteration allows a FinTech startup to maximize the probability of product-market fit and user adoption.

2. What is the role of design thinking in the banking sector?

Design thinking in banking brings the customer perspective into developing new services and improving experiences. It helps banks empathize with diverse customers, brainstorm creative ideas to meet their needs, and continuously iterate based on feedback.