Digital Wallet Design: Requirements & Insights for an Excellent User Experience

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

When was the last time you used a digital wallet? We bet it was within the last 24 hours. With their convenience, efficiency, and security, it’s no surprise digital wallets are replacing traditional payment methods.

The fact is, digital wallets are expected to transact over $16 trillion by 2028 (according to Juniper Research). This is a significant increase from $9 trillion in 2023. An increase that probably has you wondering if you should hop on the digital wallet train.

The answer is yes. Here’s how we know it.

Qubstudio is a Digital Product Design & Branding agency with a flair for FinTech. We know how to create an exceptional financial app design and we’ll be happy to share our tips and tricks on designing a digital wallet that keeps customers coming back for more.

What Is a Digital Wallet?

A digital wallet is a digitalized counterpart of the traditional physical wallet that covers various payment methods, loyalty cards, boarding passes, and much more. At its core, a digital wallet is designed to simplify transactions and provide users with a fast, secure, and seamless experience.

Digital wallet design comes in various forms, each tailored to different user needs and preferences.

The common types of digital wallets include:

- Mobile wallets. Mobile wallets are smartphone apps that allow users to store payment information, loyalty cards, and digital currencies. They offer quick and contactless payments at both online and physical stores.

- Online wallets. Online wallets are cloud-based platforms accessible through web browsers. They offer similar functionalities to mobile wallets but can be accessed from any internet-connected device.

- Desktop wallets. Desktop wallets are software applications installed on personal computers or laptops. They provide a secure environment for managing digital assets, particularly cryptocurrencies, with private keys stored locally.

- Hardware wallets. Hardware wallets are physical devices that store private keys and offer an extra layer of security for cryptocurrency storage. They’re typically considered one of the safest options for storing digital assets.

- Closed and open wallets. Closed wallets are associated with specific merchants or service providers and can only be used within their ecosystem. Open wallets, on the other hand, support various payment methods and can be used across multiple merchants.

- Hybrid wallets. Hybrid wallets combine the capacities of several types of wallets, offering users a more versatile and comprehensive solution. They can integrate mobile, online, and desktop functionalities into a single platform.

The designs of all these digital wallets may differ, but they still share the same features. After all, an intuitive and user-friendly e-wallet design promises seamless transactions and greater control over your money. But these aren’t the only advantages.

Benefits of Digital Wallet Design

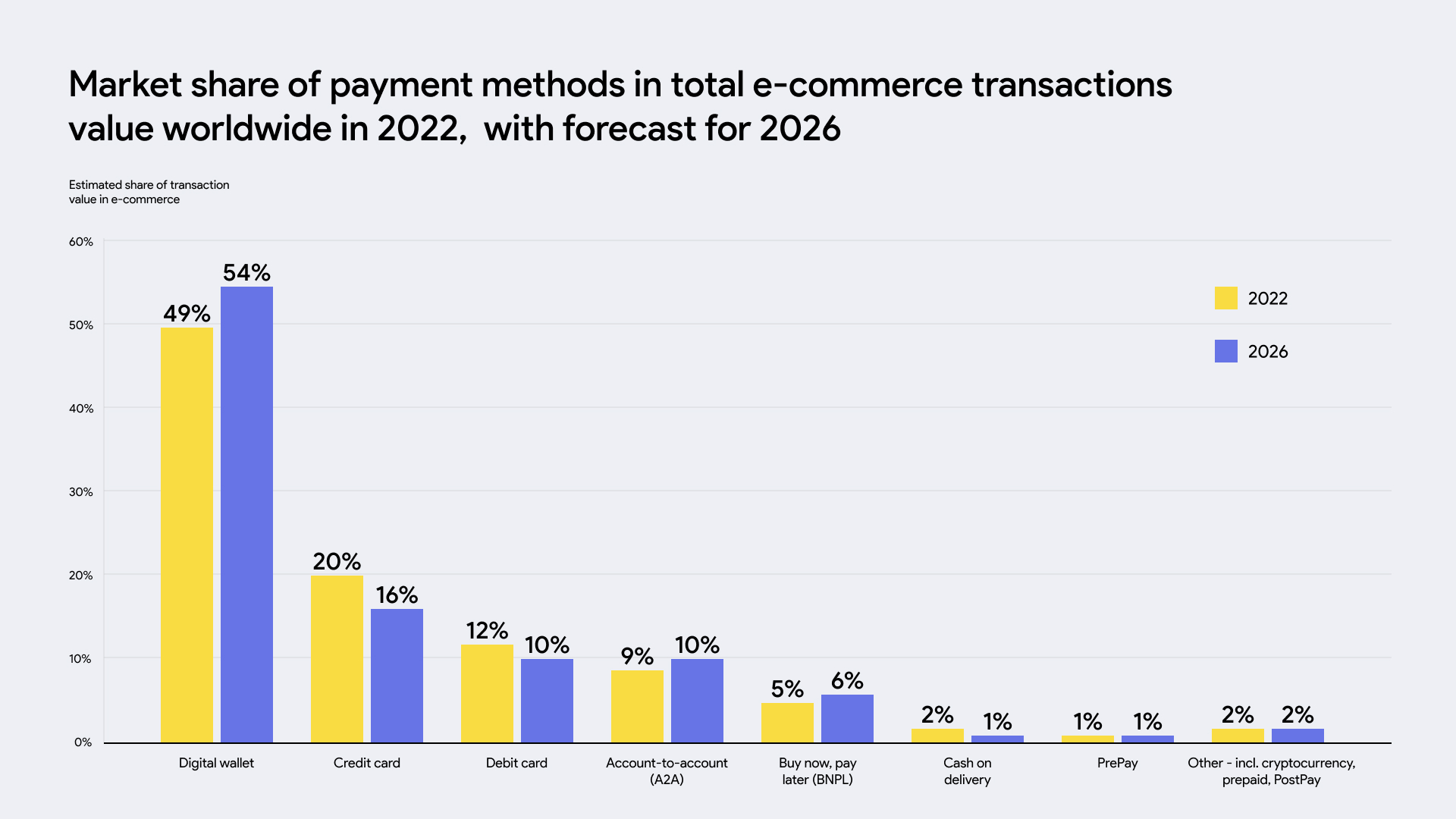

A staggering fact: in 2022, mobile wallets accounted for nearly half of all global e-commerce payment transactions. And the numbers are only set to grow, projected to surpass 54% by 2026.

This popularity stems from the following benefits of digital wallets:

- Convenience and accessibility. Digital wallets combine convenience and accessibility. Users can make payments, access loyalty rewards, or manage their finances with just a few taps on their smartphones, regardless of their physical location. They can even complete transactions on the go.

- Faster and seamless transactions. With traditional payment methods, users often have to go through tedious processes like entering card details and verifying identities. Digital wallets, on the other hand, speed up transactions by securely storing payment information and offering quick authentication methods like fingerprint or facial recognition. This results in a faster checkout process and a frictionless payment experience.

- Enhanced customer engagement and loyalty. A well-designed digital wallet boosts customer engagement by offering personalized incentives, rewards, and tailored promotions based on users’ preferences and spending patterns. By fostering a deeper connection with users, e-wallets cultivate a sense of loyalty, encouraging customers to return for future transactions and interactions.

- Cost savings through efficiency. Implementing an e-wallet system can save costs for businesses and users alike. Businesses can cut operational expenses by streamlining payment processes and reducing reliance on physical infrastructure. Meanwhile, users benefit from lower transaction fees and potential cost-effective deals offered through digital wallets.

- Data insights for business growth. Digital wallets serve as valuable repositories of user transaction data, preferences, and behaviors. By analyzing this information, businesses can gain insights into customer behavior to make data-driven decisions and develop targeted marketing strategies.

- Integration and versatility. A well-crafted digital wallet can integrate with various payment options, banking institutions, and loyalty programs, becoming a versatile financial management tool. When multiple cards and accounts are consolidated into a single platform, users get a smoother experience and can access and manage all financial aspects in one place.

- Robust security measures. Digital wallet design prioritizes user security by implementing robust encryption techniques and advanced authentication methods. Biometric verification, tokenization, and secure data storage ensure that sensitive information remains protected from cyber threats. As a result, users feel more confident when running transactions.

Now that we’ve explored the benefits of digital wallets, let’s look at the principles that make an e-wallet design exemplary.

Digital Wallet Design Requirements

When designing an effective digital wallet, you must consider the following factors to ensure a seamless user experience and optimal functionality:

User-Friendly Interface

Digital wallet UI must be intuitive and easy to navigate, even for users with limited technical expertise. A simple and well-organized layout enhances usability, shortens the learning curve, and encourages users to confidently embrace the digital wallet.

Security and Privacy

Security is paramount for digital wallets—or any wallets, for that matter. Implementing robust security measures (like two-factor authentication, biometric authentication, transaction confirmations and alerts, secure account recovery, user education and awareness, permissions, etc.) is a way to ensure that user data and financial information are safeguarded from unauthorized access and cyber threats.

Compatibility and Accessibility

A successful digital wallet design must be compatible with a wide range of devices and operating systems. The e-wallet should deliver a consistent and seamless experience, whether accessed through smartphones, laptops, tablets, wearables, or PCs.

Multiple Payment Options

Offering support for various payment methods, including credit/debit cards, bank transfers, and digital currencies, makes a digital wallet truly versatile.

Seamless Integration with Merchants

A digital wallet should seamlessly integrate with online and offline merchants, helping users make purchases, pay bills, and access services trouble-free.

Loyalty Program Integration

Incorporating loyalty programs into a digital wallet allows quickly accessing rewards, discounts, and loyalty points. This improves customer retention and encourages users to choose a specific e-wallet for their transactions.

Real-Time Notifications

Providing real-time notifications for transactions, account updates, and promotional offers keeps users informed and engaged. Push notifications ensure people stay updated on their financial activities and take advantage of time-sensitive opportunities.

Seamless Onboarding and Account Management

A user-friendly onboarding process, coupled with easy account management functionalities, boosts user satisfaction. Plus, a simple registration process and the ability to manage accounts with just a tap build up a positive user experience.

These functions work well for digital wallets. But does this mean they’re equally important for crypto wallets? And aren’t they the same? Allow us to explain.

Crypto Wallet vs. Digital Wallet

Both crypto and digital wallets securely store and manage currency, yet they cater to distinct needs and have significant differences.

Nature of Currency

- Crypto wallets are designed to store and manage cryptocurrencies like Bitcoin, Ethereum, and other digital assets. They provide a secure way to store private keys to access and manage crypto holdings.

- Digital wallets are versatile and designed to handle various forms of currency, including fiat money, digital currencies, and loyalty points.

Transaction Types

- Crypto wallets facilitate cryptocurrency transactions, such as sending or receiving digital assets and running blockchain-based operations like token swaps or staking.

- Digital wallets cover a broader range of transactions, including online and offline purchases, bill payments, fund transfers, and loyalty program redemptions.

Regulation and Centralization

- Crypto wallets often operate in decentralized environments, where users have full control over their funds, and transactions occur directly on the blockchain without intermediary institutions.

- Digital wallets can operate within centralized systems, often involving banks or financial institutions. These wallets might also rely on third-party services to facilitate certain transactions.

Adoption and Use Cases

- Crypto wallets are predominantly used by individuals handling cryptocurrency, including traders, investors, and blockchain enthusiasts.

- Digital wallets have a broader user base and appeal to a wide range of consumers who seek convenience and efficiency in managing their day-to-day financial activities.

Overall, digital wallets offer a more versatile and mainstream approach to managing various forms of currency, which makes them accessible to a wider audience. Meanwhile, crypto wallets cater to the specific needs of cryptocurrency users and enthusiasts within the decentralized blockchain ecosystem.

Now that that’s out of the way, let’s get into the really important part.

Digital Wallet Design Steps

Designing a successful digital wallet requires a systematic approach to ensure a seamless user experience and secure financial transactions. Here are the critical steps for creating an efficient, user-friendly digital wallet.

1. Understand User Personas

Run comprehensive market research before creating a digital wallet to identify your target customers. With a well-defined user persona, you will ensure your product resonates with the target audience and foster a strong brand-consumer relationship.

2. Design a User Flow

The user flow is a step-by-step path users follow to complete a transaction in the digital wallet. By optimizing the user flow, you can enhance the overall user experience and ensure that users can easily access the features they need.

3. Wireframing

Create wireframes of the e-wallet’s screens to ensure that all essential features are included. Wireframing helps visualize the logical sequence of steps required for smooth user interactions, including login authentication and registration.

4. Visualization

After creating wireframes, develop high-fidelity prototypes to represent the actual screens users will interact with. At this stage, you need to focus on colors, branding, typography, and imagery to create a cohesive, engaging product experience.

5. Quality Assurance and Testing

Thorough testing is essential to ensure a flawless user experience. Double-check if the app works and looks as planned, and fix any issues to deliver a polished digital wallet to your users.

A systematic approach to designing a reliable and convenient digital wallet is crucial. Only by understanding user personas, optimizing user flows, and creating captivating visuals can you craft an e-wallet that fully resonates with your target audience.

Digital Wallet Design: Insights And Best Practices

As digital wallets continue to gain popularity among users and FinTech companies, designers face the challenge of balancing user-friendliness and robust security.

Here are some tips we follow at Qubstudio, along with real-world cases showing exemplary digital wallet system designs.

Prioritize User Research and Feedback

When it comes to digital wallet design, nothing is more important than understanding the needs and preferences of your users. We incorporate comprehensive user research and feedback throughout the design process of all our projects. This approach ensures our designers fully understand user behaviors, pain points, and expectations.

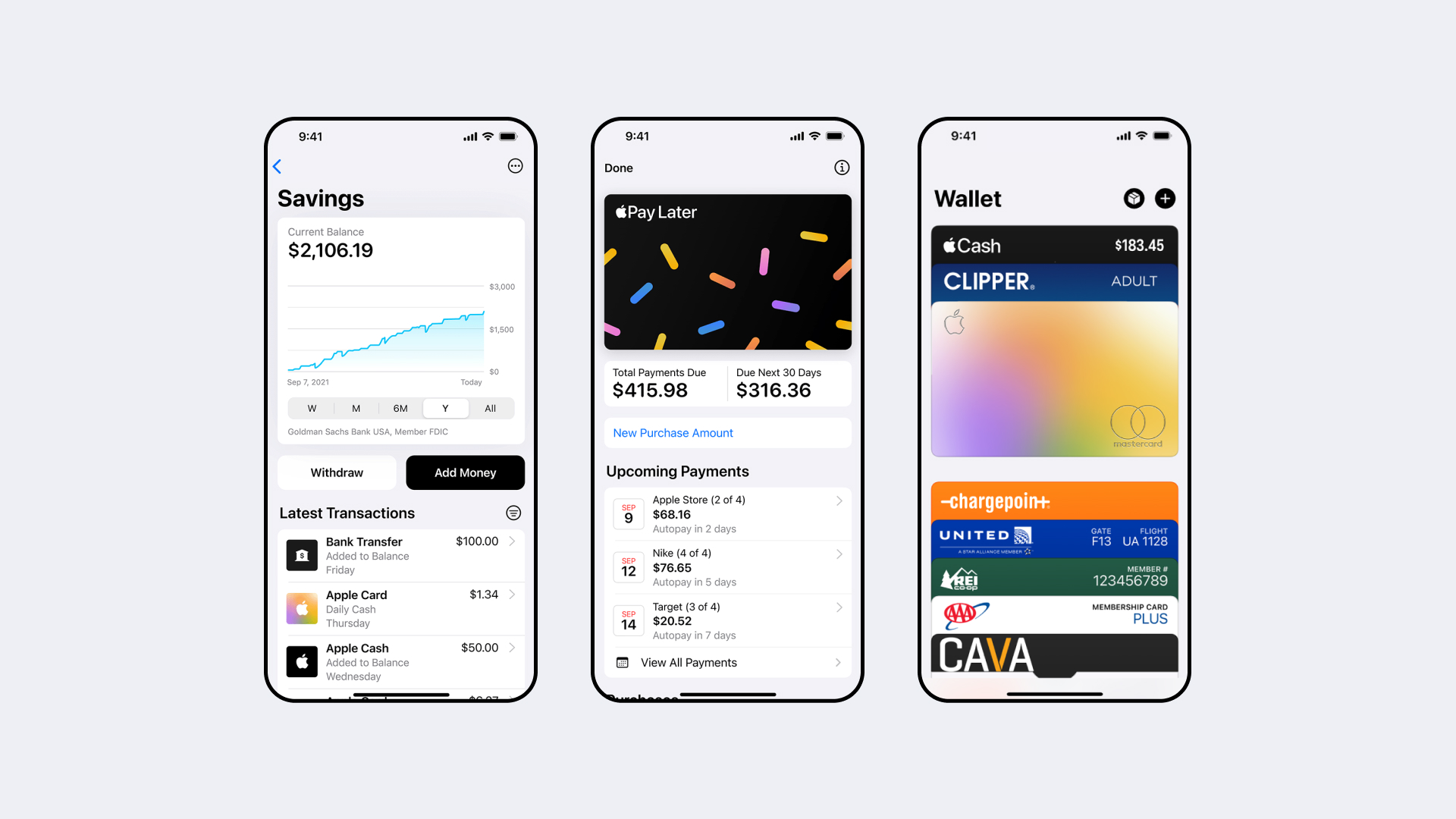

Example: Apple Wallet

Apple Wallet is a prime example of a user-friendly app that excels in digital wallet design. With its clear visual cues and intuitive navigation, users can easily manage and access digital tickets, loyalty cards, and boarding passes. A seamless integration of various functionalities contributes to a positive user experience.

Simplify Onboarding and KYC Verification

Minimize friction during onboarding and Know Your Customer (KYC) verification to drive user adoption. Clear instructions and step-by-step tutorials during the initial setup will help users quickly grasp the app’s features.

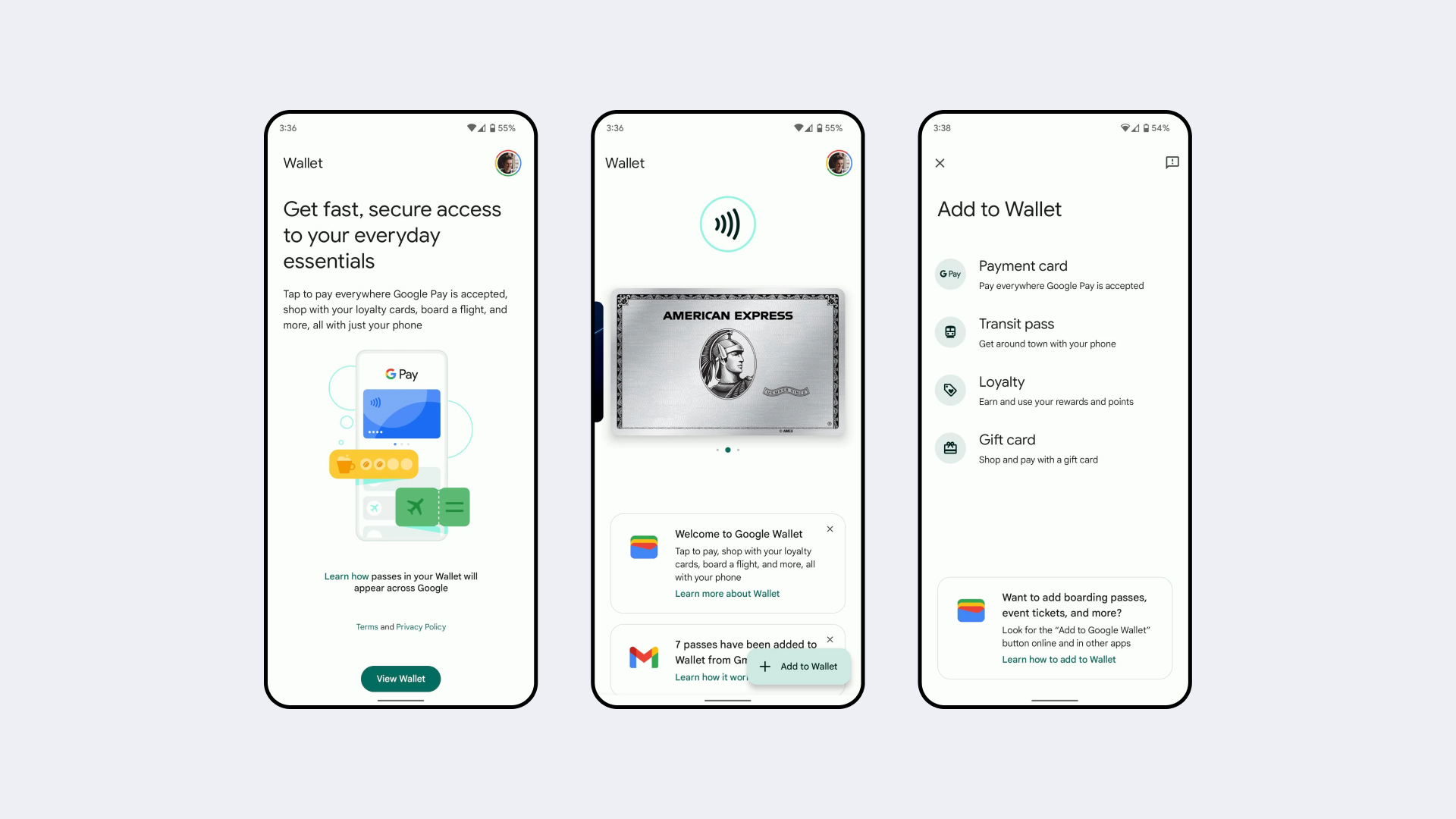

Example: Google Pay

Google Pay is a minimalist and intuitive digital wallet app with an excellent onboarding process. Users can easily access their payment methods, transaction history, and loyalty programs, guaranteeing a hassle-free experience.

Implement Intuitive Navigation

Intuitive navigation is the backbone of any successful digital wallet app. Users should be able to access essential features and functions without extra trouble, so you must organize functions logically into groups to streamline the user experience.

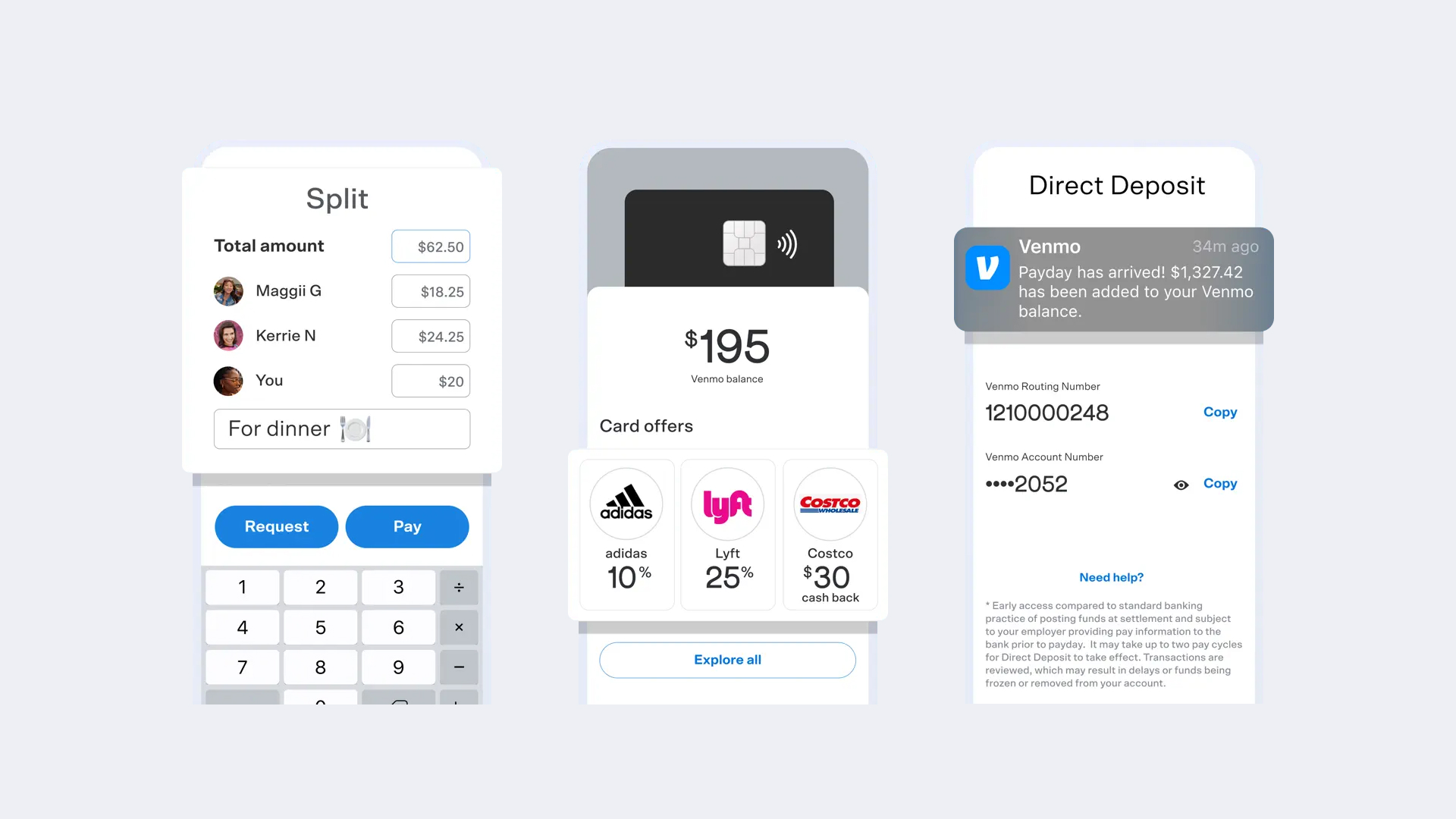

Example: Venmo

Venmo sets an exemplary standard for intuitive navigation. It creates an enjoyable, user-friendly environment by fostering social engagement and interactivity during payment. This approach encourages users to interact more frequently with the app, increasing engagement rates.

Integrate Services Seamlessly

Bringing different services together in a digital wallet takes user convenience up a notch. The app becomes an indispensable part of users’ daily lives by providing a one-stop solution for numerous financial needs.

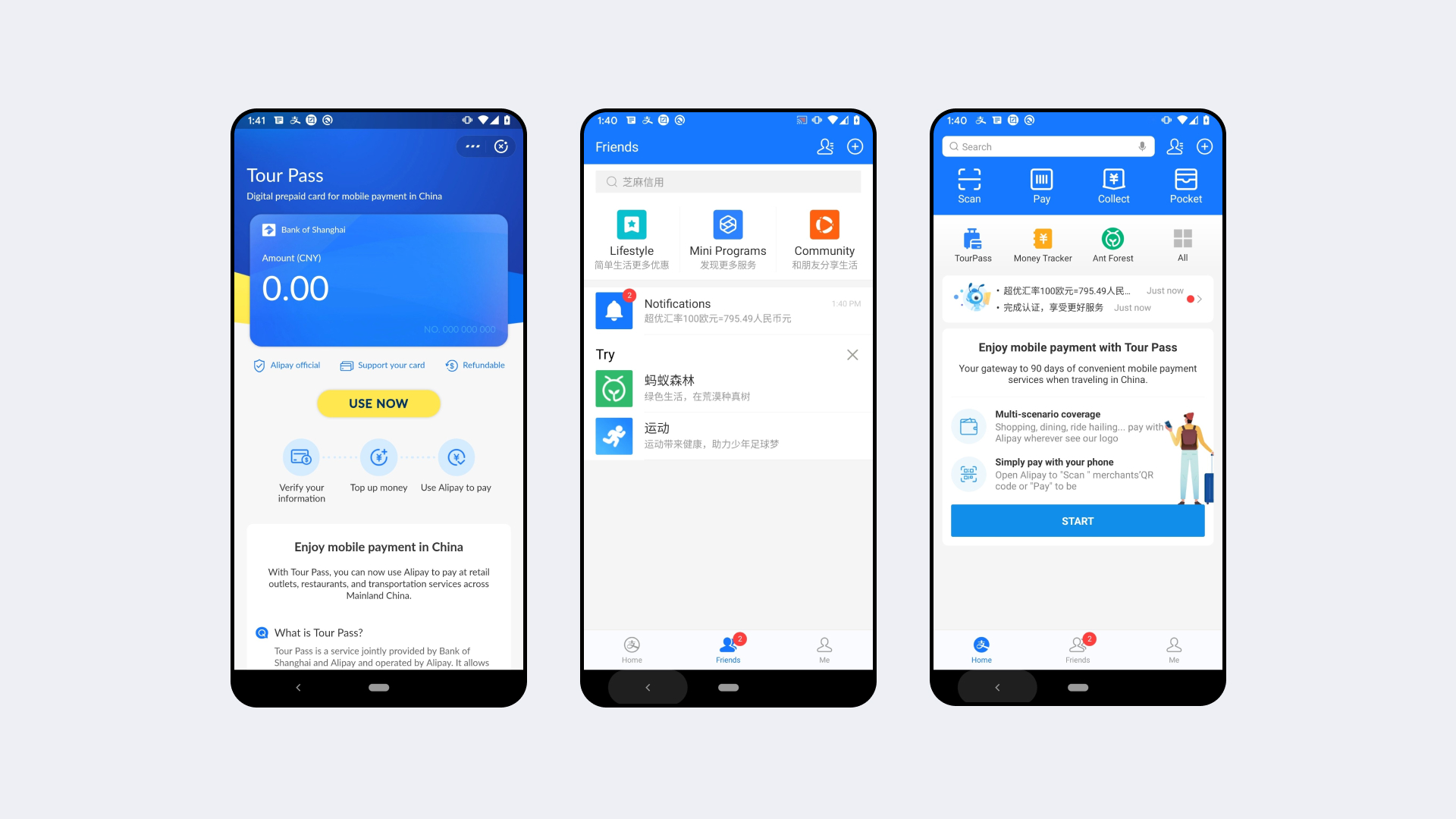

Example: Alipay

One of China’s most widely used digital wallets, Alipay stands out for its clean and modern interface infused with elements of traditional Chinese art. By seamlessly integrating mobile payments, online shopping, and financial management, Alipay has become a go-to tool for millions of users.

These apps can be a great source of inspiration when designing an effective e-wallet. By prioritizing user needs, intuitive navigation, and easy onboarding, designers can create digital wallets that exceed user expectations and attract millions.

Ways to Enhance Your E-wallet with UX Design

You can unlock a world of convenience and efficiency by integrating UX design principles. At least, this is how our designers do it. Here are the main steps to enhance your e-wallet with UX design.

Simplified Onboarding

Make the onboarding process smooth and hassle-free. Minimize the steps required to set up an account and double-check that user instructions are crystal clear. Take a cue from Venmo’s onboarding process, which requires little information and allows users to link their social media accounts for a quick setup.

Intuitive Navigation

Organize features and functions logically to simplify the user interface. Users should be able to find what they need quickly without feeling overwhelmed. Take inspiration from Apple Wallet’s clean user interface, where key features like adding cards and accessing passes are easy to find and understand.

Seamless Transactions

Optimize the transaction flow to make it fast and secure. Implement smart features like one-click payments and biometric authentication to improve the user experience. Implement Google Pay’s one-click payment feature to speed up the checkout process and add facial recognition for extra security.

Personalization

Enable users to customize their e-wallet experience. Allow them to set preferences, organize their dashboard, and personalize notifications according to their preferences. Take Alipay’s approach by allowing users to customize their e-wallet dashboard with their preferred payment methods and prioritize frequently used cards.

Real-Time Support

Integrate a responsive customer support system into the app. This way, users can get timely help when they encounter a problem or have a question. Follow the example of customer support in the PayPal app, which includes a chatbot and 24/7 support to promptly answer user questions.

Accessibility and Inclusivity

Make sure your e-wallet is accessible to all user groups, including people with disabilities. Voice commands and compatibility with screen readers are a must. As with Cash App, ensure compatibility with assistive technologies, such as voice control and screen readers, to meet different user needs.

Security Reinforcements

Prioritize the security of your users’ data and transactions. To establish trust, you should implement multi-factor authentication, encryption, and other security measures. Draw from Samsung Pay’s use of tokenization technology, which replaces sensitive card data with unique tokens to increase security.

Performance Optimization

UX design is an ongoing process. Regularly collect user feedback and analyze app usage to identify areas for improvement. Keep upgrading your e-wallet to meet the ever-changing needs of users. Learn from Zelle’s frequent updates and feature enhancements based on user feedback to ensure your e-wallet remains relevant and user-friendly.

Follow these steps and invest in UX design to make your e-wallet a user-centric, efficient, and enjoyable tool customers will enjoy using daily. And if you need help, we’re here for you.

Digital Wallet Design With Qubstudio

At Qubstudio, we take pride in our expertise and passion for crafting exceptional digital wallet experiences. As a leading Digital Product Design & Branding agency, we understand that user-centric design is just as important as cutting-edge features in digital wallet design.

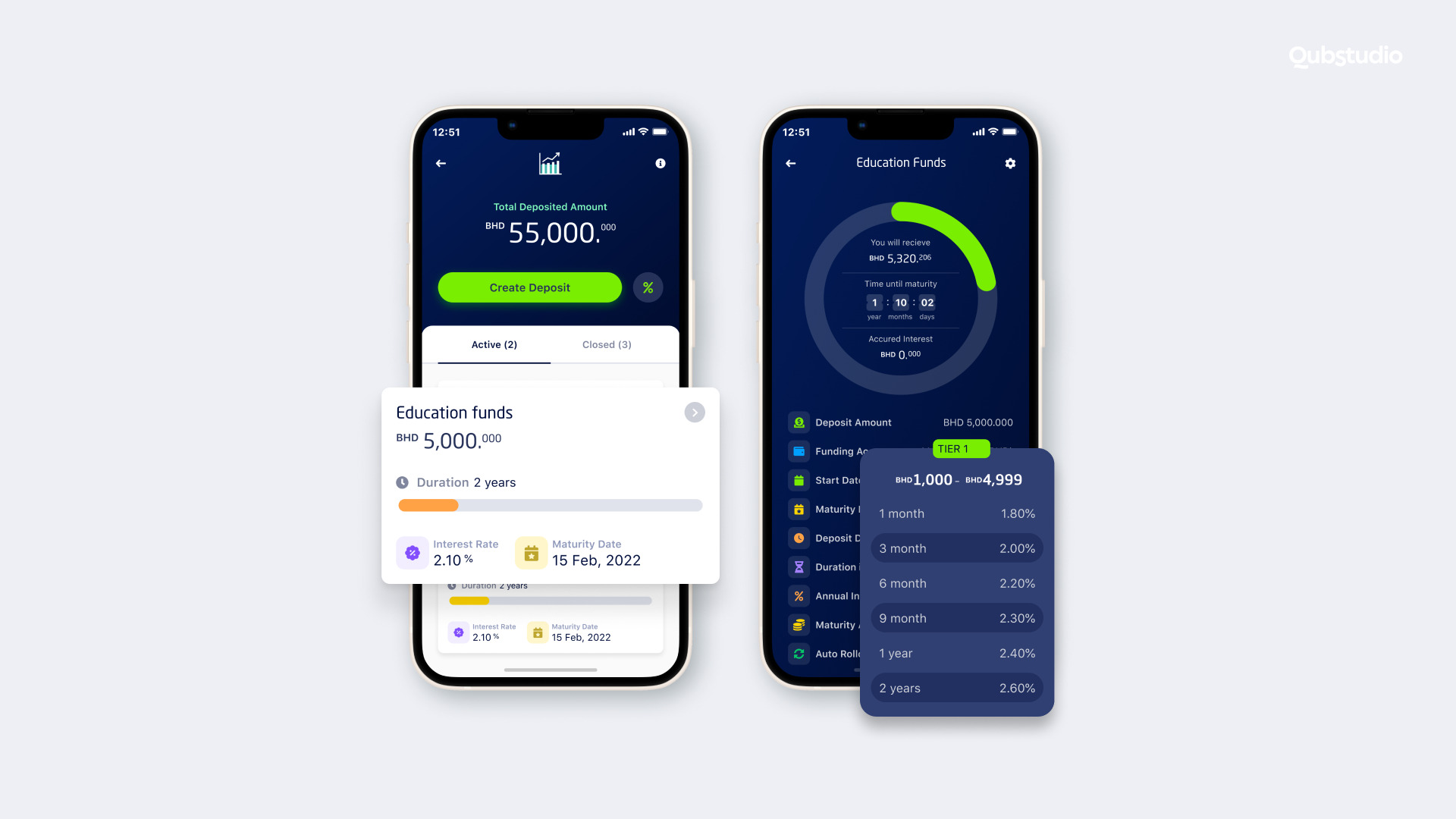

But don’t take our word for it—have a look at some of the projects we developed. Each case study represents a unique blend of creativity, technology, and user-centric design principles.

- ila Bank. ila Bank is a trailblazing digital, mobile-only bank in Bahrain powered by Bank ABC.

- Ozone API. Ozone API empowers banks and financial institutions to adapt and thrive in the new world of open finance

- Finova Financial. Finova Financial is transforming the FinTech industry as a socially responsible online lender.

- Aurora. Aurora presents an independent and innovative system for locating, analyzing, and evaluating investment opportunities.

By choosing us, you partner with a team that truly understands the complexities of digital wallet design and values your business’s growth and success.

Conclusion

The adoption of digital wallets is skyrocketing, with estimates suggesting that as many as 5.2 billion people will be using digital wallets for payments by 2026. Will your FinTech company be boarding the e-wallet train? We’ll save you a seat.

Qubstudio is at the forefront of smooth and tailored digital wallet design. Our passion for innovation drives us to create designs that meet and exceed our customer’s expectations.

So contact us today to bring your digital wallet ideas to life.

FAQ

What types of digital wallets are there?

- Mobile wallets—smartphone apps that store payment information, loyalty cards, and digital currencies

- Online wallets—cloud-based platforms accessible through web browsers

- Desktop wallets—secure environments for managing digital assets installed on personal computers or laptops

- Hardware wallets—physical devices that store private keys

- Closed wallets—wallets that can only be used within specific ecosystems

- Hybrid wallets—wallets that combine the functions of several types of wallets (mobile, online, desktop, etc.)

Why is digital wallet system design important?

A well-designed e-wallet ensures a seamless user experience, which leads to higher user satisfaction and engagement. It also implements robust security measures like encryption, authentication, and tokenization to safeguard user data and protect it against potential cyber threats. In addition, good design involves fast transactions, quick checkout, and easy fund management.

A trouble-free, satisfying user experience fosters customer loyalty and retention. For businesses, an effective e-wallet system design opens new avenues for growth and innovation. And lastly, a well-designed e-wallet system can gather valuable user data, providing insights into customer behavior and preferences.

What are the best examples of digital wallets?

PayPal, Apple Pay, Google Pay, Samsung Pay, Venmo, and Alipay are some of the best examples of digital wallets, thanks to their user-friendly interfaces, secure transactions, and wide acceptance by merchants.

What is the difference between an e-wallet and a digital wallet?

An e-wallet is primarily designed to process electronic payments and serves as a virtual substitute for a physical wallet in online transactions. A digital wallet, on the other hand, is more comprehensive and allows users to store various digital assets such as loyalty cards, digital currencies, and personal identification documents, creating a centralized platform for managing their online and offline lives.