Islamic Digital Banking: Features, Trends, and Design Innovations Unveiled

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

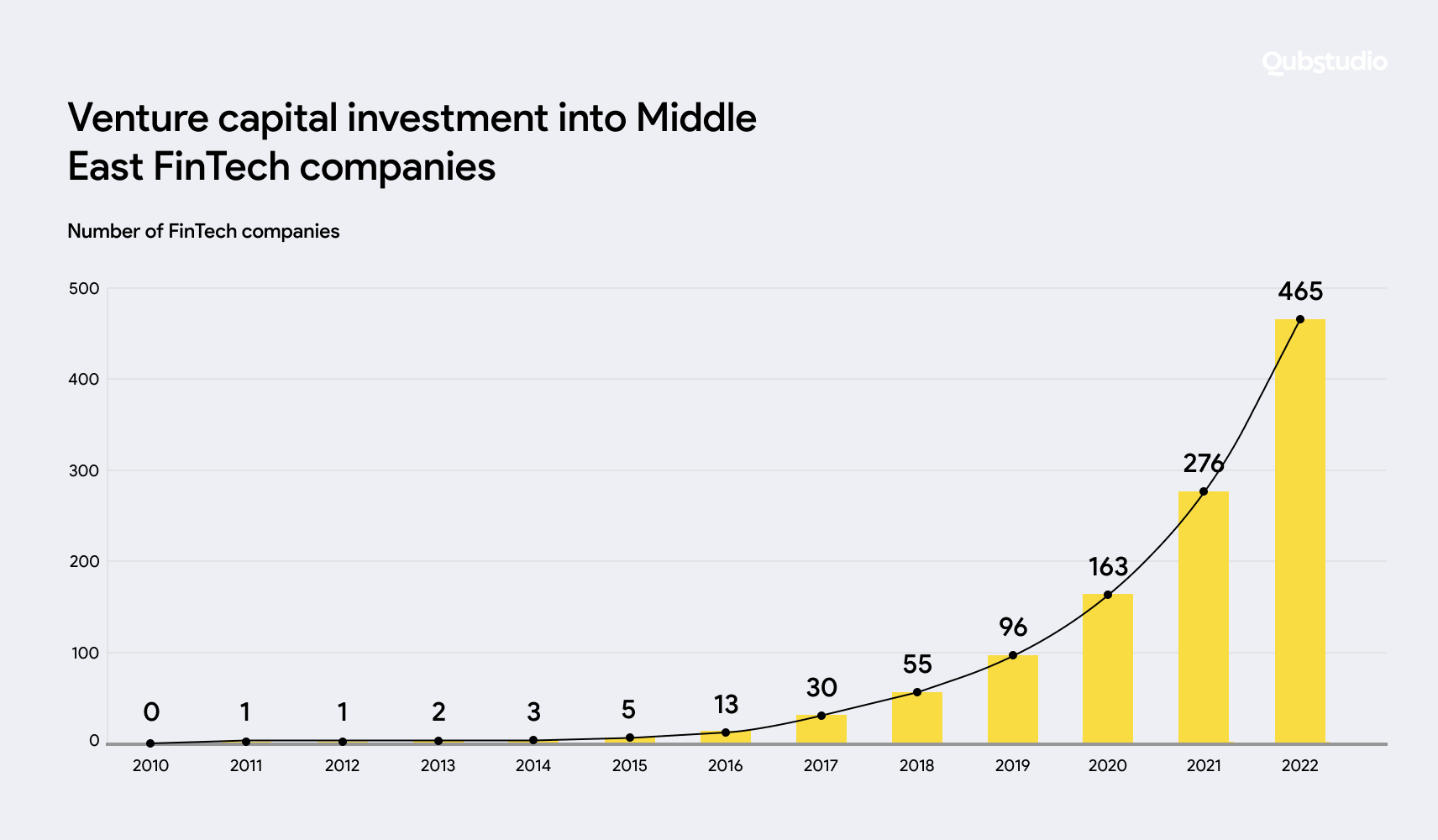

Islamic digital banking is rapidly changing the financial landscape in the MENA, thanks to government initiatives. As of April 2022, there were 465 FinTech companies in the region, compared with only 30 in 2017.

Although Islamic banking and finance apps are increasing in number, development agencies often fail to implement them correctly. Most solutions that companies create run counter to Islamic banking principles and, thus, can’t properly serve the needs of the MENA population.

Qubstudio mastered the principles of Islamic banking when we built an app for Bahrain’s Bank ABC. A pioneer in Islamic digital banking, the app received several accolades from Mastercard and Global Finance. Qubstudio helped scale this trailblazing mobile-first solution to enable customers to benefit from all the advantages of Islamic banking within a single product.

What Is Islamic Banking?

Islamic banking is a form of banking based on Shariah law. It discourages interest-based transactions (riba), transactions with uncertain outcomes (gharar), and investments in businesses considered forbidden by Shariah law. These tenants mean that Islamic banking differs fundamentally from conventional banking.

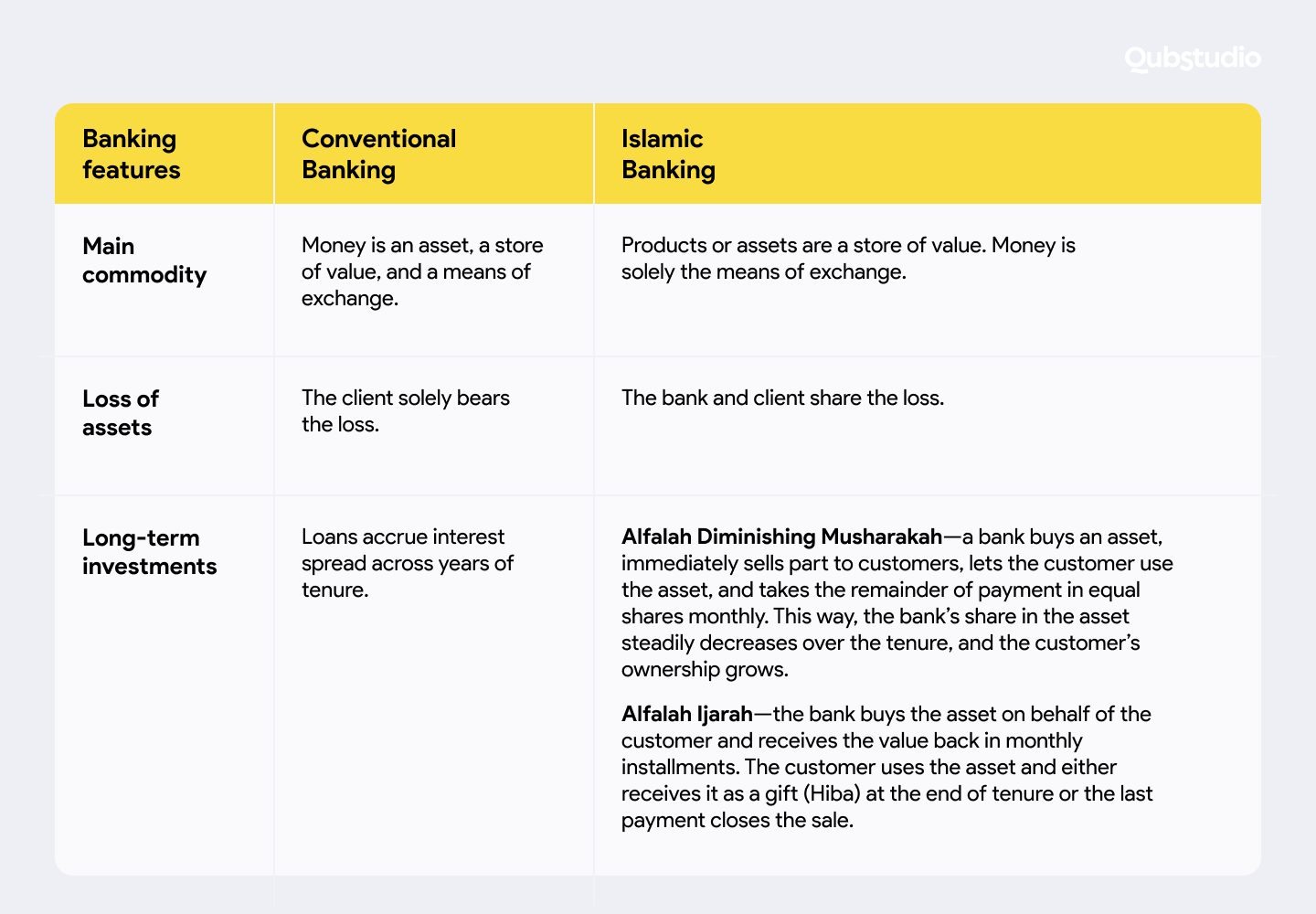

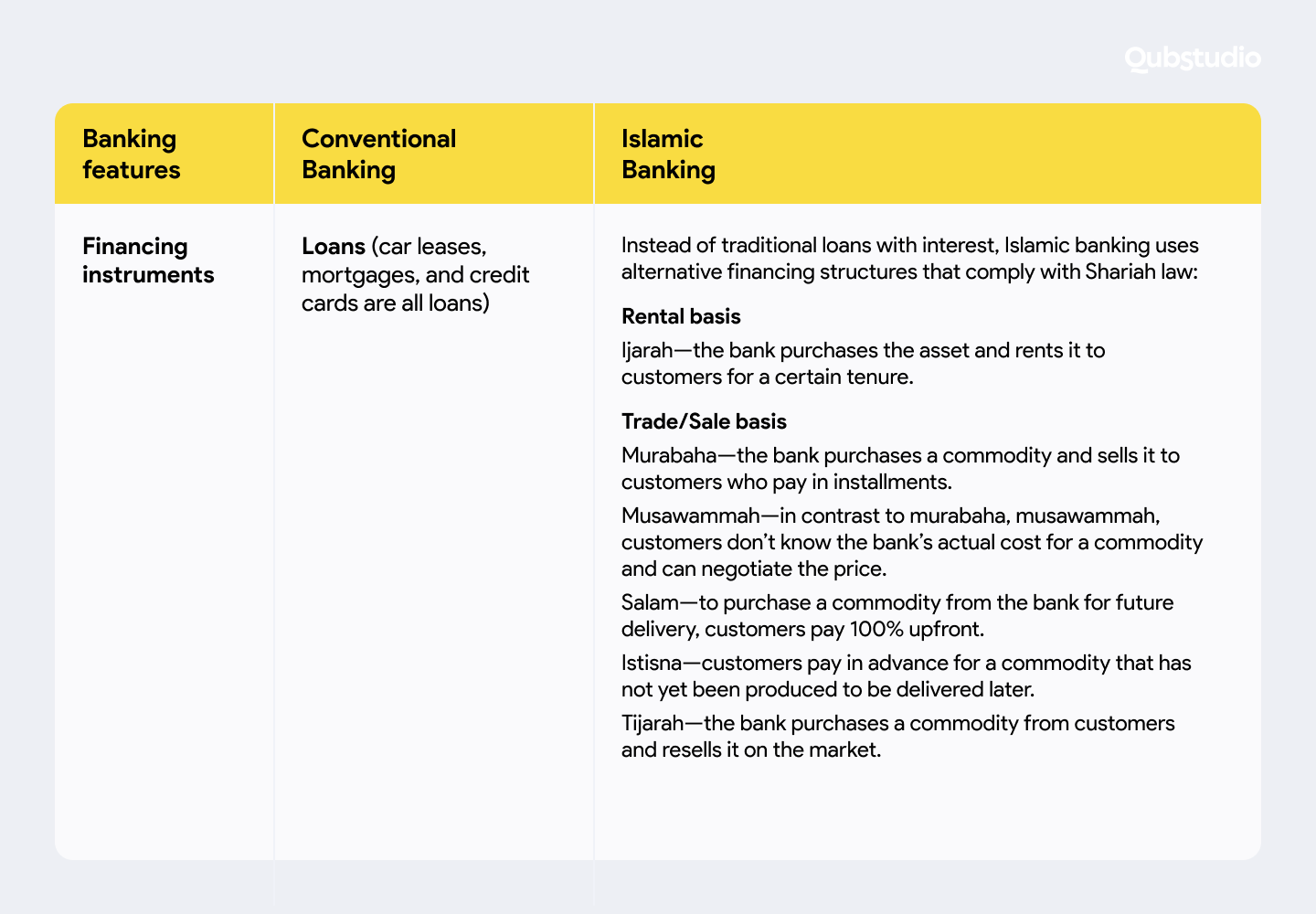

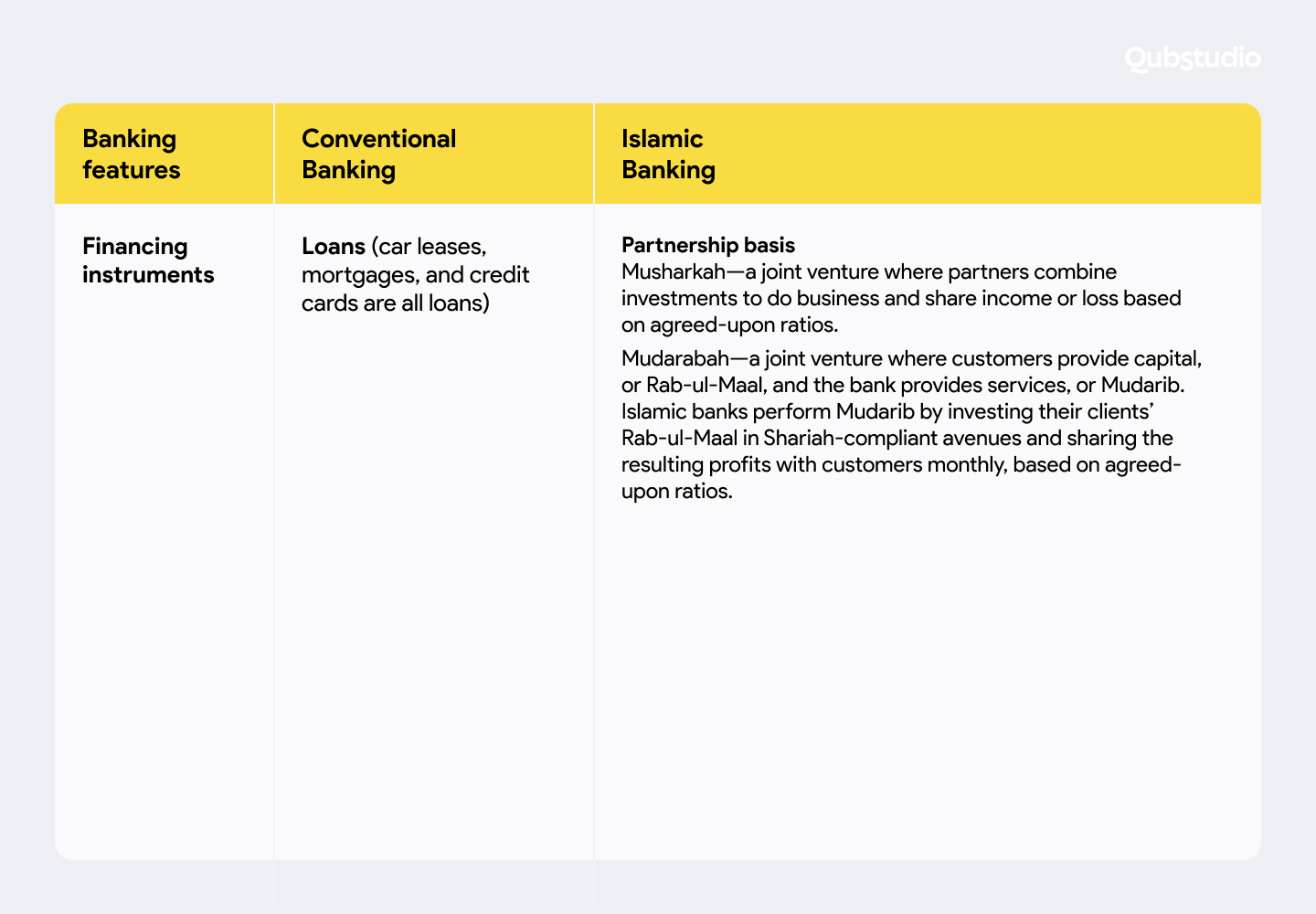

Below we describe the differences between Islamic and conventional banking in detail.

Islamic Banking vs. Conventional Banking: Key Differences

Examining banking worldwide reveals that Western banking principles differ greatly from Islamic banking principles.

Conventional banks can invest in any industry—including gambling and wine production—and are never held liable for any losses the bank might incur as a result of their investments. Meanwhile, Islamic banks invest customers’ money only in socially responsible industries (those allowed by Shariah law), don’t charge or pay interest, and share profits and losses with their customers.

Let’s unpack this below.

As you can see, Islamic digital banking has a very flexible mode of operation. Entrepreneurs can fully leverage the immense untapped potential of combining the advantages of Islamic banking with the convenience of digital customer experiences.

Islamic Banking Trends

Islamic banking proved to be more resilient during the COVID-19 pandemic, compared to its Westernized counterparts.

Based on ethical principles and supported by governmental initiatives throughout the region, Islamic digital banking looks into the future with confidence and actively expands its range of services.

Below we list the major Islamic banking trends in 2023 and beyond.

Active Introduction of Western Capital Through M&A and Free Financial Zones

Islamic banking institutions are consolidating their assets within the MENA region through M&A and accepting foreign capital. The goal is to speed up economic growth through Shariah-compliant investments and partnerships within free economic zones.

Rise of Green Sukuk

Aligned with the Shariah principle of “protection of life,” green sukuk investment instruments help develop environmentally friendly projects and gain traction with every passing year, with a potential to attract up to $2 trillion in investments.

Increased Market Share

Financial services based on Islamic banking principles are steadily growing in popularity within the region and throughout the Islamic world. In Saudi Arabia, Shariah-compliant banking assets made up over 50% of all banking assets in 2020 and have increased ever since. In Kuwait, that percentage is 42%, and in Qatar, 26% of banking assets are Shariah-compliant.

Strong Emphasis on ESG Compliance

Core Islamic banking paradigms align well with ESG principles. As the global financial market moves towards sustainable and eco-friendly initiatives, Islamic banking will spearhead this process in the MENA and other regions.

All in all, Islamic banking is on the rise throughout the GCC, and many financial institutions aim to tap into its potential to provide more value for customers. However, the required expertise to design digital banking apps that will appeal to this audience is lacking.

What Is the Concept of Islamic Banking Design?

The best practices of Islamic banking app UI/UX are the same as for digital banking in general. Basically, the design should be clear, consistent, and intuitive to ensure a smooth customer journey for every user, including people unfamiliar with digital banking experiences. As for security, it’s a top priority, as usual.

In Islamic banking, meticulous feature testing stands as a cornerstone. Every release undergoes a process of verification through research and testing process. Ensuring that each element and idea is validated not only confirms their necessity for the audience but also guarantees their meaningful utilization post-release.

At the same time, there are some nuances due to the specifics of the Arabic language that impact design, such as:

- Terms and functions explainable in a couple of English words might take a couple of lines in Arabic. A balance between brevity and providing more space for the text is needed.

- While words are written right to left in Arabic, digits are written left to right—an additional challenge to planning layouts.

- Western names are usually short, but Arabic can be quite long. This dictates the need for longer input fields that might take up a lot of screen space.

Meeting these challenges can be quite complicated. But a proper design will hit the sweet spot.

Custom Islamic Digital Banking Design with Qubstudio

There are multiple digital banking apps in the MENA region, but most of them provide basic conventional banking features. In contrast, by combining Qubstudio’s FinTech UI/UX design expertise with Islamic banking principles, we were able to rapidly design and implement customer experiences that cater to both the needs of conventional bank users and Islamic digital banking users.

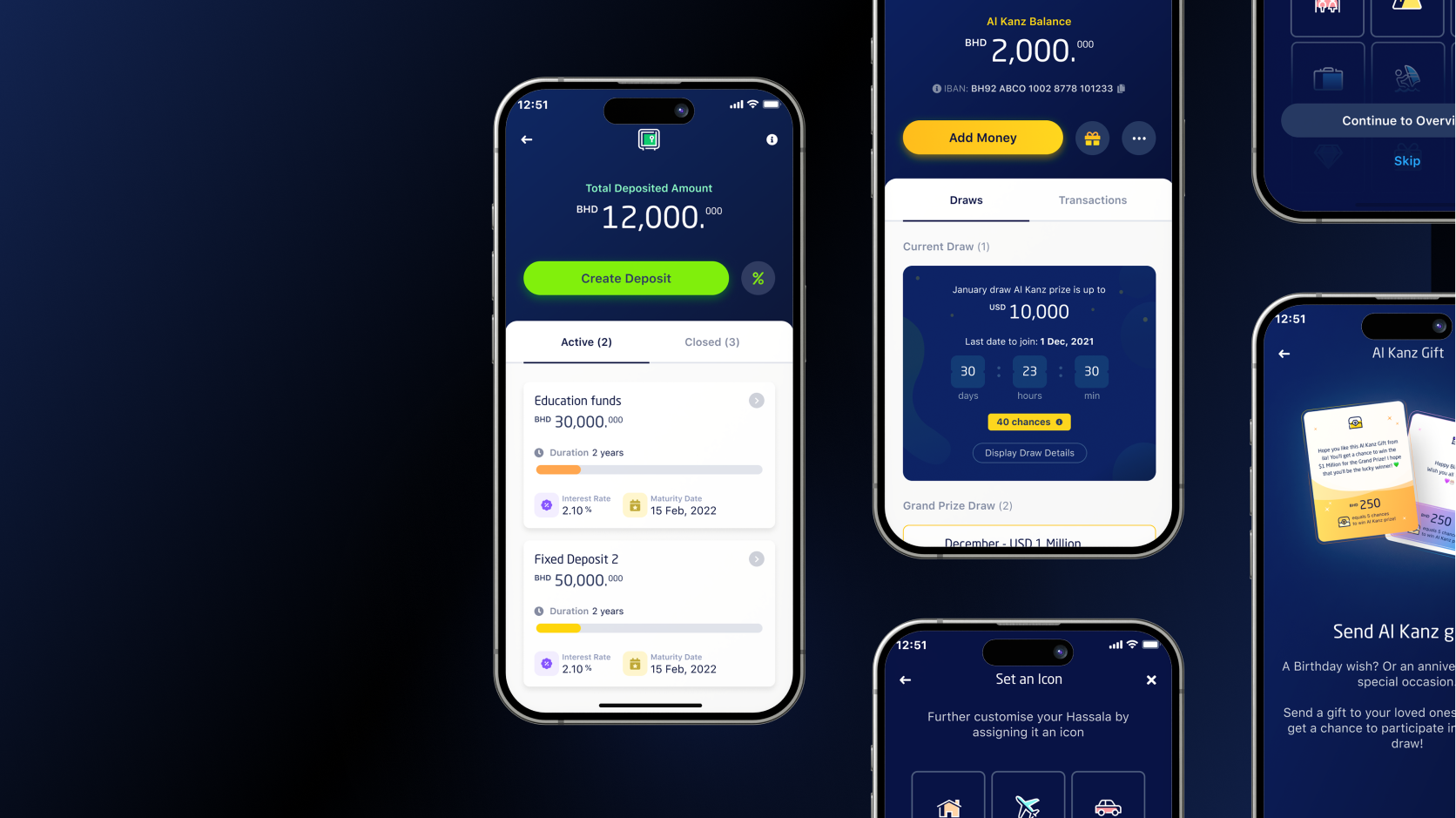

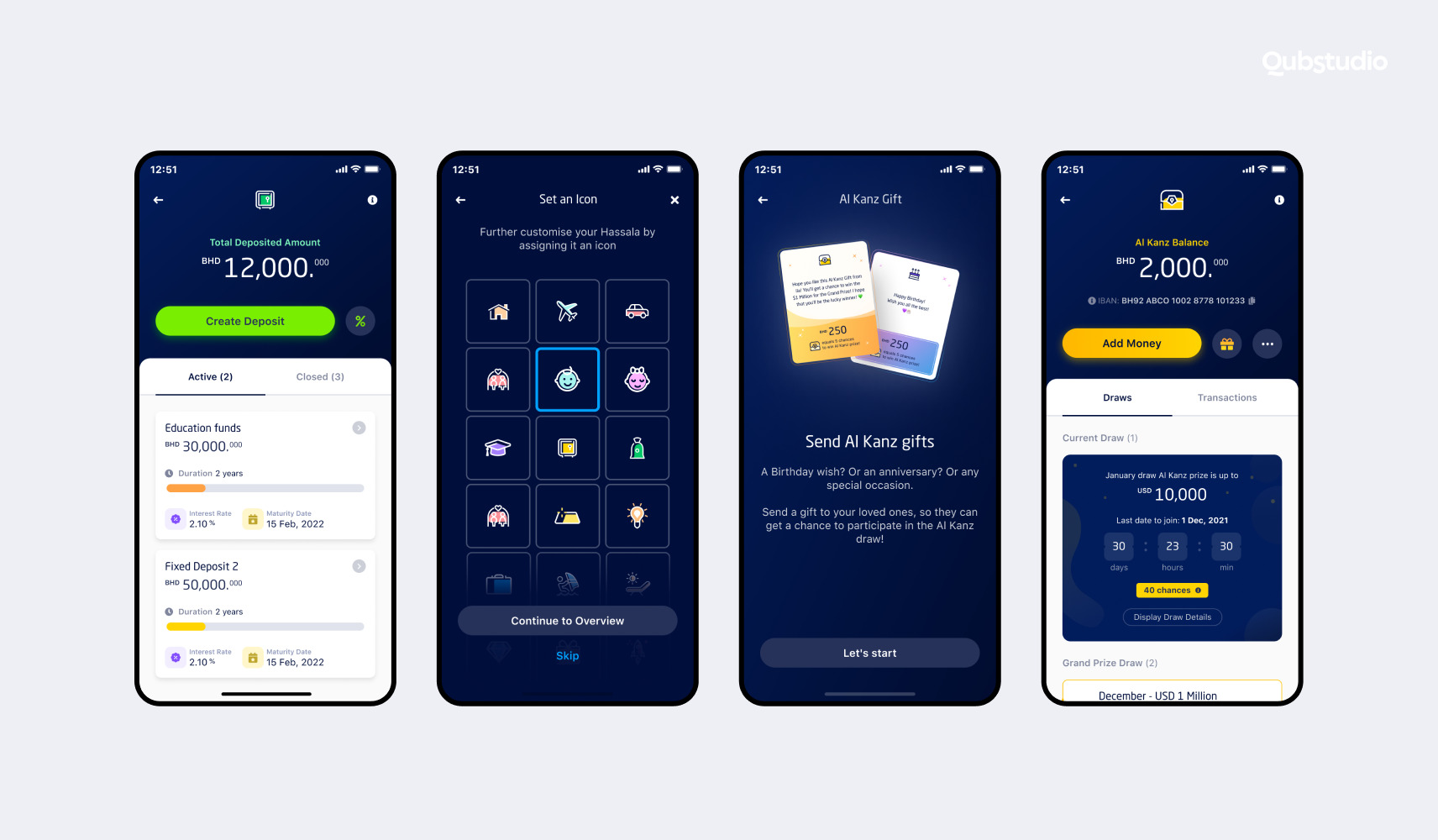

The ila Bank’s app provides a multitude of services:

- Al Kanz, where every deposit account gets a chance to win a fixed sum of money and can send any transaction as a gift with Kanz Gift;

- Jamiyah, a group savings account where all parties can deposit their savings toward a common goal;

- Hassala, an individual savings deposit;

- Fixed deposit, a conventional savings account with competitive interest rates;

- Fatema, a smart assistant helping navigate ila Bank’s offerings and services.

The ila Bank’s app allows users to simply toggle conventional banking features on and off to provide a smooth customer experience for any client.

MasterCard named the ila Bank as the “Best Digital Bank User Experience” in MENA in 2020, and Global Finance awarded it “Best Consumer Digital Bank” and “Best Mobile Banking App” in Bahrain in 2021.

Conclusion

Islamic digital banking is steadily gaining traction both in the MENA region and across the entire Islamic world. However, design agencies have difficulties embracing the specifics of Islamic banking app design.

Qubstudio has already solved this challenge when it helped design the ila Bank’s app, which was a pioneer in MENA digital banking. Contact us, and we’ll help you implement design best practices that are Shariah-compliant to deliver outstanding customer experiences!

FAQ

Does the US have Islamic banking?

Yes, US banks started providing Islamic banking services back in the 1980s. As of now, the country has 25 large Islamic banks. Plus, there’s a variety of non-Islamic banks that offer Shariah-compliant investments, mostly in commercial real estate.

Why is Islamic banking design important?

In a world where services are commoditized, and customers can switch between providers with ease, building long-term partnerships based on mutual respect is crucial. Islamic banking enables transparency, respect, and trust between the bank and its customers. Apps designed with these values in mind help accomplish this.

Lead Designer

Product Designer