Open Banking and Customer Experience Unveiled: A Finance Revolution

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

In this exploration of open banking, we’ll uncover its promises and unravel its role as a catalyst for innovation. Success in an open finance transformative journey hinges on understanding the open banking customer experience and devising strategies to foster consumer trust.

Decoding Open Banking

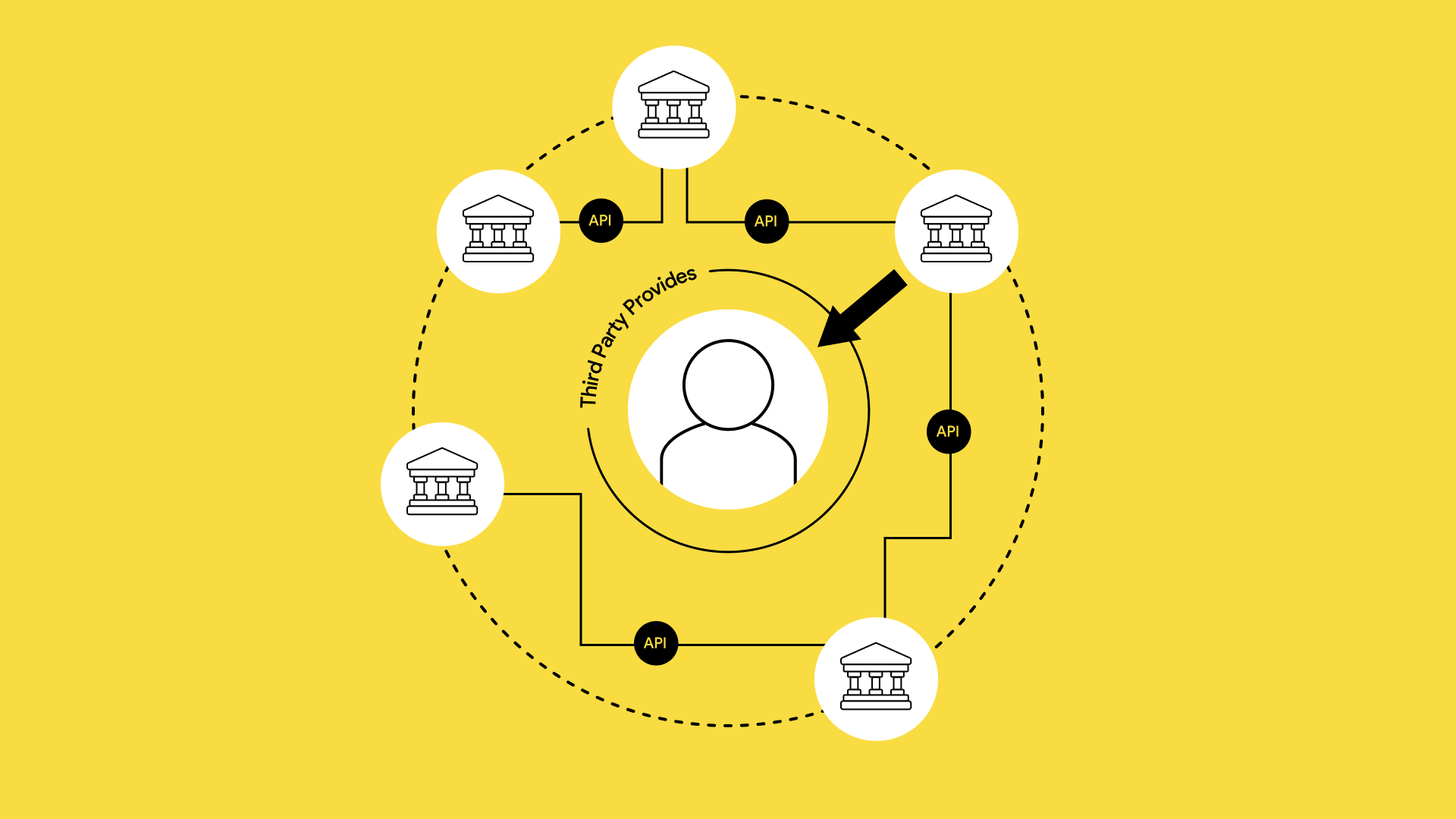

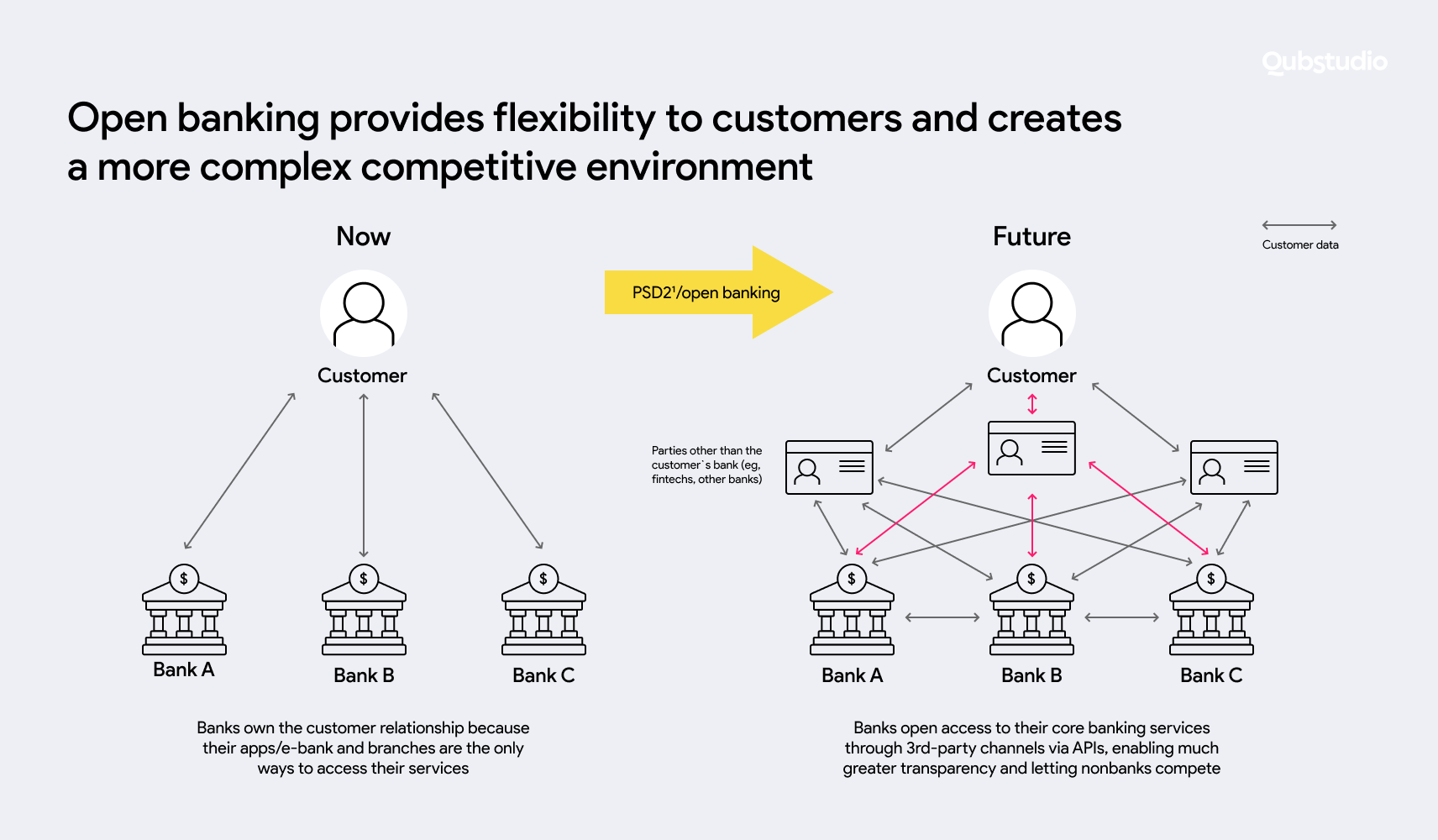

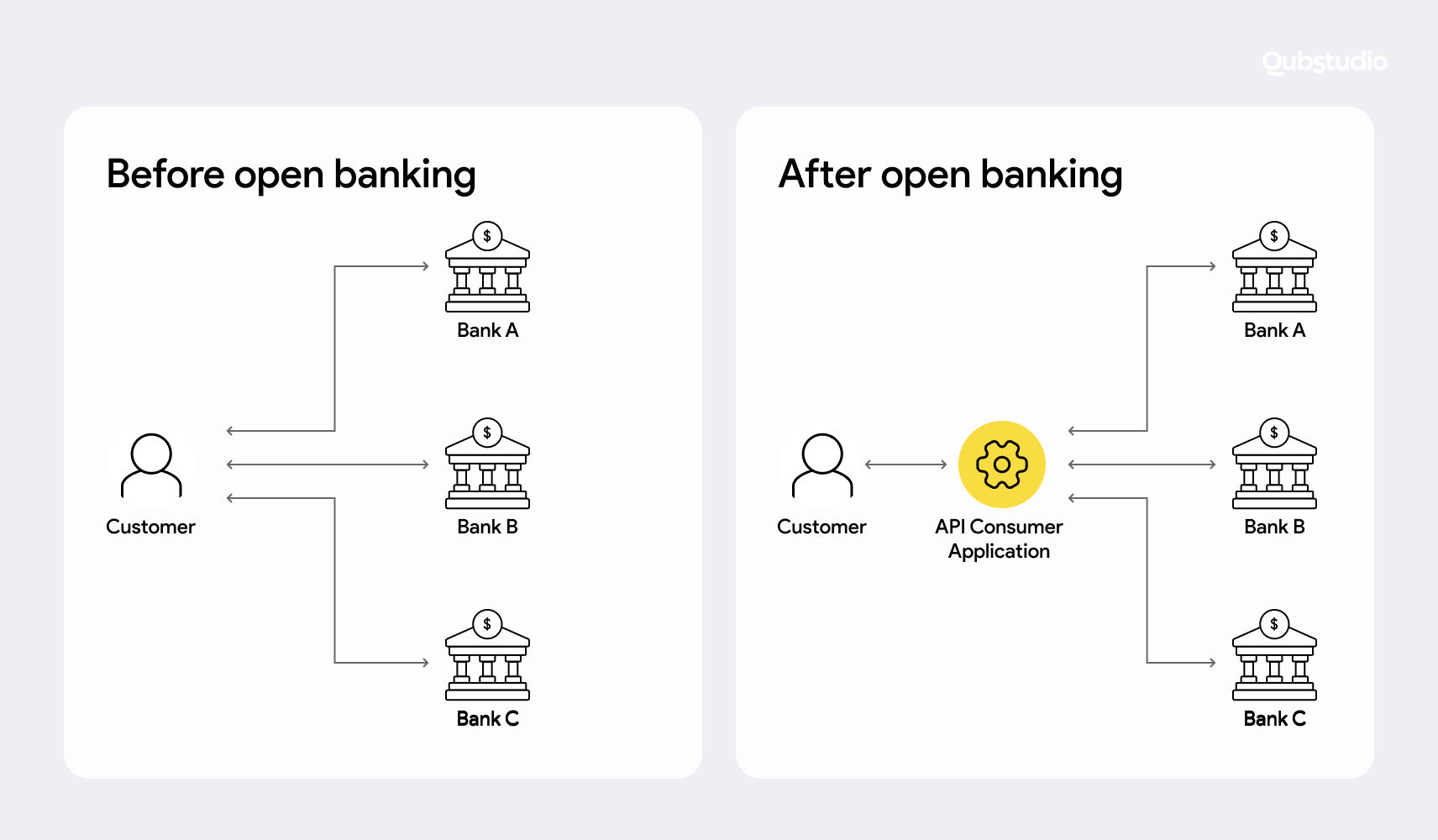

Commonly known as “open bank data,” open banking enables third-party financial service providers to access consumer banking and financial data through application programming interfaces (APIs). This practice facilitates seamless networking of accounts and data across institutions, promising a metamorphosis in both competitive dynamics and consumer interactions within the banking industry.

How Does Open Banking Work?

The fundamental open banking design revolves around the implementation of regulated APIs (Application Programming Interfaces) by banks, designed to align with prevailing legislation such as PSD2.

The APIs serve as digital bridges, establishing secure connections between users’ bank accounts and third-party service providers. Through this connection, a seamless exchange of financial data becomes possible. The user plays a pivotal role in this process, wielding the power to grant consent for third-party entities to access their financial information.

Some Examples of Open Banking Potential

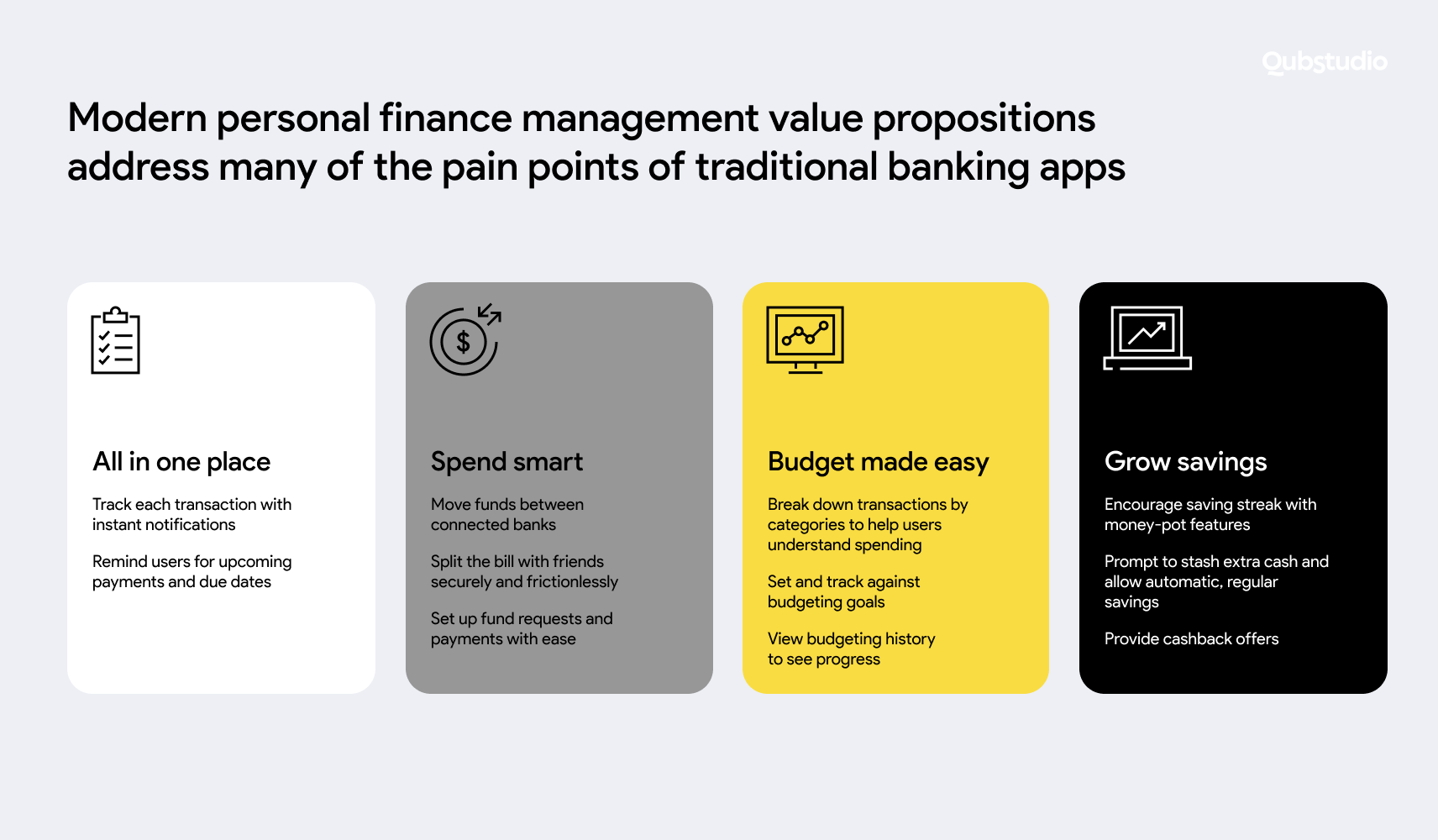

Open banking stands as a harbinger of innovation in banking, shifting from centralized systems to network-based solutions. It empowers financial services customers to securely share their financial data with diverse institutions, simplifying tasks such as switching banks or identifying optimal financial products and services.

This transformative potential extends beyond convenience. Open banking, through networked accounts, can provide lenders with a nuanced understanding of a consumer’s financial situation, leading to more favorable loan terms. It also aids consumers in gaining clearer financial insights before making significant financial commitments.

Applications of open banking span from automating calculations for prospective homebuyers to assisting visually impaired individuals in managing finances through voice commands. Small businesses benefit from time-saving online accounting, and fraud detection is heightened through more effective monitoring of customer accounts.

Market Leaders Shaping Open Banking Customer Experience

B2C solutions

- Revolut

Their APIs facilitate seamless integration, allowing users to manage their finances, make international payments, and invest—all in one place wrapped in exceptional design. - Square

Square has made a significant impact on B2C transactions with its user-friendly payment solutions. - Robinhood

Robinhood empowers users to seamlessly trade stocks, cryptocurrencies, and other financial instruments, democratizing access to the world of investments. - Acorns

Acorns has pioneered the concept of micro-investing, rounding up everyday purchases to invest spare change. - Chime

Chime’s B2C approach focuses on providing consumers with fee-free banking services. Their APIs underpin a range of features, including early direct deposit, automatic savings, and a user-friendly mobile interface. - Mint

With budgeting tools and financial insights, Mint enhances the B2C financial management experience.

B2B solutions

- Addepar

Addepar specializes in providing comprehensive financial data management and analytics solutions for businesses, empowering businesses with robust tools for investment and wealth management. - Ozone API

Ozone API is the open API solution for banks and financial institutions, delivering ‘out of the box’ compliance with open banking standards and regulations around the world. - Tink

Their B2B solutions support various financial services, including personal finance management, payments, and investment insights. - FIS (Fidelity Information Services)

Provides a range of B2B fintech solutions, including APIs that facilitate payment processing, risk management, and financial analytics. - Plaid for Business

Businesses can leverage these APIs to enhance financial workflows and decision-making. - Envestnet | Yodlee

Envestnet | Yodlee extends its expertise to the B2B space, offering APIs that facilitate financial data aggregation and insights.

Navigating in the Era of Open Banking Customer Experience

Open banking introduces a secure avenue for customers to share financial data with entities beyond their traditional banks. As modern banking platforms embrace API compatibility for friction-free consent authorization and secure data sharing, the spotlight shifts to open banking customer experience strategies for building and sustaining consumer trust.

What Makes Open Banking Customer Experience Engaging and Effective?

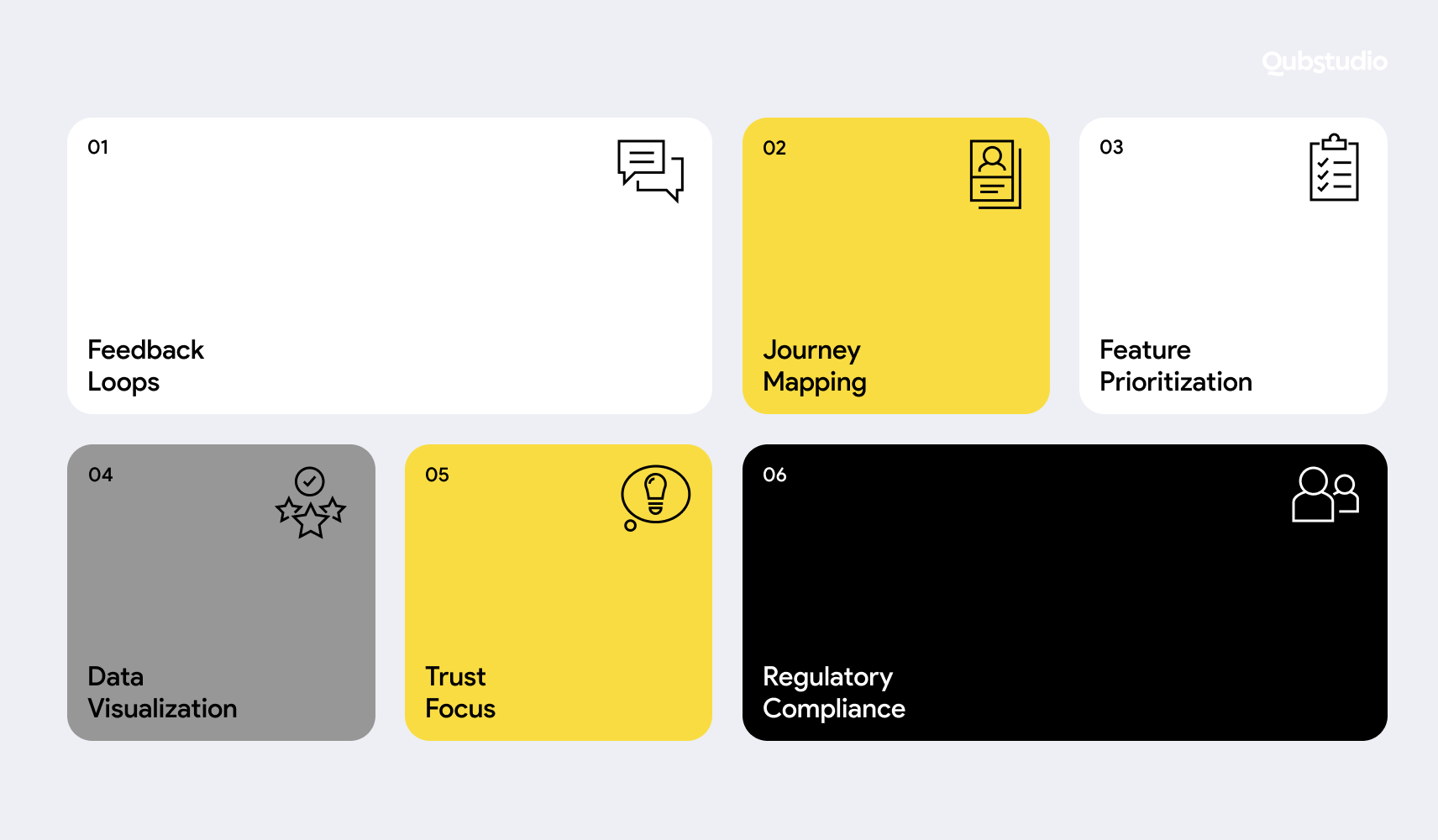

Feedback Loops

Implement feedback mechanisms, particularly in the realm of open banking design, to keep users informed about the status of their actions. Real-time feedback enhances the sense of control and reduces uncertainty.

Journey Mapping

Map out the entire customer journey, from onboarding to ongoing interactions. Identify touchpoints and design seamless transitions to ensure a cohesive and user-friendly open banking UX.

Feature Prioritization

Prioritize features based on user needs, business goals, and regulatory requirements. A well-prioritized feature set in the open banking design ensures that the product addresses critical customer pain points.

Data Visualization

Present financial data in a visually engaging and comprehensible manner. Use charts, graphs, and other visualizations to make complex information more digestible for users and refines open banking UX.

Trust Focus

Prioritize measures to build and maintain customer trust, including robust data privacy, strong customer authentication while working on open banking UX, and transparent communication about fraud prevention.

Regulatory Compliance

Stay abreast of regulatory requirements in the financial industry. Ensure that the open banking design and the product complies with relevant laws and standards, building trust with customers.

Conclusion

In the grand scheme, open banking emerges as a transformative force in banking, promising a paradigm shift in consumer interactions with financial services. While the gains are evident, addressing challenges in ensuring consumer trust and maintaining a high open banking UX level is imperative. The future of banking is undoubtedly shaped by the openness, collaboration, and innovation ushered in by the dynamic landscape of open banking.