Digital Banking Design in 2025: How to Sustain and Grow While Others Are Failing

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

Discover the reasons behind modern FinTech challenges together with approaches that could help virtual banks to meet those. And find out why digital bank design is not the last thing to consider for a sustainable FinTech product strategy.

Intro: The Problem With Digital Banks’ Profitability

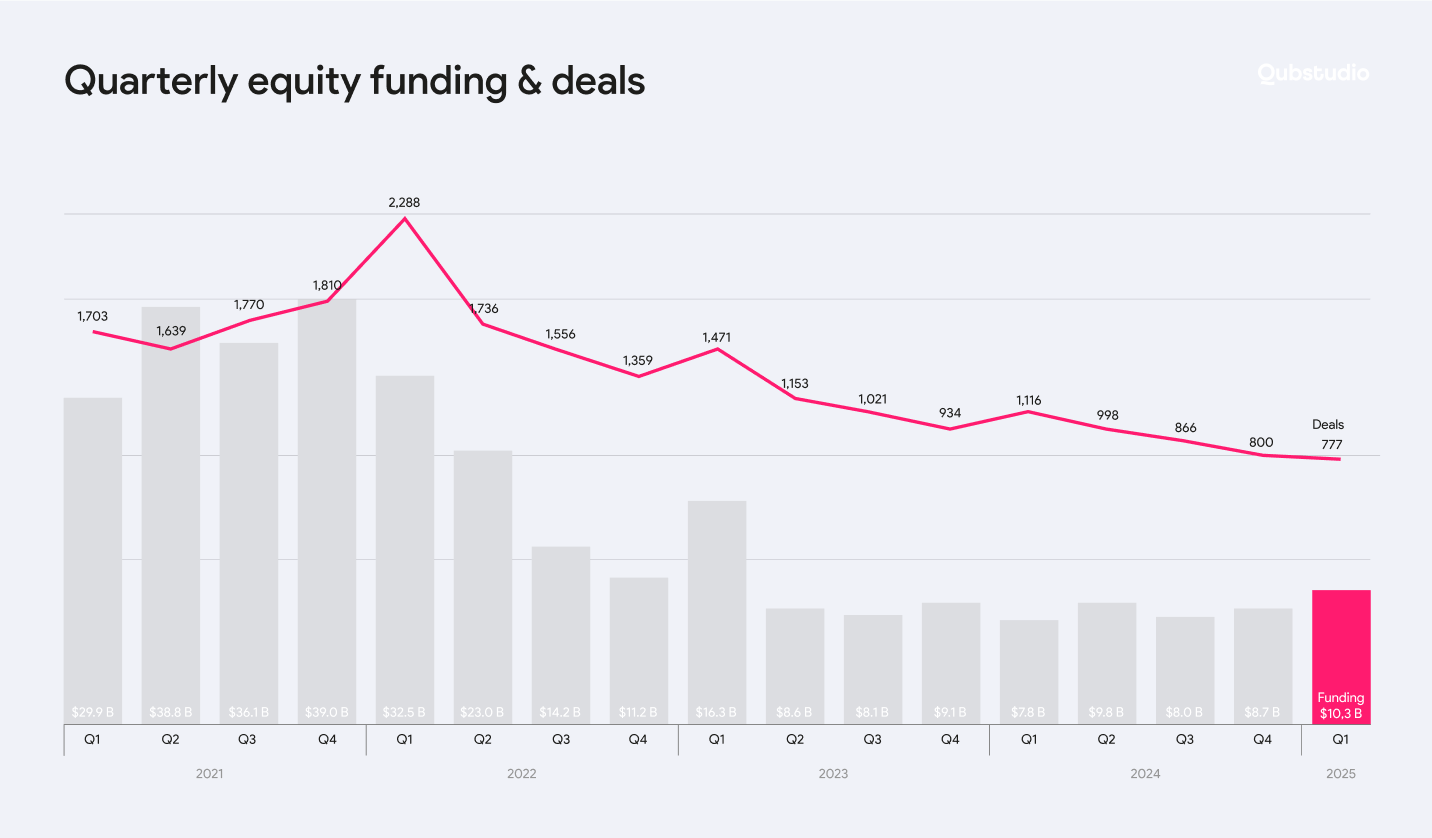

The current economic state continues to shape the funding landscape for FinTech companies. According to CB Insights, in Q1 2025, global FinTech equity funding totaled just $10.3 billion across 777 deals.

Since remote banking emerged as the new norm, a new breed of neobanks, focused on better digital banking design and digital-only service approach, appeared as front-runners in driving the digitization of financial services. However, with the proliferation of neobanks worldwide since 2019, these emerging players now face fresh challenges in securing their long-term viability.

“The pioneers of the neobank era—Simple, Moven, PerkStreet Financial, Monzo, etc.—should be celebrated. But the days of a general purpose, retail bank-like FinTech—that doesn’t lend and has no charter—is over”.

Challenges Faced by FinTech Businesses in Digital Banking

Typically, neobanks begin by offering a set of distinctive features, such as low-cost foreign exchange and international money transfers (as seen with Revolut), fee-free credit cards (like Nubank), or specialized business accounts (such as Tide). Newest UX approaches in digital banking design were developed as well. Over time, they aim to expand their services to encompass a broader range of offerings, including current accounts, lending, insurance, and investments. Empowered with an excellent UX and UI, virtual banks aimed to become multi-country & full-service banks, as seen with N26 and Revolut.

However, this growth strategy faces several potential obstacles:

- Retail banking, much like consumer markets in general, is highly influenced by cultural specificities. What may work successfully in one country might not necessarily resonate with consumers in a neighboring nation: services and digital banking design require solid market understanding.

- Regulations surrounding deposit-taking and payments vary across countries and regions, making it challenging to transfer established business models and digital bank design seamlessly.

- Many developed markets are already saturated with traditional banks, creating significant barriers for full-service neobank entrants, as N26 experienced in the UK. Traditional banks in certain markets, including the UK, are gradually catching up in terms of technology and design, narrowing the technological advantage that early FinTech entrants once enjoyed. This reduced differentiation based on functionality and UI/UX alone limits the scope for neobanks to set themselves apart.

These factors help to explain why Nubank managed to establish a thriving credit card business in Brazil, where the incumbents were slow, expensive, and technologically lacking. However, replicating the same success in Europe would have posed considerably greater challenges for digital banking design and business modeling. Similarly, disparities in regulations between Europe and the US clarify why European neobanks like Monzo and N26 have abandoned attempts to expand into the US market. The complexities of building full-service digital banks from scratch in that particular market proved to be formidable hurdles.

Enhancing FinTech Growth in 2025: Effective Strategies to Thrive

Launching a generalist neobank today faces low odds of success, as evidenced by failed attempts from various players, including N26 in the UK and US, Bó in the UK, Xinja and 86400 in Australia, Finn by JP Morgan, Google’s Google Plex venture, and Uber Money.

Given the increasing competitiveness of retail banking markets, what are the potential paths to success?

Here are five suggested strategies to consider:

1) Target an underserved market niche: Identify specific segments that are served not well enough by mainstream providers.

This could include financially marginalized consumers with specific needs in terms of:

- Digital banks UI (like Credit Sesame in the US)

- Young people (such as NatWest’s acquisition of RoosterMoney in the UK, Greenlight, and Current in the US)

- Families (like Apple Card Family in the US)

- Freelancers, and microbusinesses (Tide and HSBC Kinetic in the UK)

- Small companies (such as Agicap in France) requiring assistance with international trade, smoothly wrapped with a modern UX (for instance, AGTB in the UAE).

2) Focus on a growing value pool: Concentrate efforts on emerging segments, such as gig workers. Targeting the substantial pool of workers with fluctuating incomes, as Tide and Metal are doing in the UK, or aiming at the 59 million gig workers in the US, as Lance is doing, can prove fruitful.

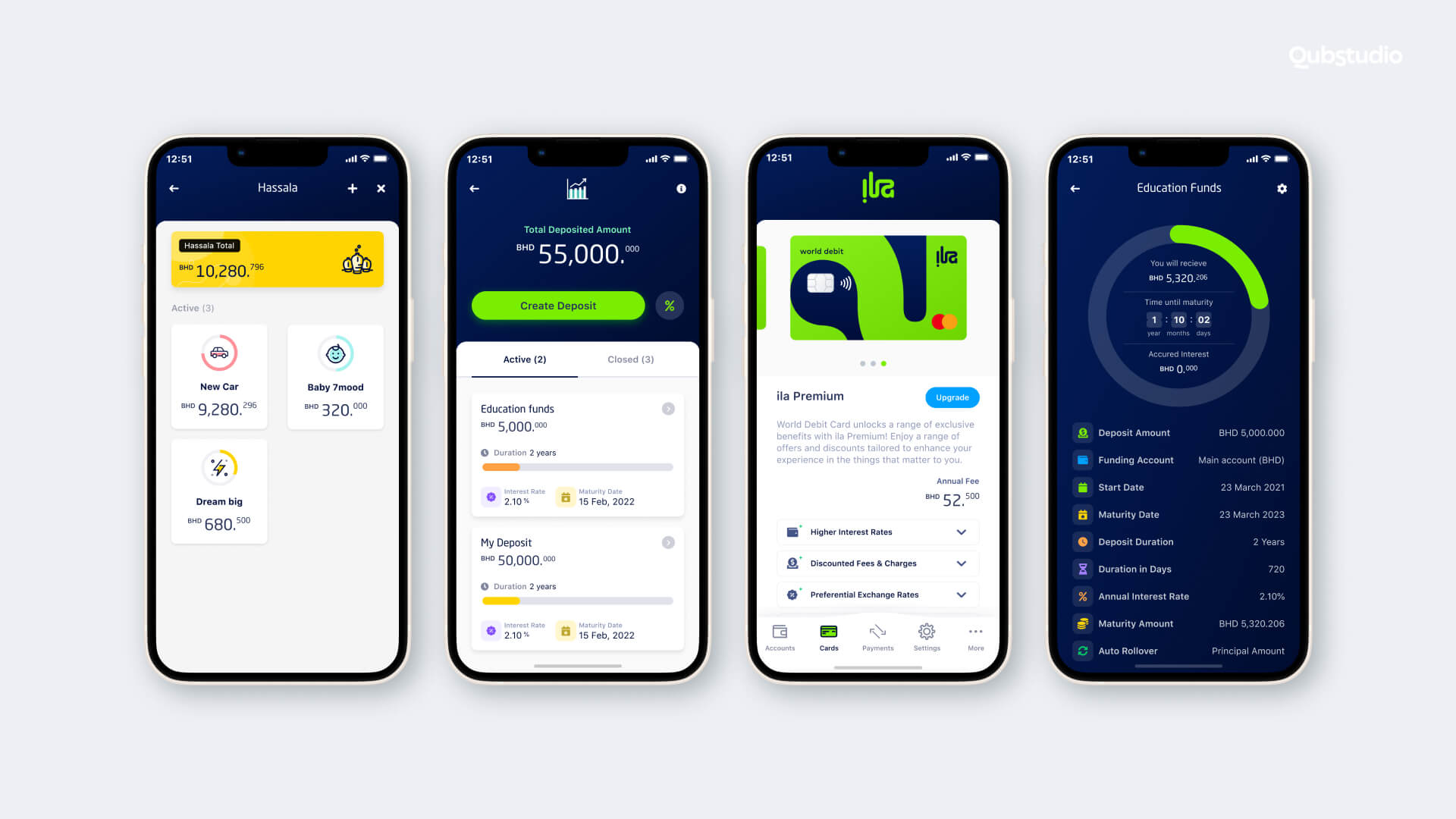

3) Leverage digital delivery to redefine financial products: Challenge the notion that all financial products are commoditized by utilizing the potential of digital platforms and digital banking web design. For example, Curve’s “Go Back in Time” feature allows users to switch past payments to any desired card or transform a completed payment into a future loan. Repackaging traditional products in innovative ways with an outstanding digital banking design provides a powerful source of differentiation.

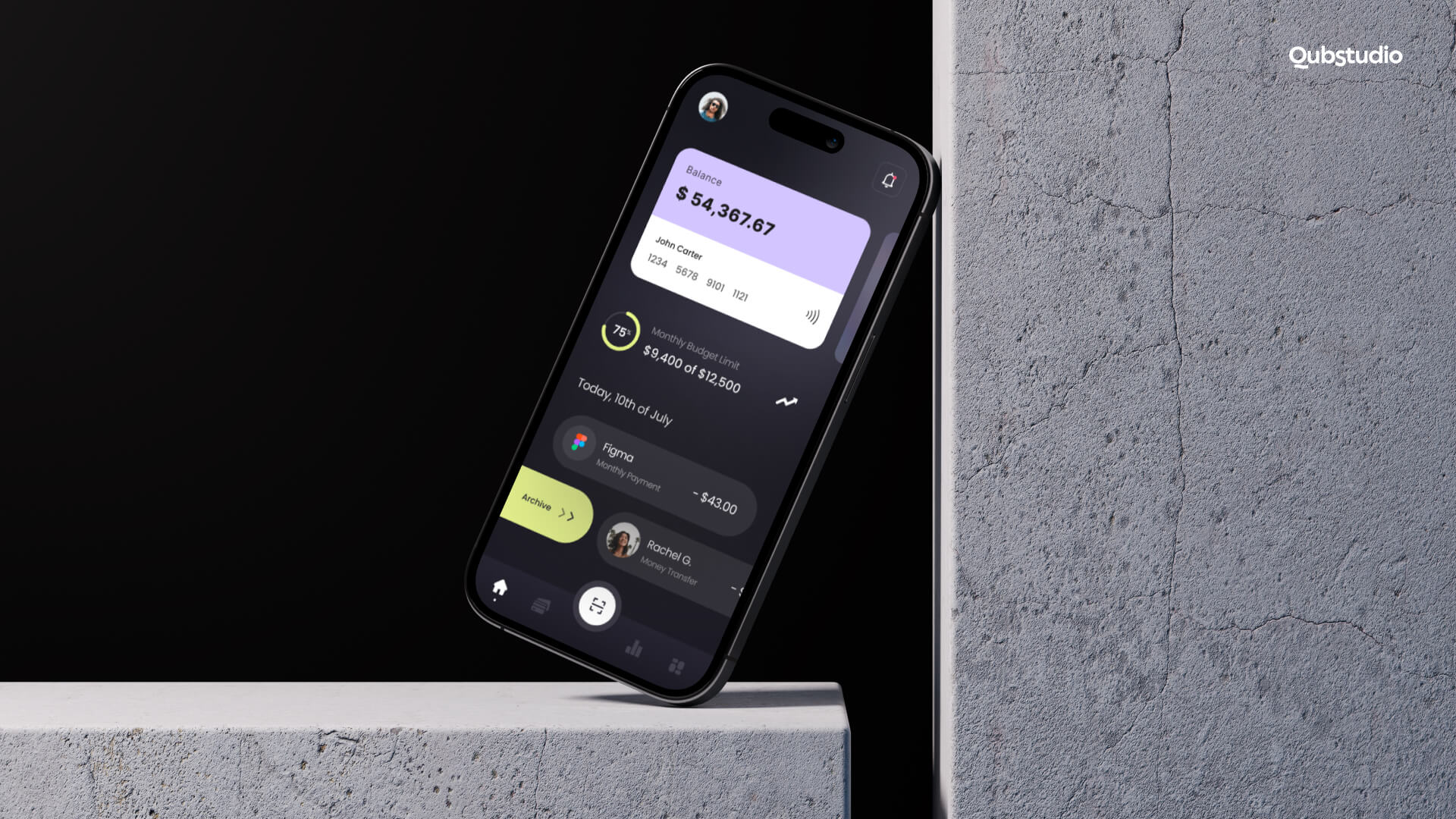

4) Differentiate through user experience: Capitalize on the opportunity to create a unique identity for the bank by offering a distinct and exceptional user interface. According to a study by Forrester Research, every dollar invested in user experience design can yield a return of up to $100 (ROI of 9,900%).

Moreover, well-crafted digital bank UI together with intuitive bank UX can be a differentiating factor that sets a neobank apart.

Seamless design for a digital bank, together with proper UX writing, would probably include seamless onboarding and a simple cross-platform experience, personalization options, and financial well-being tools for B2C users.

Building a successful FinTech entails managing a multifaceted and intricate endeavor, but design could be a game-changer for the overall solution’s success. At last, McKinsey found a strong correlation between high MDI [McKinsey Design Index (MDI), which rates companies by how strong they are at design] scores and superior business performance. Top-quartile MDI scorers increased their revenues and total returns to shareholders (TRS) substantially faster than their industry counterparts did over a five-year period — 32% higher revenue growth and 56% higher TRS growth for the period as a whole.

5) Seek an unfair advantage: Identify opportunities to leverage existing business footprints, whether in banking or another sector like retail or telecoms, to bolster and differentiate the neobank’s proposition. Integrating this advantage into the app design and your digital banking web design in general can create a distinctive and standout experience.

Instead of Conclusions

The retail banking market has become increasingly crowded with the emergence of numerous digital challengers worldwide since the onset of the pandemic five years ago. However, within the retail banking landscape, there are still underserved sub-markets, including sizable segments like young people and small businesses, that can be effectively targeted with digital services.

The key to success lies in differentiation, professional digital banking design, and ensuring neobanks offer distinctive and relevant propositions that fully consider the local market characteristics in each territory they operate.

At Qubstudio, we help banks and FinTechs stand out in a saturated market. As a FinTech design agency, we combine deep industry knowledge with user-centric design to build scalable, high-impact digital banking products. Let’s talk about how we can bring your next banking innovation to life.