The Gulf Cooperation Council FinTech Revolution: Reshaping Finance in GCC and MENA

Whitepaper

Fintech & Banking Trends: Transforming Product Experiences in 2025

- Growth and Investor Backing

- Regional Outlook

- Transforming Daily Transactions and Building Wealth

- Gulf Cooperation Council Fintech Startups Set for Multi-Market Growth and Expansion

- Offerings Across the Financial Services Value Chain

- Incumbents and New Entrants

- Maintaining Sustainability Within Global Fintech Uncertainty

- Final Thoughts

The Gulf Cooperation Council fintech sector is experiencing a remarkable surge in growth and investment. With its eye-catching numbers and disruptive solutions, FinTech is reshaping the financial landscape, bringing convenience and innovation to consumers and businesses alike. Let’s explore MENAP and GCC FinTech and its potential to revolutionize finance.

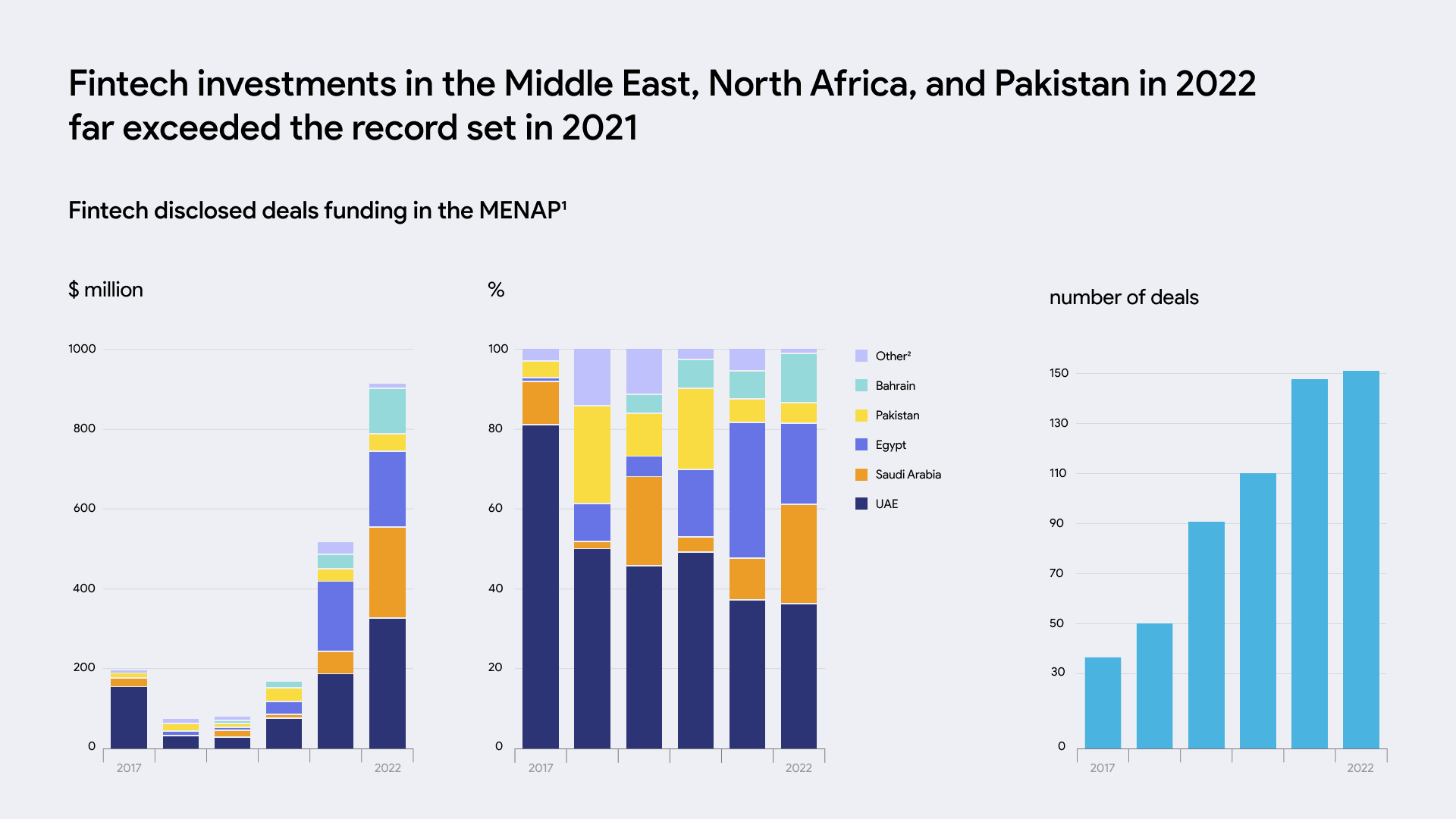

Growth and Investor Backing

Over the past few years, the FinTech sector in the GCC and MENA has witnessed robust growth, with investor backing skyrocketing at an annual rate of approximately 36 percent. From 2017 to 2022, funding for FinTech start-ups in the region more than quadrupled, reaching a staggering $885 million in 2022, according to Magnitt. This surge in funding has empowered FinTech companies to expand their operations and introduce cutting-edge solutions to the market.

Regional Outlook

The positive macroeconomic outlook and the consistently strong performance of Gulf Cooperation council fintech and GCC financial services industry create a favorable environment for FinTech’s continued growth. Experts estimate that MENAP FinTech revenue could triple from $1.5 billion in 2022 to a range between $3.5 billion and $4.5 billion in 2025. This remarkable growth trajectory would significantly increase FinTech’s share of financial services revenue from less than 1.0 percent to approximately 2.0 to 2.5 percent.

Transforming Daily Transactions and Building Wealth

Gulf Cooperation Council Fintech innovators have the potential to play a pivotal role in transforming the way consumers and businesses conduct their daily transactions and build wealth. By reinforcing the fintech ecosystem with capital, regulatory support, talent, and partnerships, these diverse actors can unleash their full potential and make a lasting impact on the region’s financial landscape.

Gulf Cooperation Council Fintech Startups Set for Multi-Market Growth and Expansion

Gulf Cooperation Council Fintech startups are not confined to a single market. According to TechCrunch, nearly 60 percent of the founders surveyed operate in multiple markets within the financial market of the GCC, showcasing their ambitious plans for further expansion and financial investments.

In this regard, Tabby, a buy-now, pay-later (BNPL) provider founded in 2019, already serves over two million customers in Saudi Arabia, the United Arab Emirates, and Kuwait. Such strategic expansions are instrumental in achieving growth targets and establishing a footprint comparable to fintech leaders in major global markets.

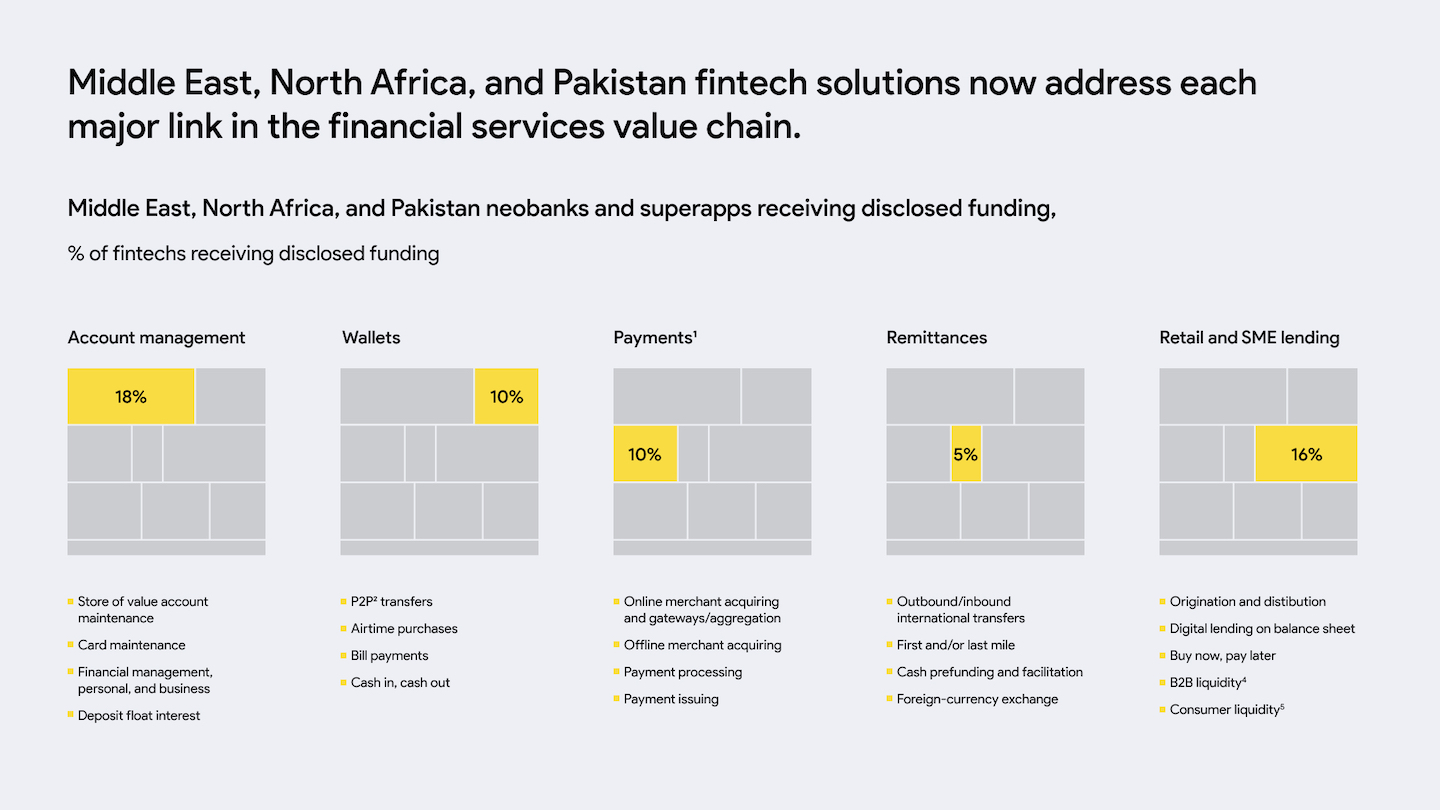

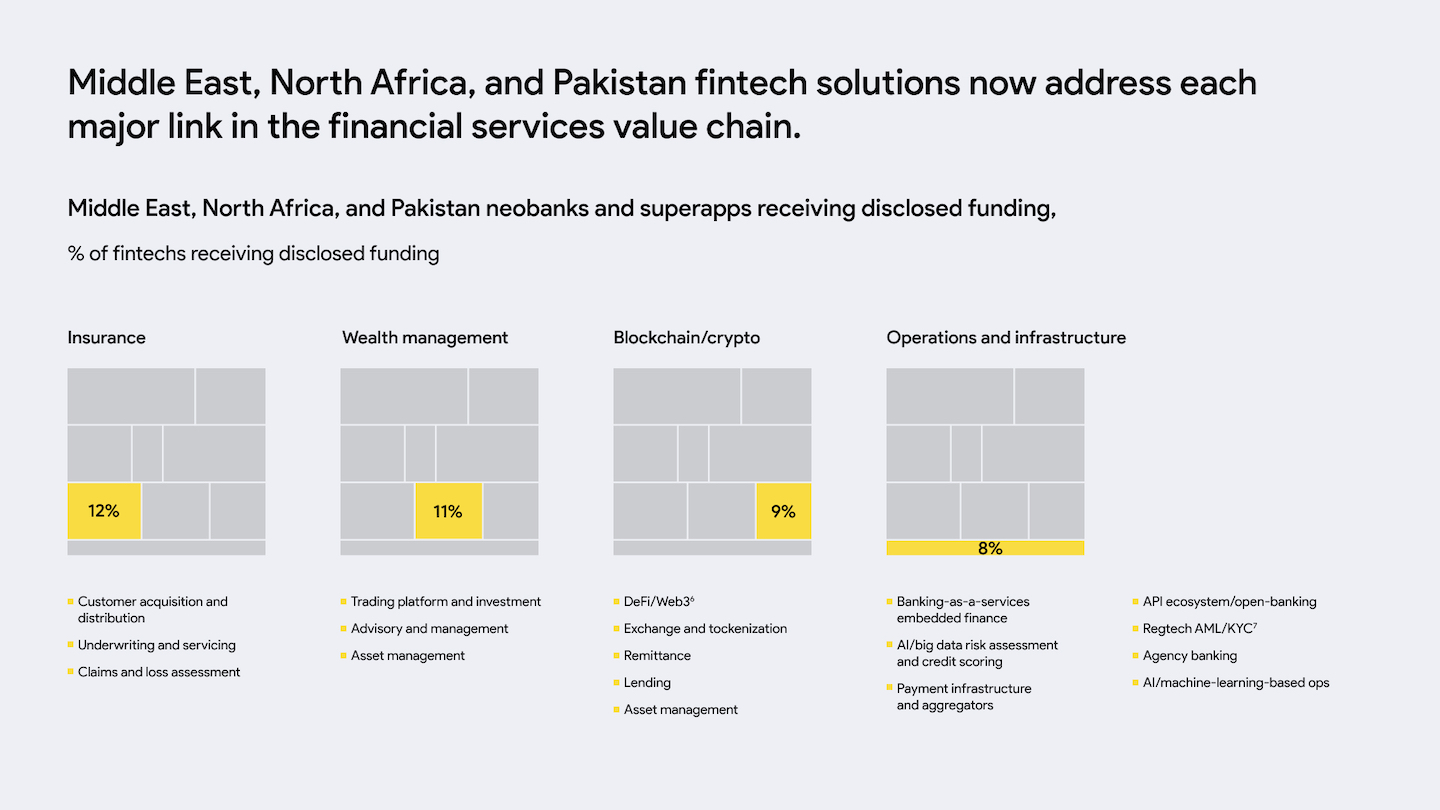

Offerings Across the Financial Services Value Chain

GCC and MENA FinTech offerings extend beyond basic mobile wallets and payments solutions.Start-ups in the region are venturing into various financial services verticals, catering to both consumer and business needs. Alongside payments acceptance and lending for small and medium-sized enterprises (SMEs), GCC financial solutions offer a range of B2B services such as employee benefits solutions, payroll services, and microlending. Open-banking GCC start-ups provide seamless integration of bank, fintech, and merchant systems, facilitating secure and convenient financial transactions.

Incumbents and New Entrants

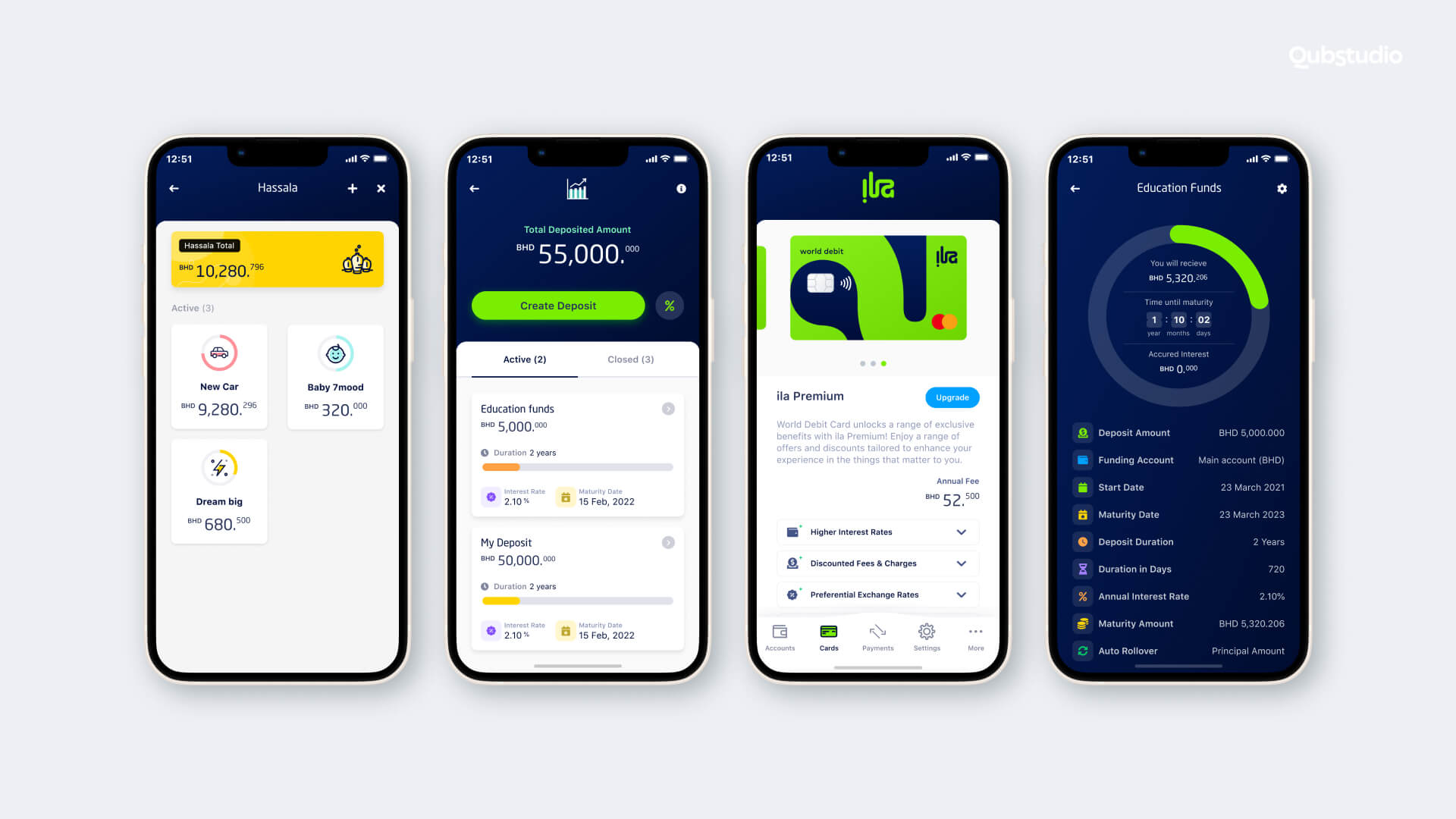

The Middle East and Gulf countries fintech revolution is not limited to start-ups. Established international fintech firms, banks, non-bank financial institutions, and cross-sector fintech firms are all driving innovation and transforming the financial landscape. Leading banks, such as a mobile-only digital bank ila Bank, have launched digital-only offerings, while traditional infrastructure providers have embraced mobile apps and digital portals. Telecom giants are also making their mark in the fintech space, integrating payments and financial services into their ecosystem offerings.

Maintaining Sustainability Within Global Fintech Uncertainty

Despite global trends showing a decline in fintech valuations, the Gulf Cooperation Council FinTech sector within the financial market of the GCC is expected to sustain its momentum. As digital transformation deepens, collaboration with a fintech design agency becomes a key enabler for creating intuitive, compliant, and scalable financial products that resonate with regional users.

To fully capitalize on this potential, four key building blocks are crucial for GCC financial services: sufficient capital, regulatory and market harmonization, technical and leadership talent, and strategic partnerships. With the right support, MENAP and Gulf Cooperation Council FinTech have the potential to emerge as major players in the global market, creating substantial value for customers, partners, and investors.

Final Thoughts

The FinTech revolution in the Gulf Cooperation Council is underway, fueled by significant investment, regulatory support, and a hunger for innovation. As the sector continues to grow, MENAP’s and GCC FinTech companies are poised to reshape finance, unlocking new opportunities for consumers and businesses. With its vast potential, the financial market in GCC is not just transforming the regional landscape; it is emerging as a global force, driving the future of finance.