The New Way

of Investing for

Individuals

Web App UI/UX Design

for Investment System

About AURORA

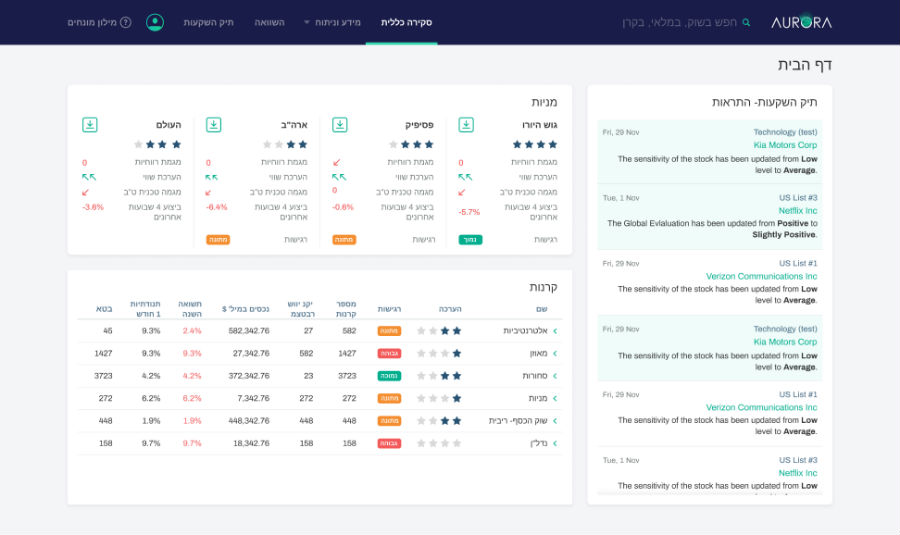

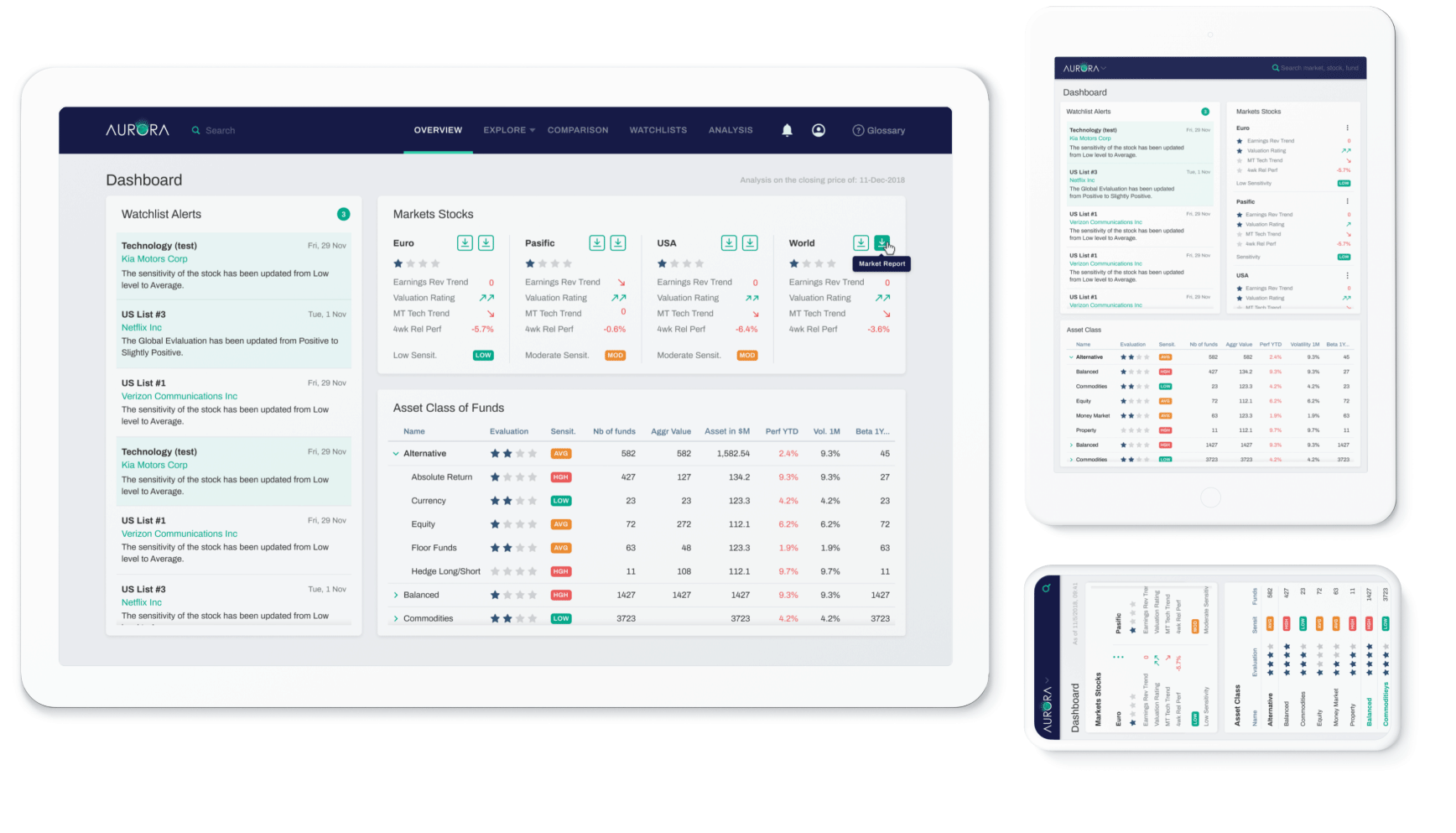

Aurora is an independent system for locating, analyzing, and evaluating investment opportunities. The innovative tool provides data-driven investment ideas and portfolio control that’s easy to use for individual, independent investors.

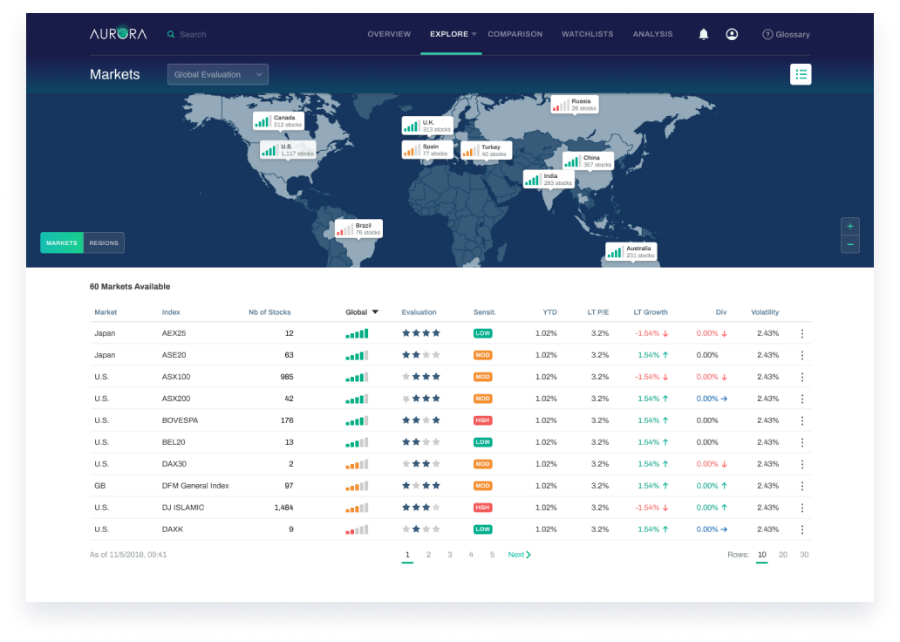

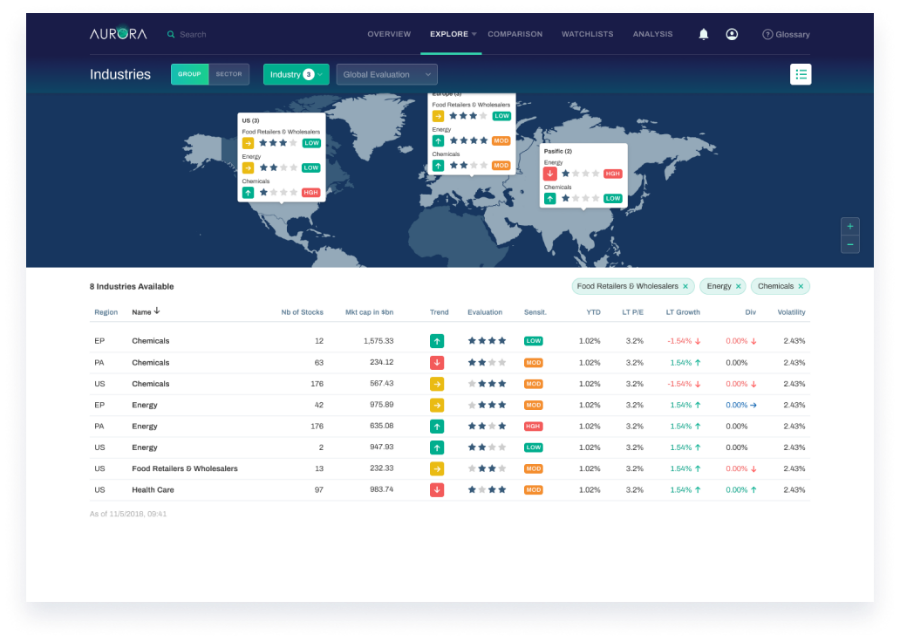

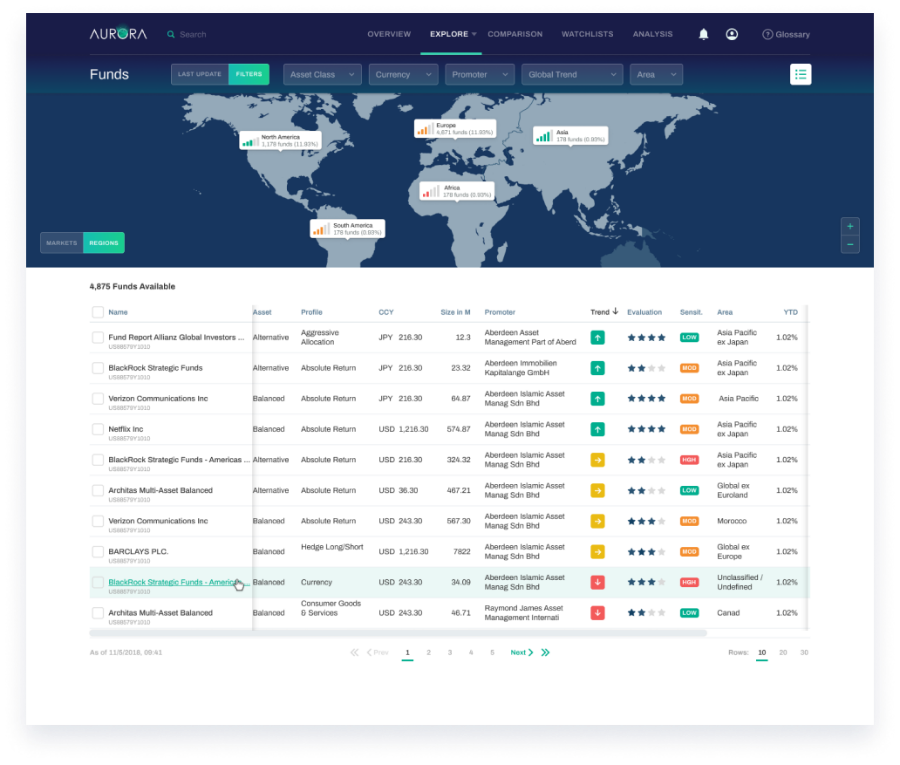

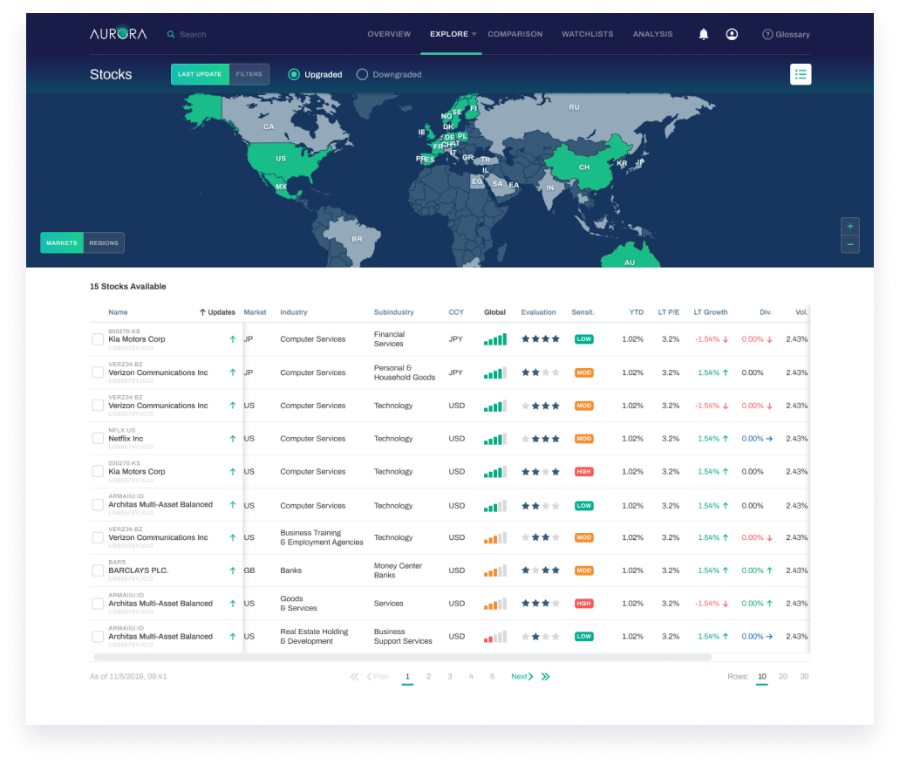

Aurora covers over 60 markets, 50 indices, 100 manufacturing industries, 6,000 shares, and 15,000 investment funds.

Qubstudio was invited to transform a sophisticated, professional investment system into a comprehensible, accurate, and simple tool for individual investors who don’t have a solid finance background.

It provides a modern analytics tool to make investment decisions based on data that’s easy to read. In the role of fintech UX/UI design agency, our task was to create a user-friendly investment platform design.

DIY for independent investors

Aurora takes advantage of theScreener methodology from Switzerland, analyzes dozens of factors and simplifies the complex financial process of investment decision making.

It empowers investors without a strong financial background effortlessly identify investment ideas, set up your investment portfolio, and simulate your investment plans. Moreover, the pressure and cost of working with financial advisors is now gone. It empowers individuals to gain full control over their finances.

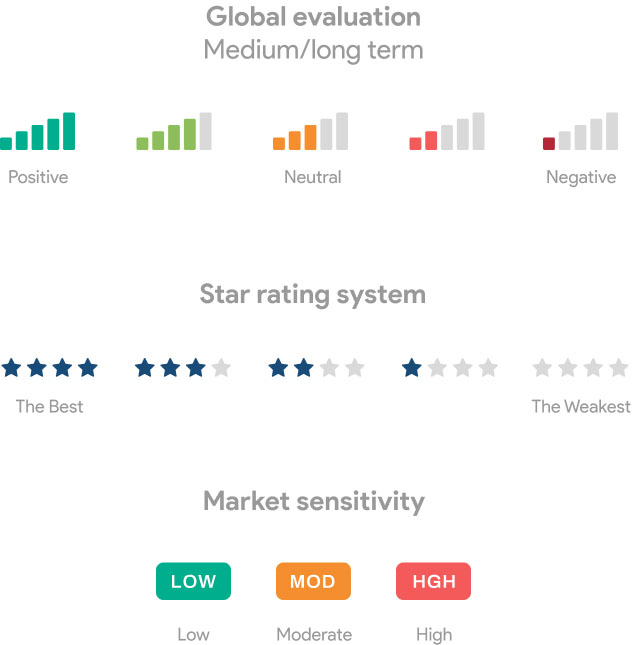

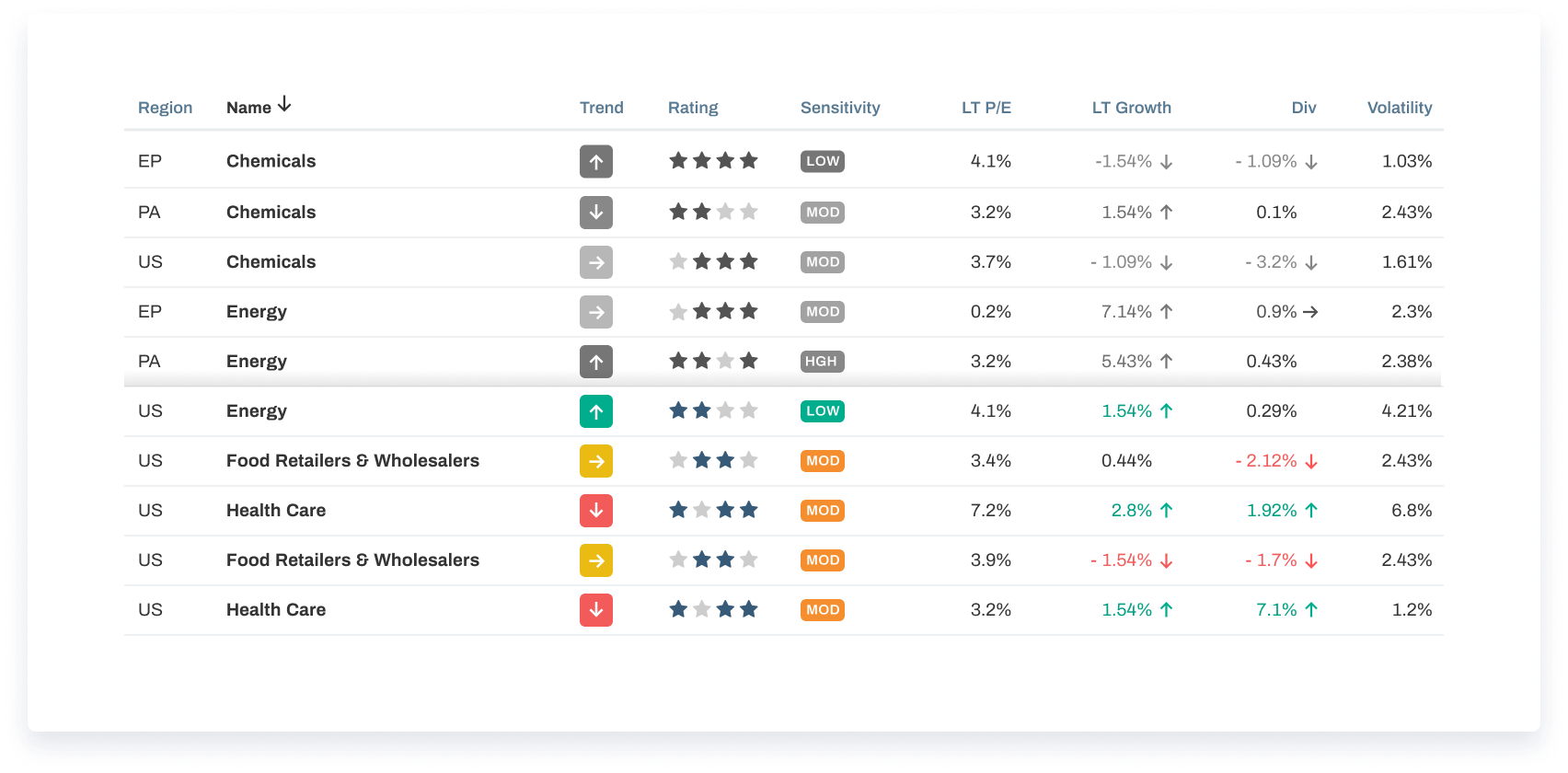

Global Evaluation System

A quick, simple, and yet accurate estimate of stocks and investment funds.

It combines financial and technical analysis (valuation, profit adjustments,

technical factors, group benchmarking).

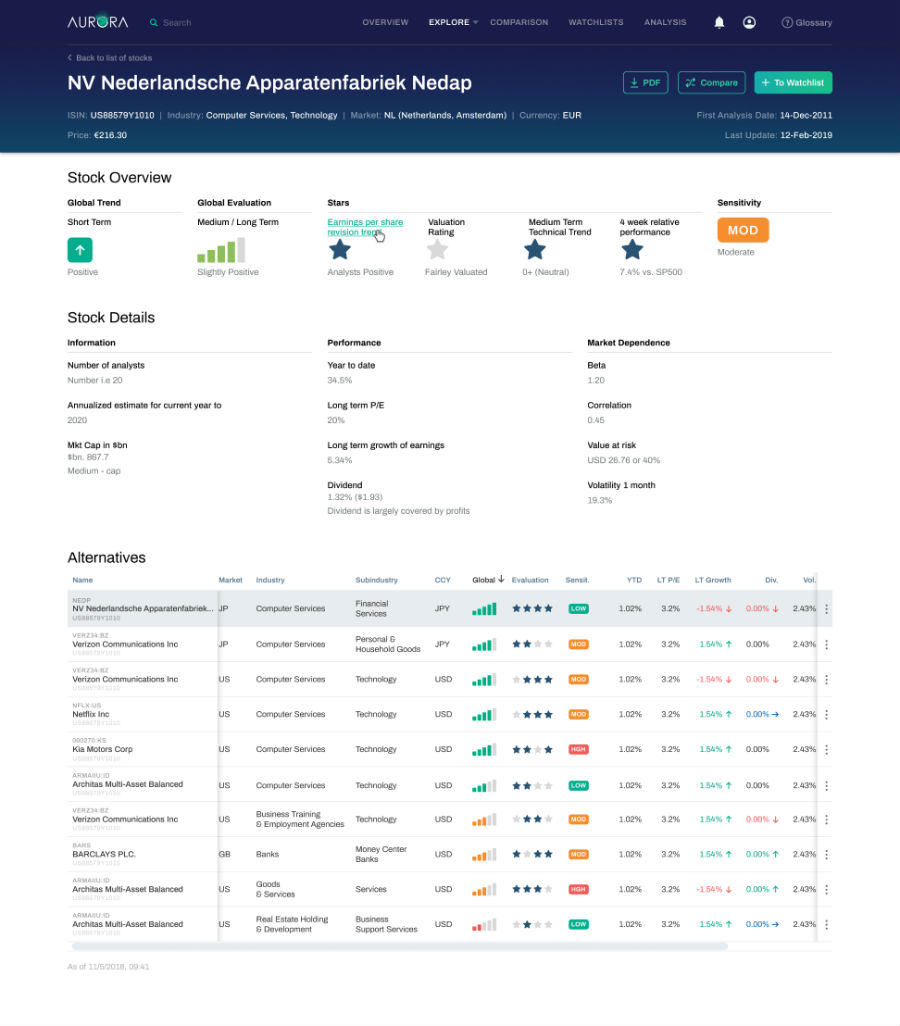

Analyze stocks

A thorough asset analysis is provided on one screen. In addition to global evaluation system, Aurora provides more statistics. Each of the four stars represents a segment of financial metrics analyzed. Earnings Revision Trend indicates whether the EPS were ascending or descending during the past seven weeks.

Stock Overview

Valuation Rating indicates growth to the price-earnings ratio that allows individual investors to quickly see which assets are undervalued and which ones are overvalued.

The midterm technical trend indicates how positive or negative the market (buying/selling) tendencies of a stock is.

4-week relative performance measures the performance of a stock relative to its national index (compared to four weeks ago) and gives reliable insights to which stocks investors want.

Sensitivity is a measurement of the Bear Mkt Factor and the Bad News Factor against the world reference.

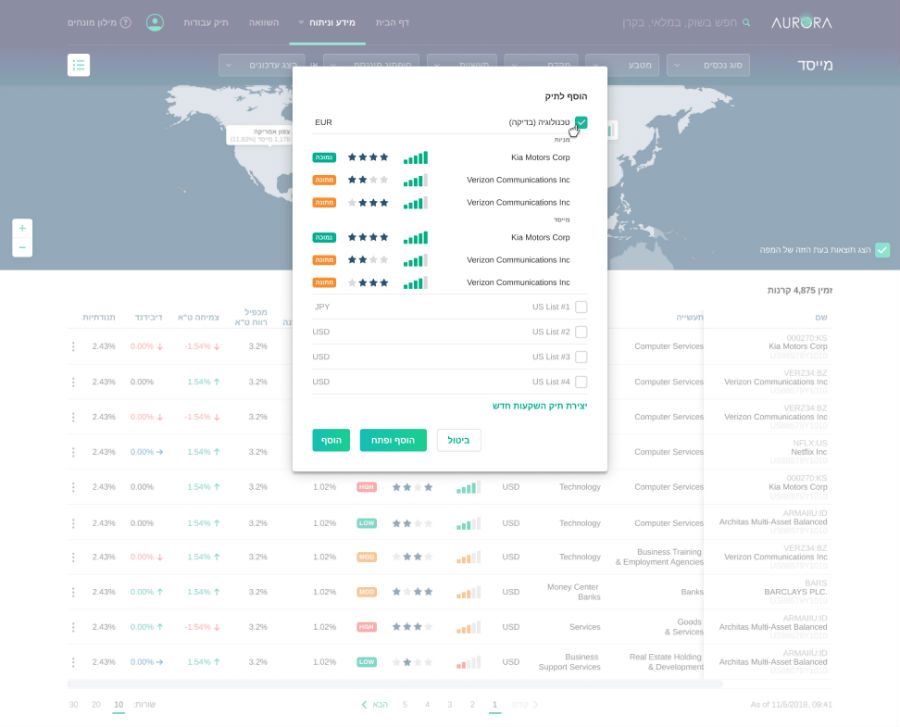

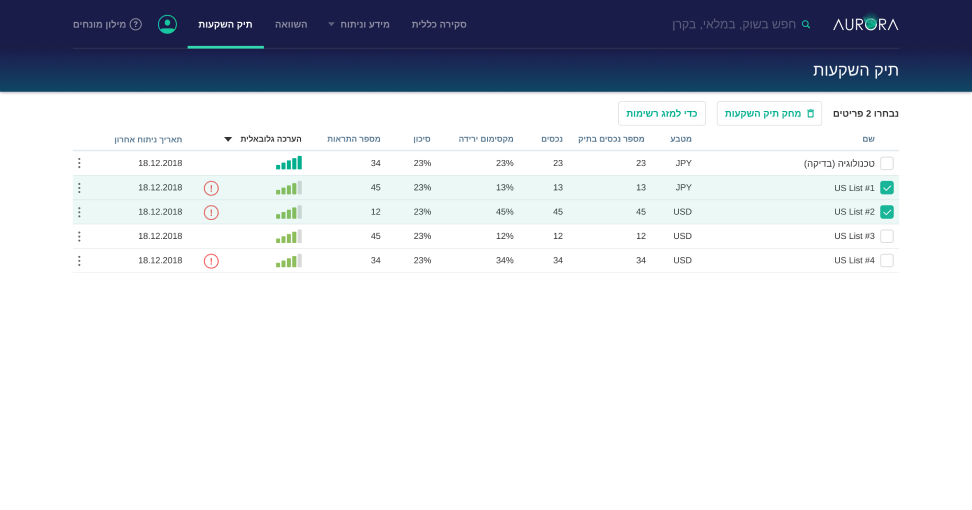

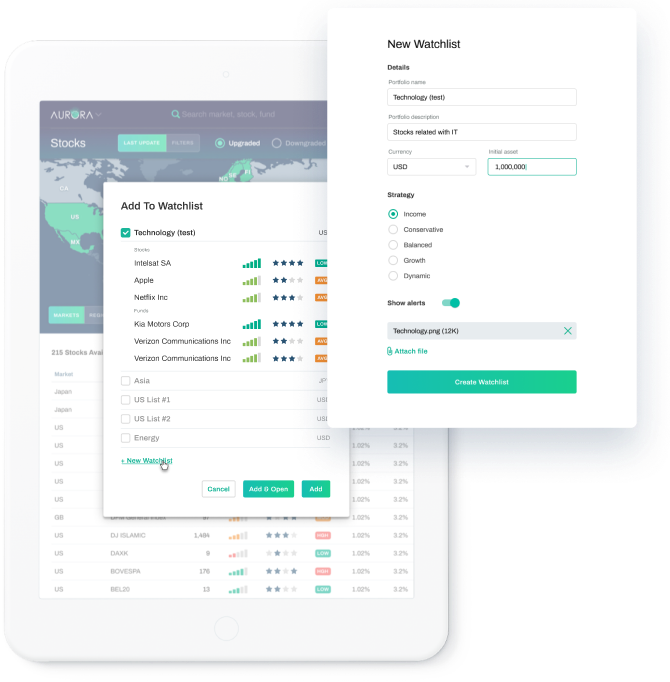

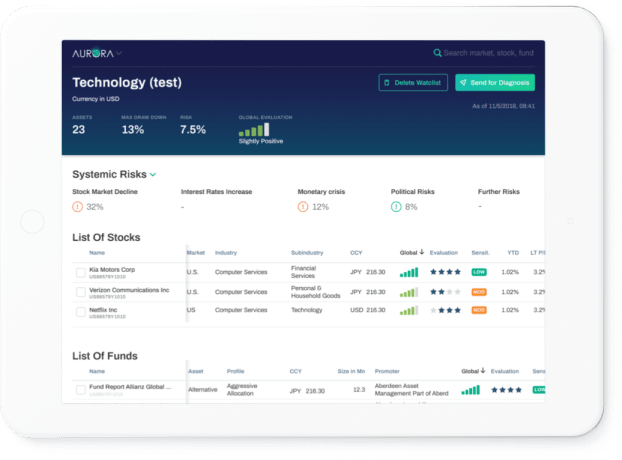

Add your favorite assets to watchlist

Organize your favorite stocks and funds into multiple watchlists to stay on track with all critical updates

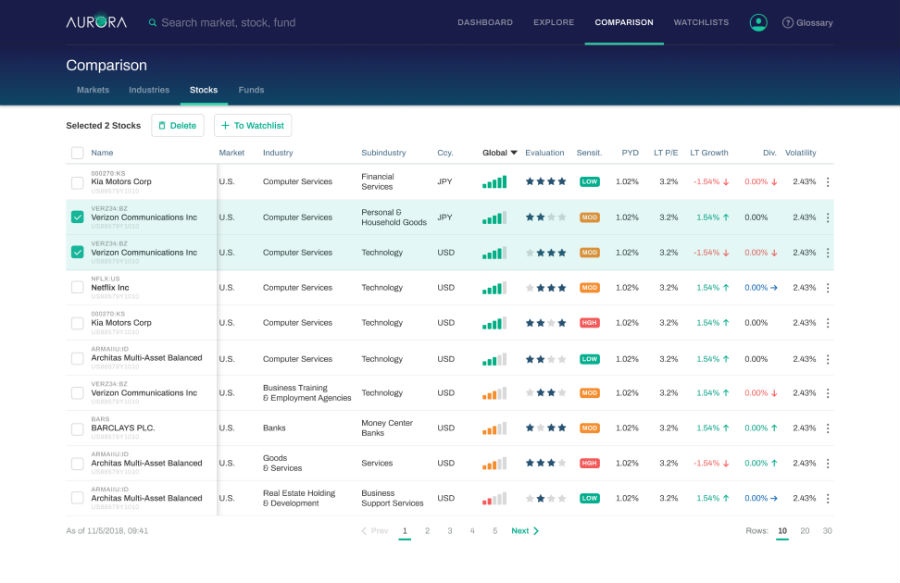

Compare stocks and funds

Found stocks and funds you’re interested in? Compare them side by side and never miss a single movement that can influence your investment decision.

Inclusive design

In this fintech UX design, all data is accessible

to people with visual impairments.

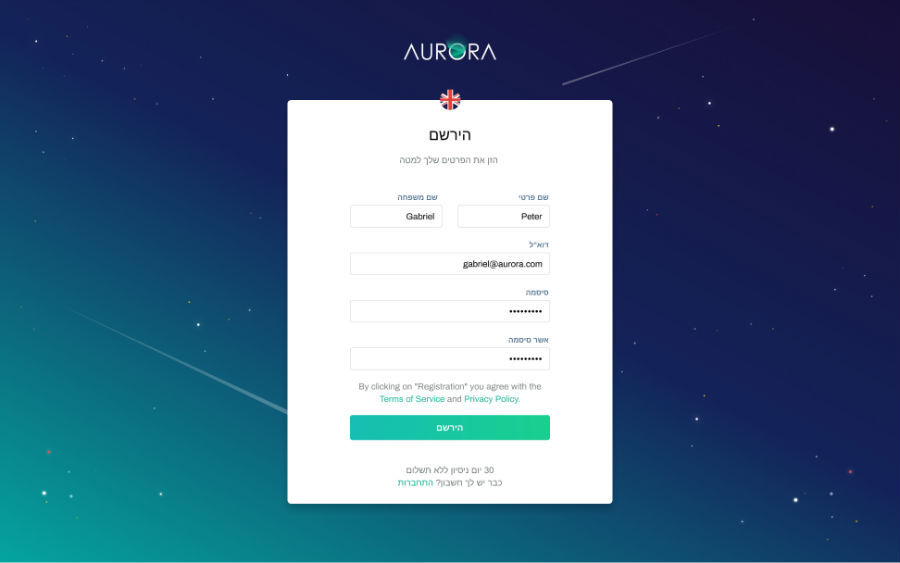

RTL

The Aurora is in high demand in the Hebrew-speaking market; that’s why we made it right-to-left friendly and intuitive.

Mobile-first Design Approach

AURORA changes the game rules

in the investment world

Friendly to independent investors, the

investment game will never be the same again.

Stay in tune!

Project summary

Services:

User flows mapping

Information Architecture

Wire-framing and Prototyping

User Interface Design

Product management

Duration:

Team:

Project Manager

UX Designer

Product Manager

Business Analyst