Loan Mantra

Redesigning a Lending Platform for Secure and Clear Loan Management

Loan Mantra is a powerful loan management platform that connects users with optimal financial products and lenders. In other words, Loan Mantra serves as a secure intermediary between borrowers and lenders. Designed to help entrepreneurs get the necessary funding, it also provides small businesses with financial knowledge and expertise.

The Qubstudio team has recently enhanced the platform’s user experience to cater to its expanding audience.

Capabilities

Product Redesign

Design System and

Documentation Creation

UI/UX Review

Model of Cooperation

T&M

Team

Product Designer

Business Analyst

Project Manager

Location

USA

Industry

Fintech

Loan management

Duration

9 months, ongoing

Capabilities

Product Redesign

Design System and

Documentation Creation

UI/UX Review

Model of Cooperation

T&M

Team

Product Designer

Business Analyst

Project Manager

Location

USA

Industry

Fintech

Loan management

Duration

9 months, ongoing

Refresh Lending Platform for its Growing Audience

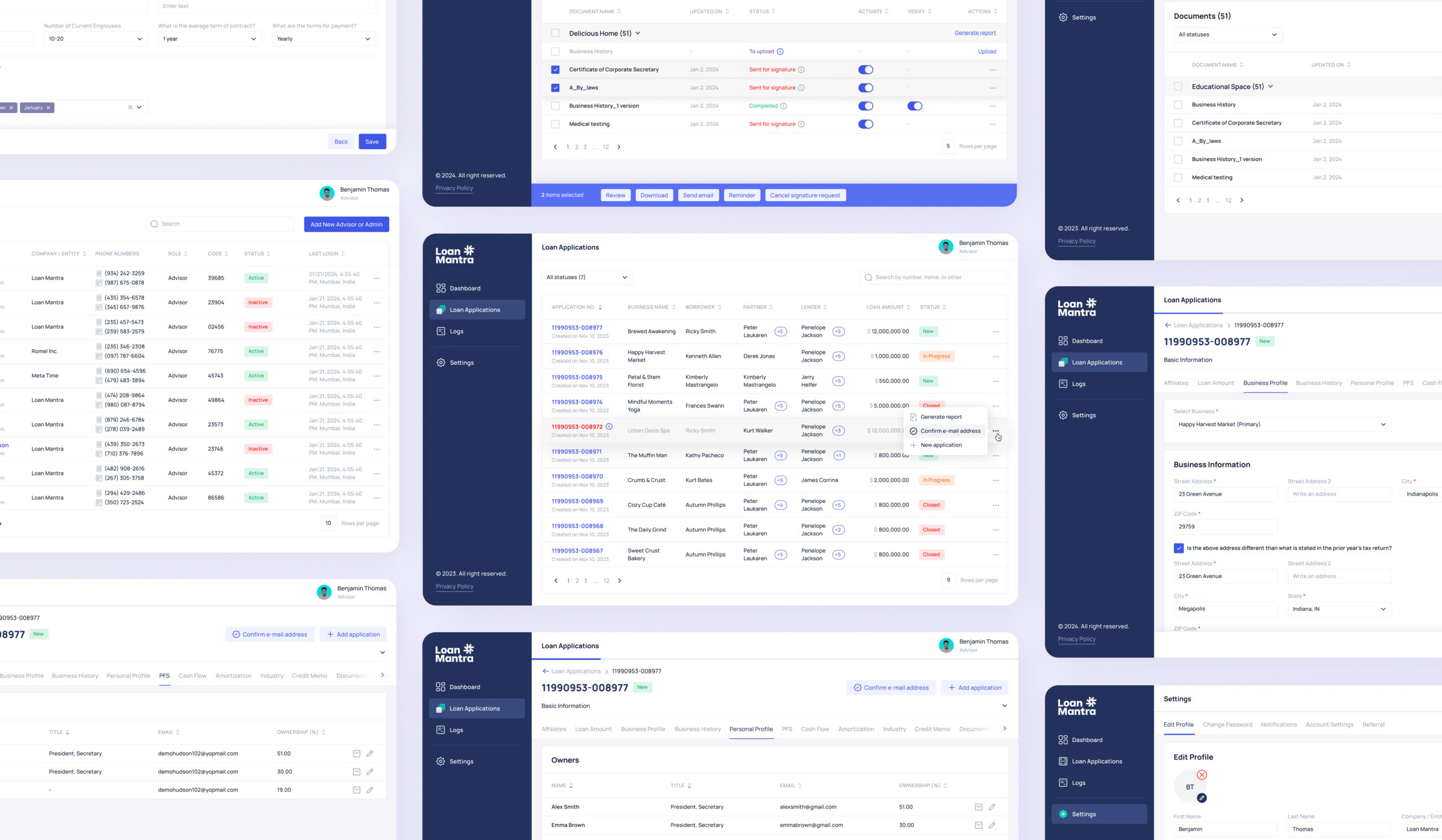

As the platform grew and scaled, we were tasked to update its design to accommodate different types of users, such as advisers, borrowers, lenders, and administrators. Also, we needed to simplify the functionality and add new features to strengthen its market presence.

Since one of the platform’s standout aspects is straightforward, reliable service for all users, the upgraded version was expected to deliver a flawless and secure customer experience.

Enhancing Loan Experiences & Prioritizing Security and Simplicity

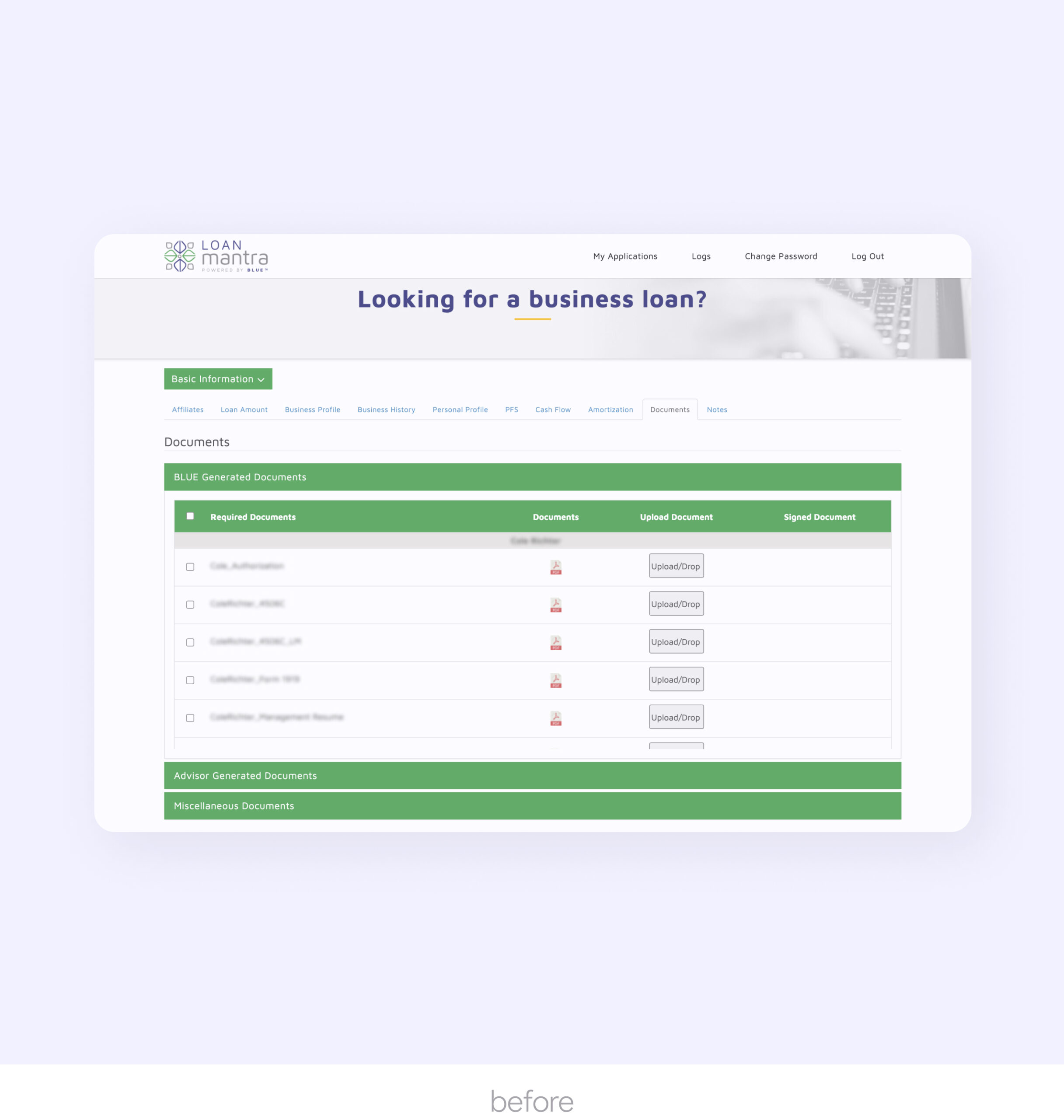

A thorough UX audit, rooted in heuristic analysis and established UX principles, helped us identify numerous opportunities for enhancement. These insights shaped our subsequent actions: improving the platform’s navigation and structure while maintaining a consistent UX. This effort involved more than just a superficial update; we needed to fundamentally change the user flow of specific modules to enhance the overall user experience and simplify the lending process.

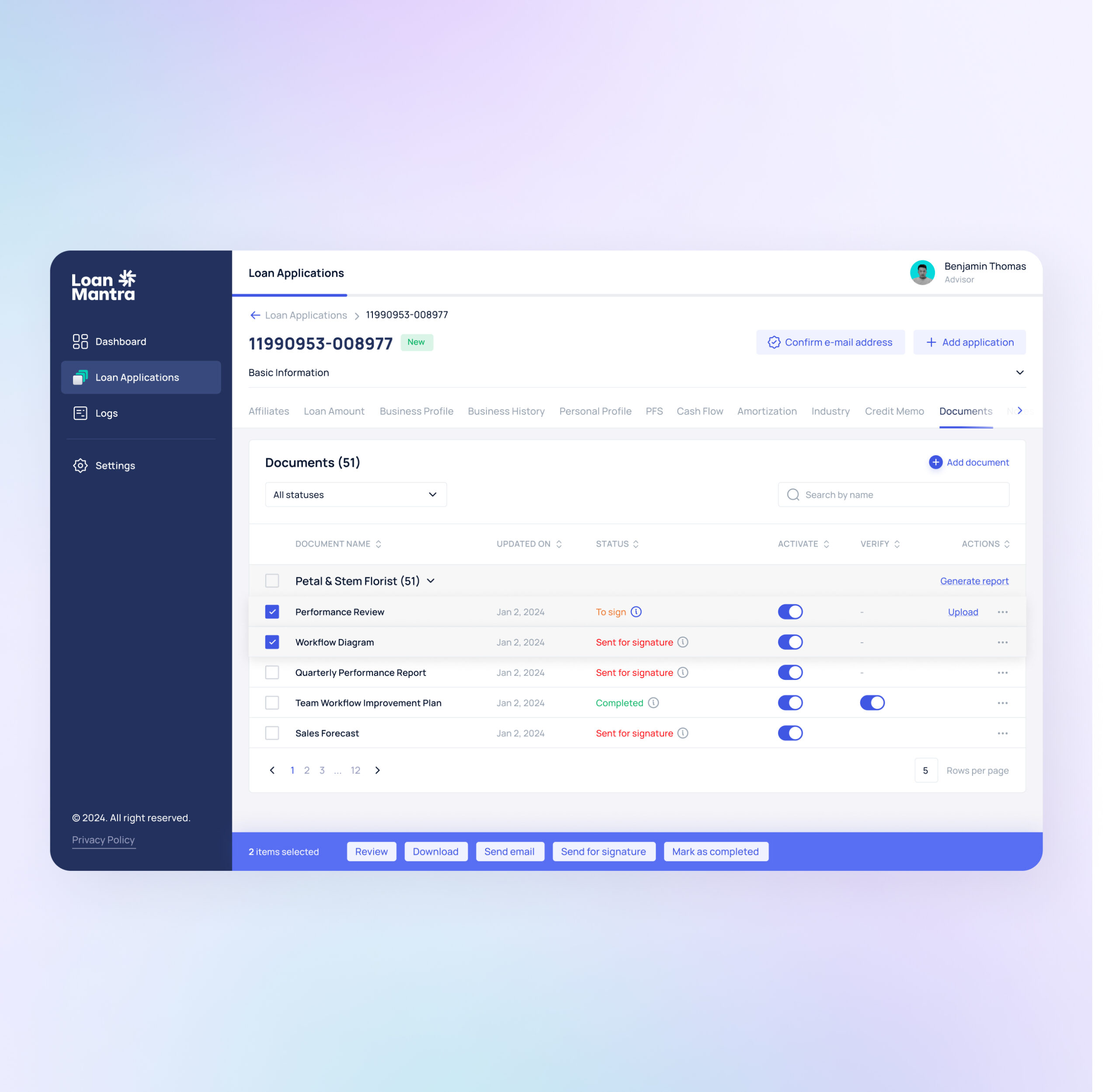

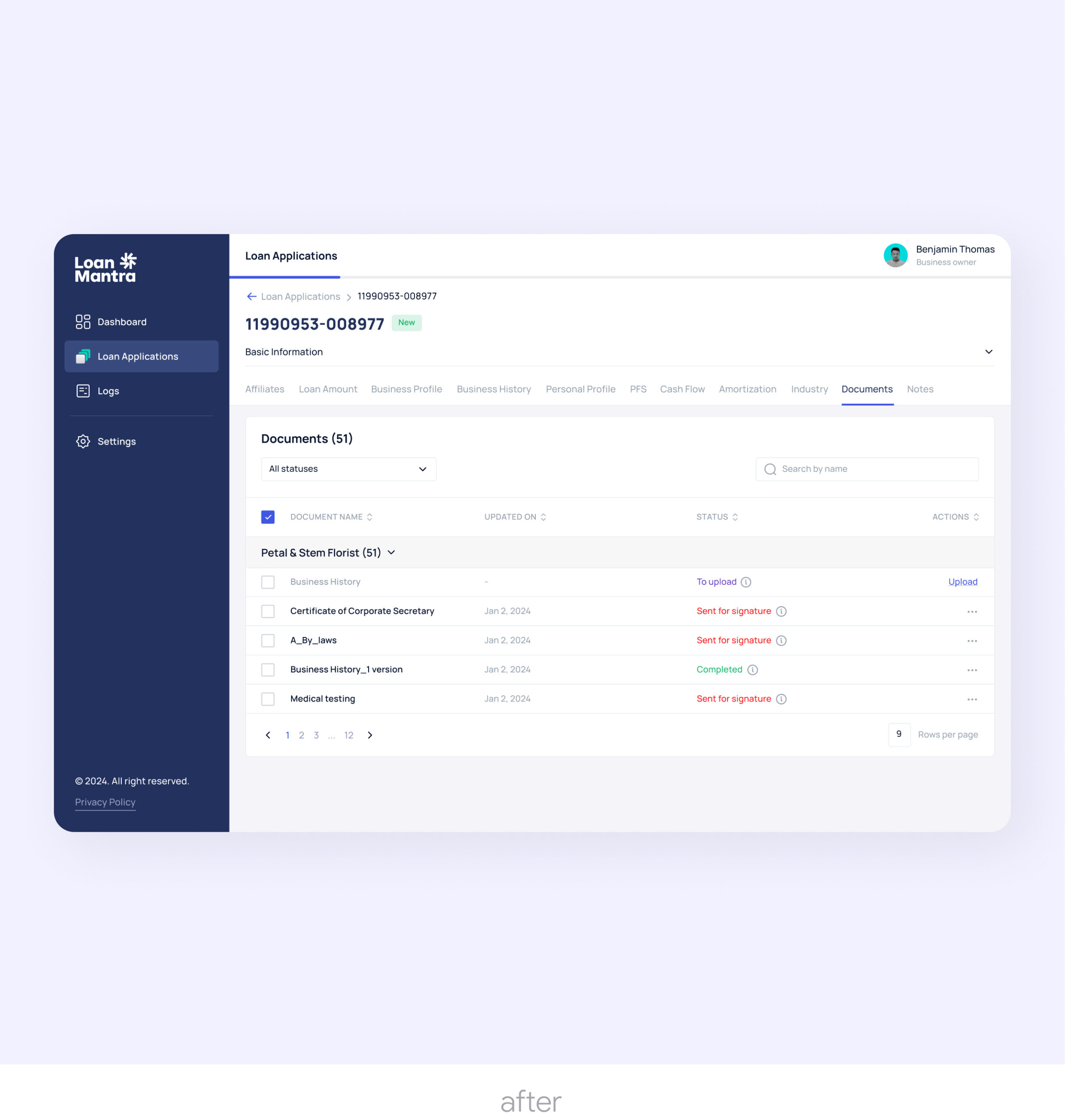

Additionally, we revamped the platform’s UI to align with the new visual identity we had developed earlier in the project.

The New Design for Seamless, Secure, and Transparent Lending Experience

The new design has significantly enhanced the loan management within the platform, meeting the evolving client’s needs.

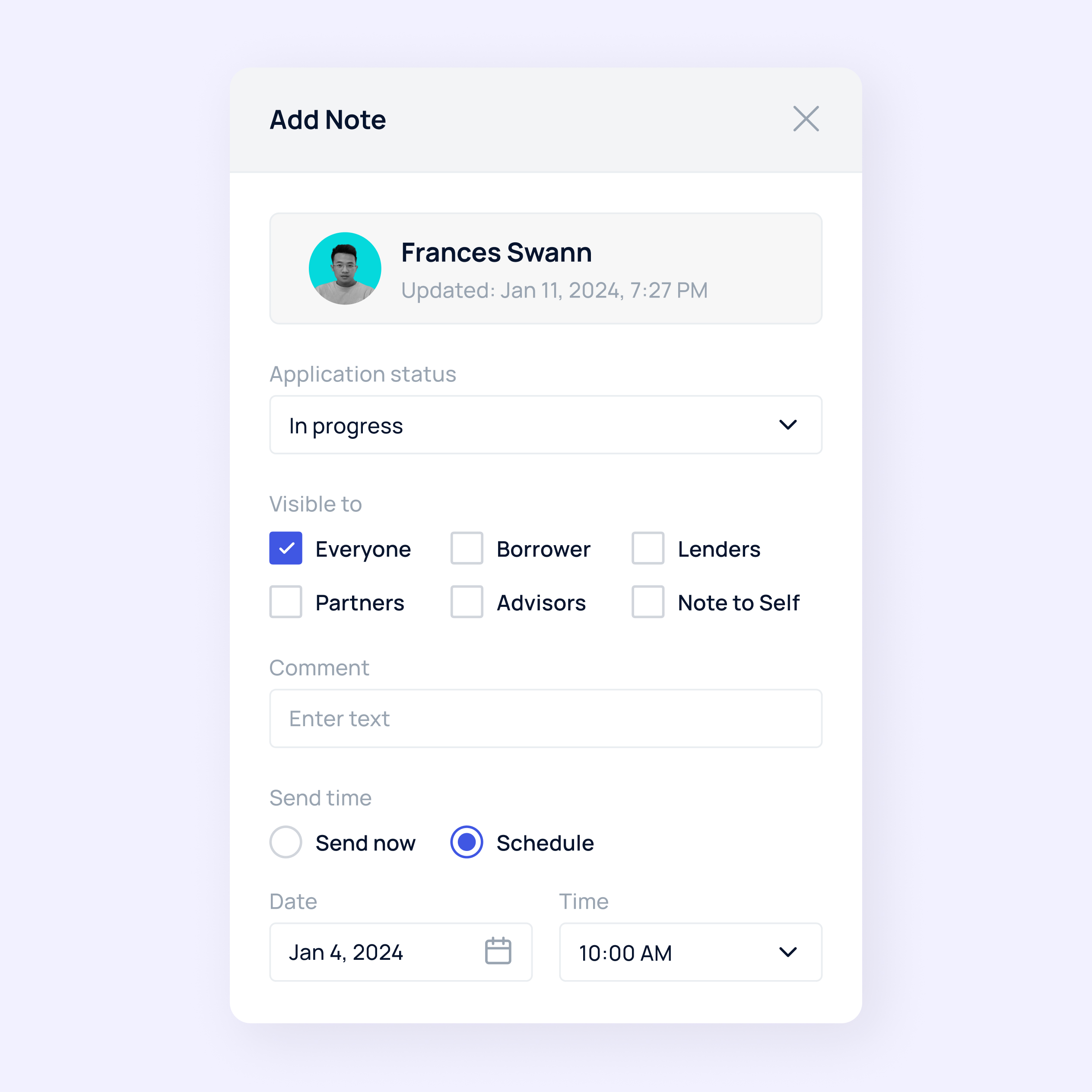

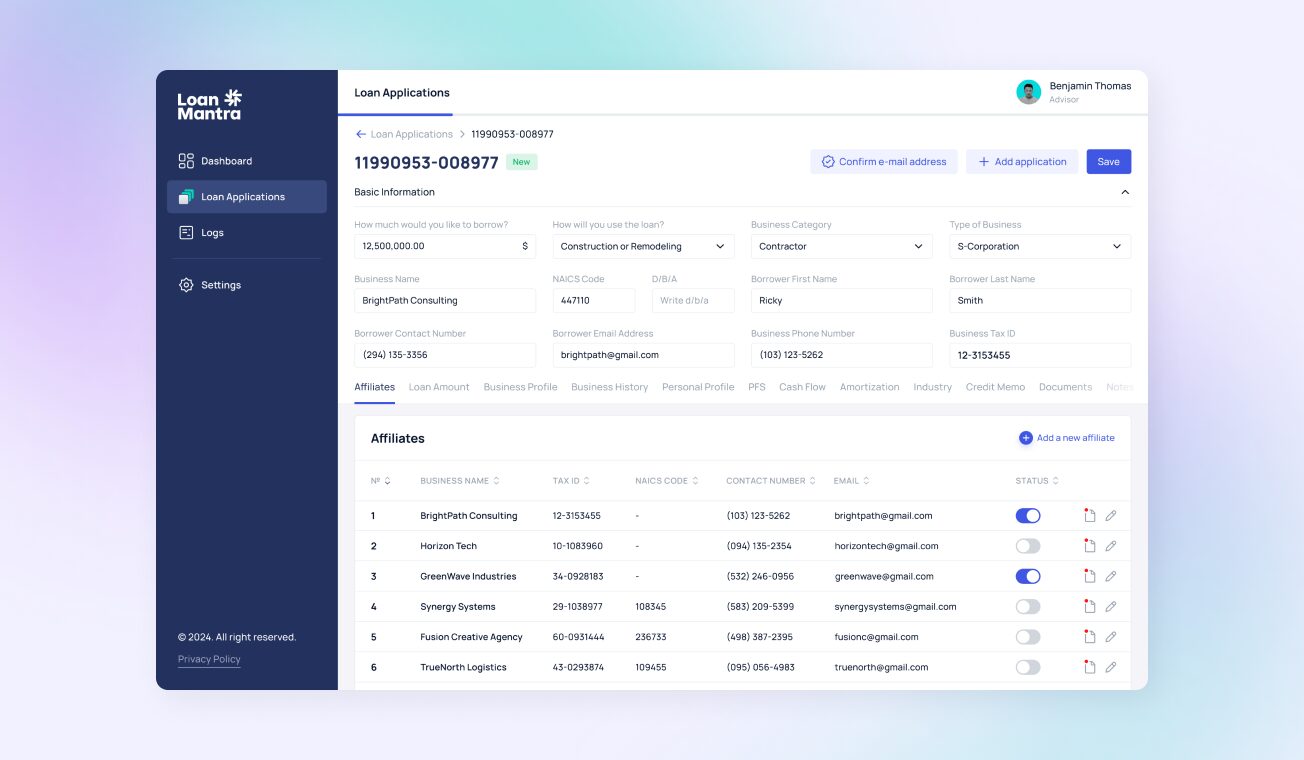

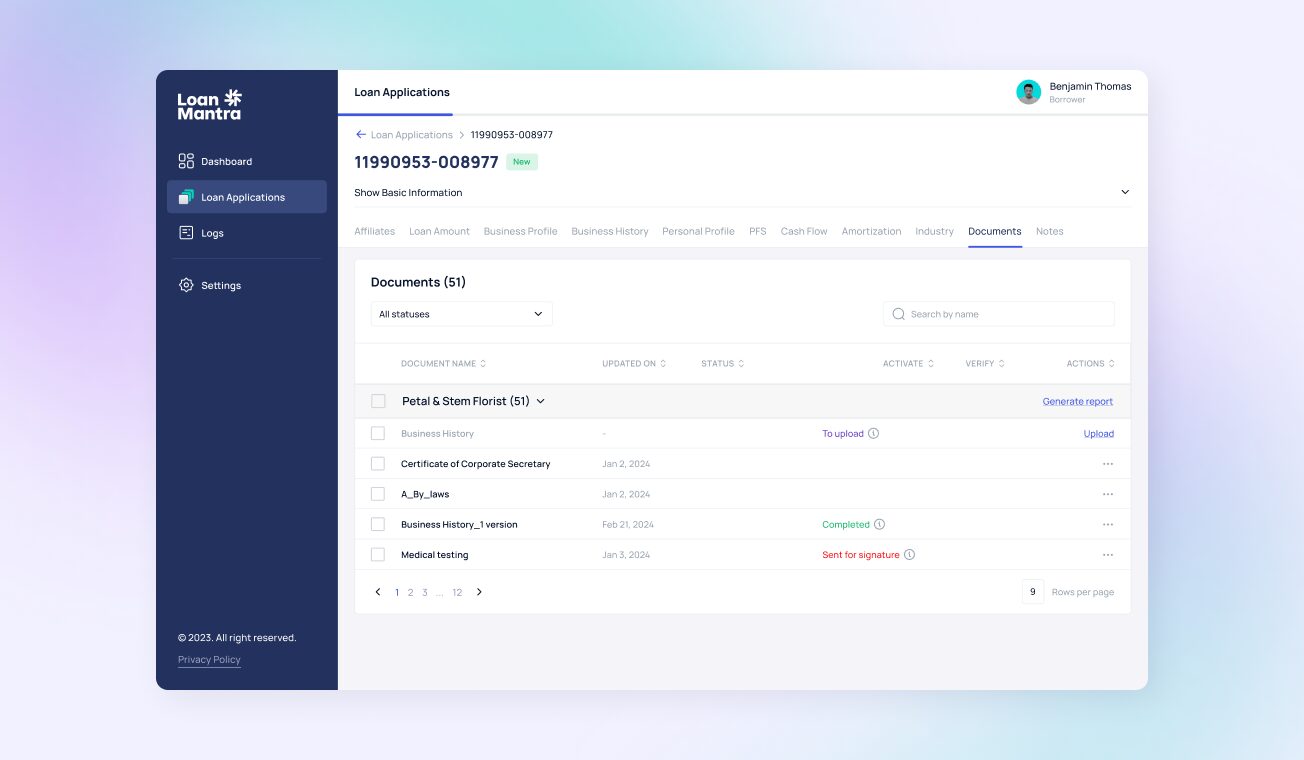

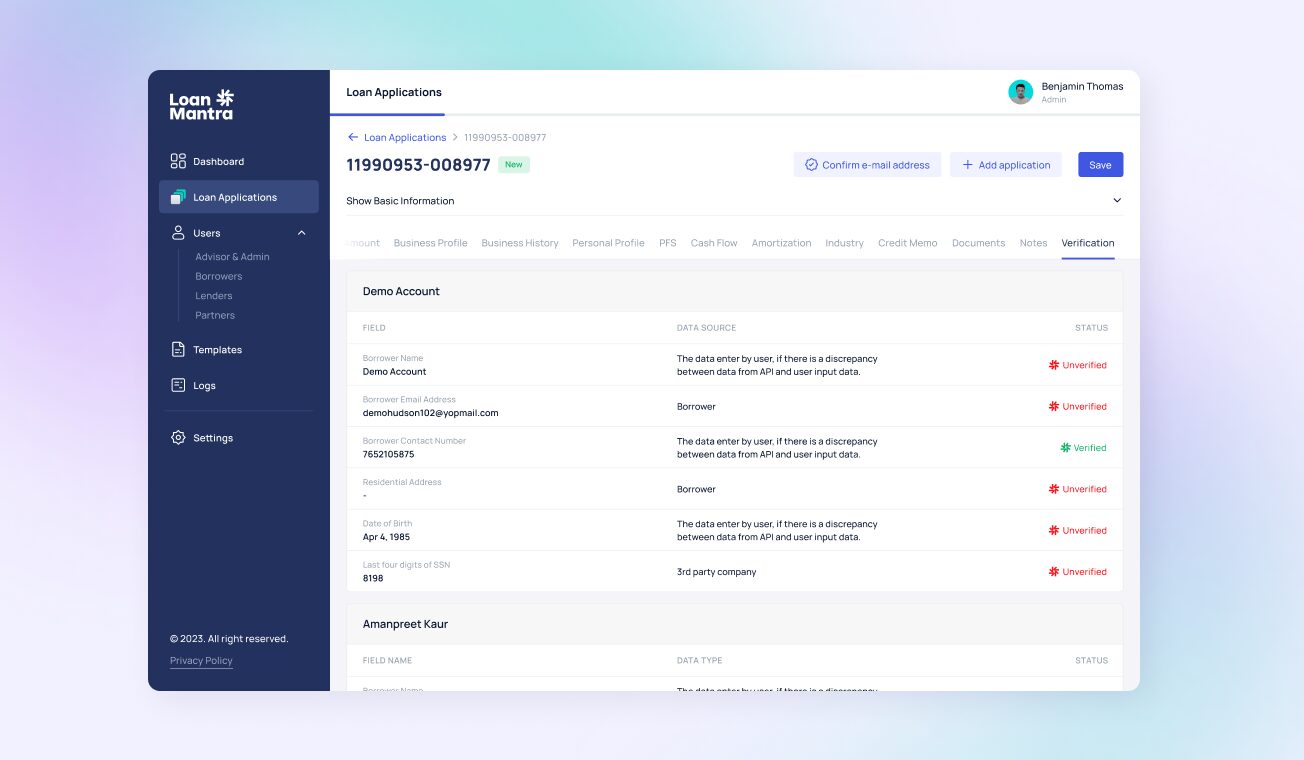

- The new design represents lending services that are up-to-date, secure, and transparent for all users: advisers, borrowers, lenders, and administrators.

- The platform’s design has been updated using modern approaches and patterns, leading to a cleaner interface with fewer screenshots. We have also refreshed and simplified new flows for important platform sections such as Documentation and Loan Applications. By streamlining key sections, we boost platform efficiency and drive better business results.

- We developed a design system and detailed documentation to ensure seamless scalability, and enabling the product to grow efficiently. Also, we introduced new screens that we didn’t have before. These improvements helped increase analytics awareness of each user, allowing for better tracking of loan metrics, and making account management easier than ever.