Risk Management Solution

Streamlining Risk Management with AI to Drive Business Growth

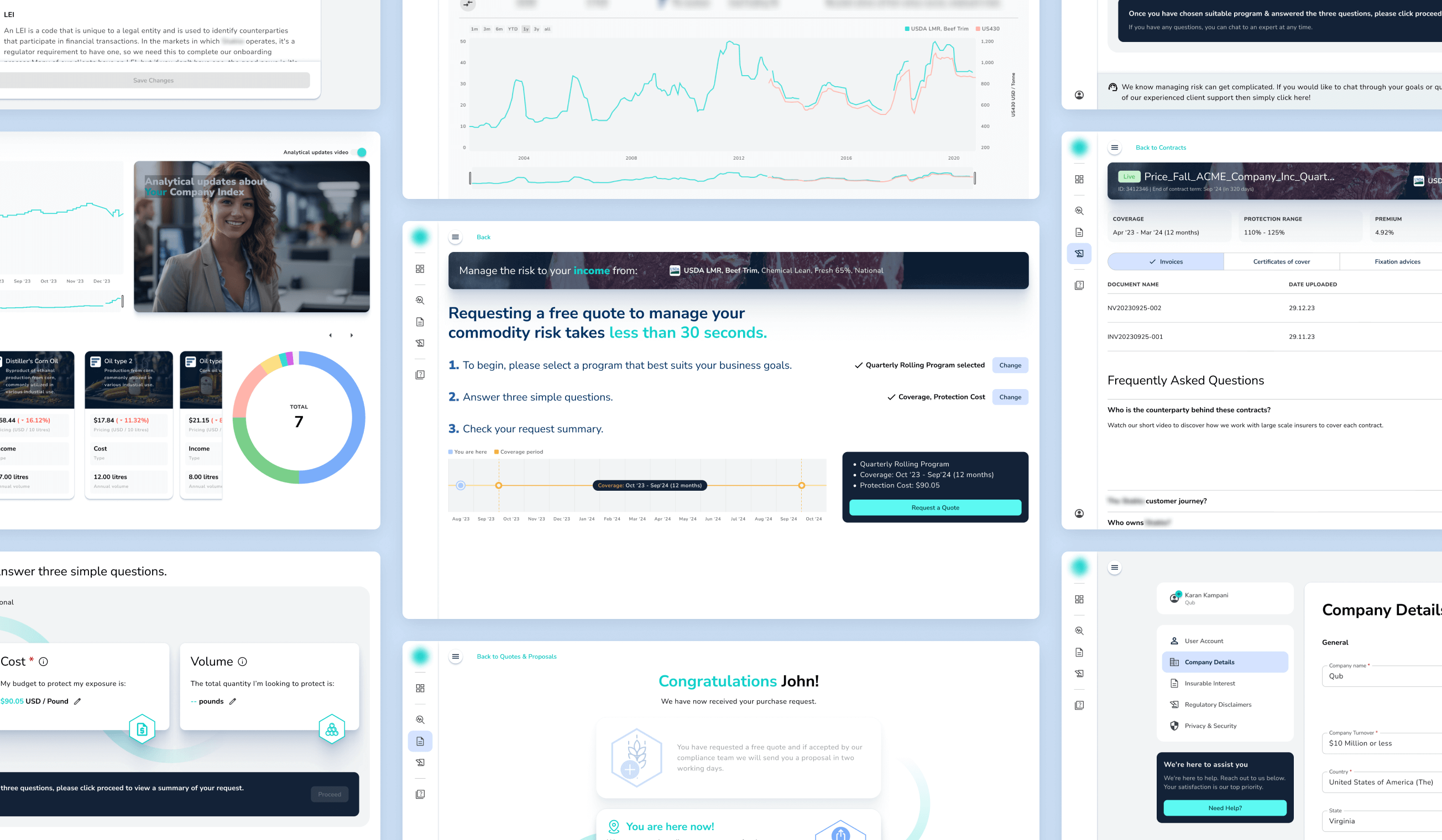

Our client’s platform is a comprehensive AI-enhanced risk management and insurance solution. It empowers companies to confidently manage price volatility, reduce uncertainties, and customize insurance products.

The product offers easy-to-understand analytics and configurable insurance options to shield users from financial losses.

The client reached out to Qubstudio to design the next-level risk management platform, ehnanced with AI-functionality.

Capabilities

Product Design & Redesign

Motion Design

Website Design

Branding

Model of Cooperation

T&M

Team

Product Designer

Business Analyst

Project Manager

Industry

Fintech, Insurtech

Duration

1 year, ongoing

Capabilities

Product Design & Redesign

Motion Design

Website Design

Branding

Model of Cooperation

T&M

Team

Product Designer

Business Analyst

Project Manager

Industry

Fintech, Insurtech

Duration

1 year, ongoing

Digitizing Client Relationship Management with AI for Accessible Insurance Solutions

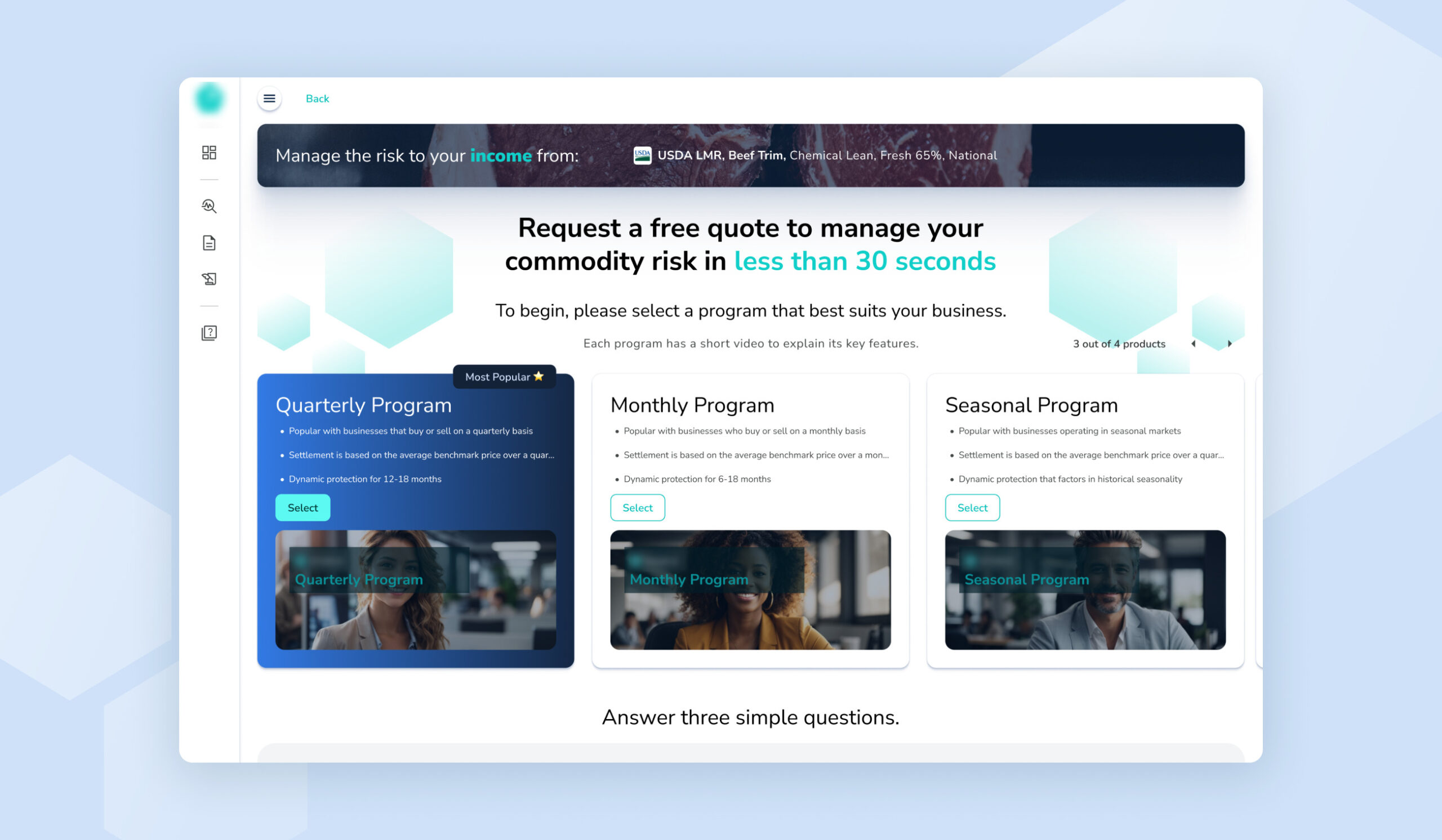

Before the platform was developed, our client—a financial product provider—relied on traditional sales methods to create sales proposals and finalize deals. The introduction of the solution aimed to streamline and automize processes for both the client and their prospects, which led to the creation of the modern platform’s functionality.

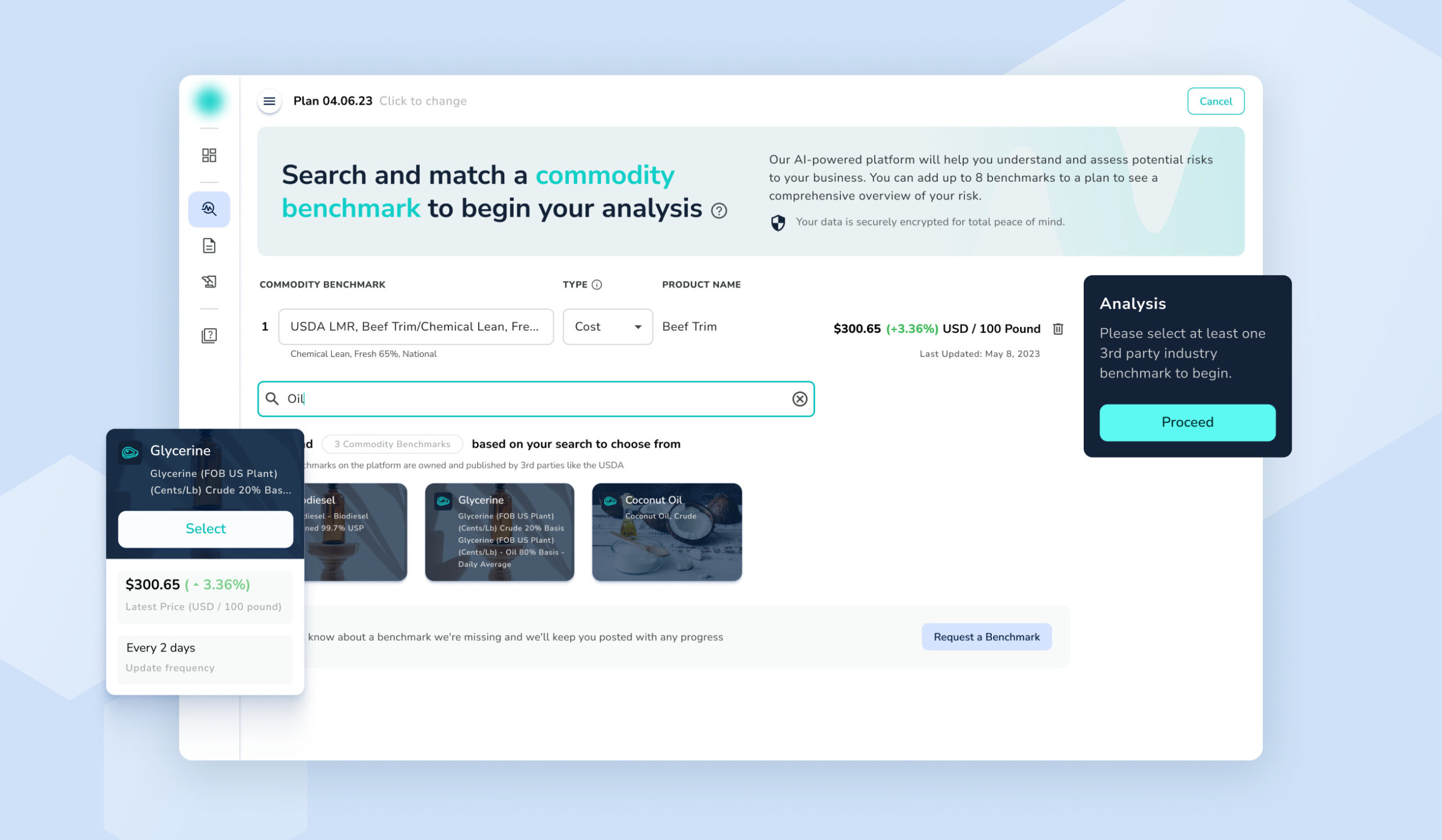

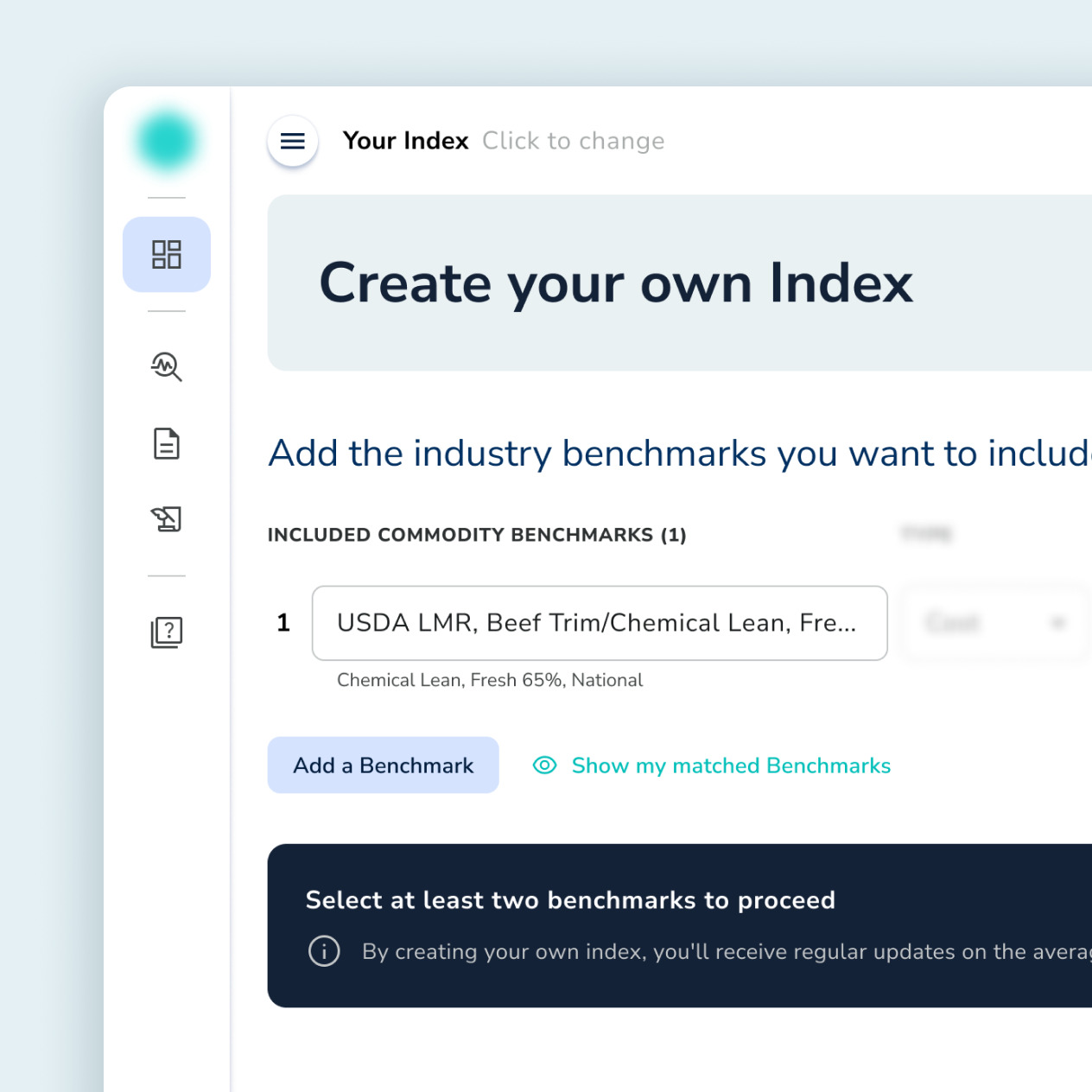

The client shared high-level wireframes that mapped out their sales processes, and our goal was to digitize, scale, and simplify these workflows. It was essential to tailor the platform to meet the needs of several user personas. This meant ensuring that even those without a comprehensive financial background could easily understand complex financial charts while keeping the platform intuitive for more experienced users.

A Three-Level Feasibility Assessment Before Implementation

Our goal was to create a workflow for users without a financial background, while still robust for experts. We held several brainstorming sessions and workshops to deeply understand the end users’ needs and how AI could best serve them. The ideas generated during these meetings went through a three-tier feasibility assessment.

First, we created low-fidelity wireframes for rapid, high-level UX validation. Second, we interviewed managers who interacted directly with their clients to ensure that the proposed solutions effectively address the needs of the end users. Finally, we evaluated the technical feasibility of the suggested concepts.

This approach helped us minimize risks and cut down on time spent on rework.

Meeting User and Business Goals via AI-Driven Functionality

Our collaborative efforts resulted in a platform that digitized the client acqusition, making a wide array of risk management solutions easily accessible to a diverse audience.

- Two distinct user categories benefited from AI features tailored for those new to insurance. AI-powered explanations were introduced to make complex diagrams easier to understand, enhancing clarity and accessibility for users. For example, when a user views a business forecast, the AI provides clarifying insights through video or text.

- The simplified risk management process and contract creation workflow from end to end saves time and effort for risk managers. This optimization also enables the company to process more contracts efficiently and effectively.

- We added an educational component to the platform to explain complex topics like hedging, insurance, and risk mitigation. This initiative aligns with one of the client’s business key values: supporting users throughout their product journey, well beyond onboarding.